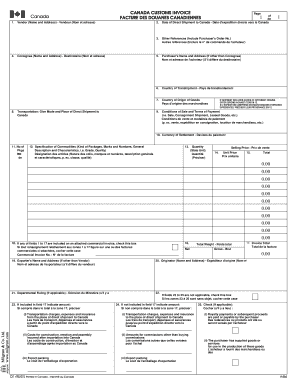

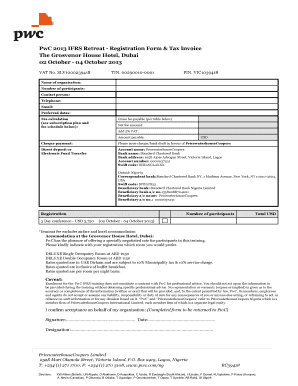

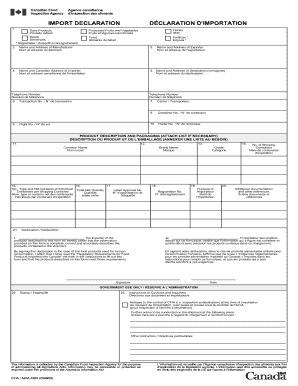

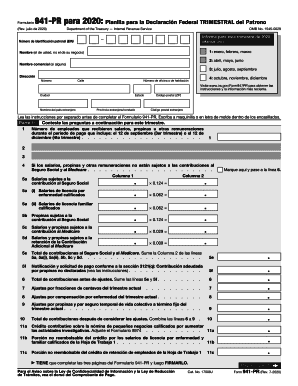

Obtain a collection of Commercial invoice us Canada Forms and easily handle them online. Get the template you need, adjust it, and safely share it with other contributors, all in your DocHub account.

Accelerate your file operations using our Commercial invoice us Canada Forms collection with ready-made form templates that meet your needs. Access the form template, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

The best way to manage our Commercial invoice us Canada Forms:

Discover all of the possibilities for your online document administration with the Commercial invoice us Canada Forms. Get a free free DocHub profile right now!