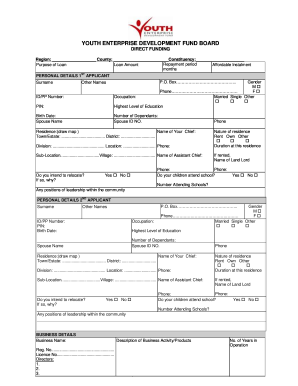

Get started with a comprehensive collection of Youth loan Business Forms. Select, adjust, complete, and send your business forms without a hassle.

Your workflows always benefit when you can find all the forms and documents you require at your fingertips. DocHub gives a a large collection forms to relieve your day-to-day pains. Get a hold of Youth loan Business Forms category and quickly find your document.

Start working with Youth loan Business Forms in several clicks:

Enjoy seamless file administration with DocHub. Discover our Youth loan Business Forms category and find your form today!