Definition and Meaning of the PTA Reimbursement Form

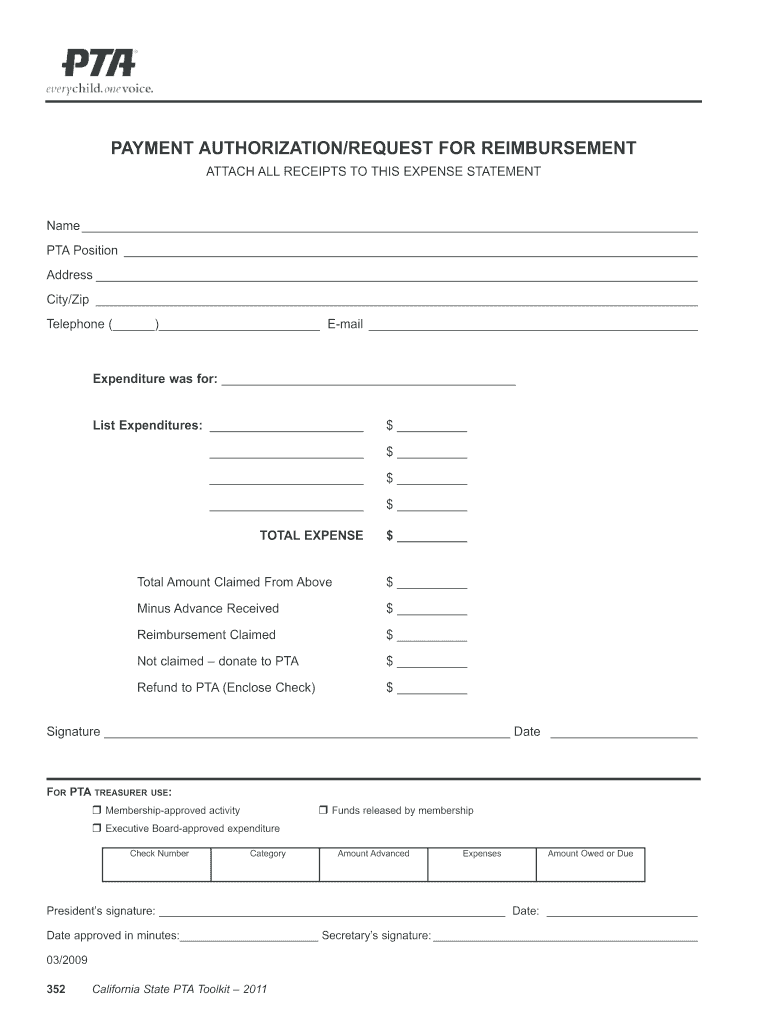

The PTA reimbursement form is designed for members of the Parent-Teacher Association to claim financial reimbursements for eligible expenses incurred during the execution of association activities. This document serves as an official request to retrieve funds that were spent on behalf of the PTA, ensuring transparency and accountability in financial matters. It requires the submission of personal information, a detailed breakdown of expenses, and appropriate signatures to validate the claims.

When filling out this form, PTA members must specify the purpose of each expense, which can include costs related to events, supplies for school initiatives, or other activities that promote the educational environment. The completion of this form not only facilitates the reimbursement process but also ensures that the PTA maintains accurate financial records.

Key Elements of the PTA Reimbursement Form

Understanding the essential components of the PTA reimbursement form helps ensure a complete and accurate submission. The key elements typically included are:

-

Personal Information: Name, contact details, and PTA membership identification are required for processing the request.

-

Expense Details: This section must document each expenditure in a clear and organized manner. Members should include dates, descriptions of expenses, amounts spent, and how each cost relates to PTA activities.

-

Total Claim Amount: A tally of all expenses claimed for reimbursement should be clearly stated. This ensures that the PTA Treasurer can easily verify and process the claim.

-

Approval Section: This designated area often requires signatures from the claimant and the PTA Treasurer, authorizing the request for reimbursement.

-

Policy Compliance Acknowledgment: Many forms include a statement confirming that the claimant has adhered to the PTA's reimbursement policies.

Proper completion of these sections is critical in establishing eligibility for reimbursement and facilitating timely payment.

Steps to Complete the PTA Reimbursement Form

Completing the PTA reimbursement form involves several systematic steps to ensure that all required information is accurately captured. Members should:

-

Download the Form: Access the official PTA reimbursement form either online or through the PTA office.

-

Fill Out Personal Information: Enter your name, contact information, and membership details accurately to ensure proper identification in the system.

-

Itemize Expenses:

- For each expense, note the date, description, and amount.

- Align the details with the corresponding PTA activity to clarify the relevance of each expense.

-

Calculate Total Amount: Sum up the individual expenses and ensure that this reflects the total reimbursement being claimed.

-

Seek Approval: Present the completed form to the PTA Treasurer for review. Obtain their signature and any required comments regarding the reimbursement request.

-

Submit the Form: Send the approved reimbursement form to the designated PTA finance officer via the appropriate submission method, whether online, by mail, or in person.

Following these steps will enhance the chances of timely reimbursement, while correct documentation can prevent delays.

Examples of Using the PTA Reimbursement Form

Using the PTA reimbursement form effectively involves various scenarios relevant to PTA members. Here are examples illustrating its application:

-

Event Expenses: A member organizing a fundraising fair may incur costs for supplies such as banners and refreshments. By filling out the PTA reimbursement form with detailed receipts for these expenditures, the member can claim reimbursement for amounts spent on promotional materials.

-

Educational Supplies: Teachers who purchase STEM kits to demonstrate science principles during a PTA-sponsored workshop can submit the PTA reimbursement form. In this case, each purchase should be itemized with receipts attached to support the claim.

-

Community Outreach: If a PTA member incurs costs for a community service project, such as buying supplies for a tutoring program, they can utilize the PTA reimbursement form to recover those funds. Specific details regarding the purpose and benefit of the expense will help ensure proper consideration by the PTA Treasurer.

These examples illustrate how the form can facilitate reimbursement across various PTA-affiliated activities and reinforce the importance of diligent record-keeping.

Important Terms Related to the PTA Reimbursement Form

Understanding key terms associated with the PTA reimbursement form can clarify its use and significance:

-

Reimbursement Policy: Guidelines set forth by the PTA regarding what expenses are eligible for reimbursement, how to submit claims, and any limits or conditions.

-

Eligible Expenses: Costs that qualify for reimbursement, typically including items necessary for the operation of PTA activities, such as materials or services that directly benefit students and the school community.

-

Receipts: Proof of payment for items purchased, which must accompany the reimbursement form to validate each claimed expense.

-

Approval Process: The internal workflow within the PTA to assess and authorize reimbursement claims, often involving checks for compliance with financial policies.

-

Treasurer’s Role: A key position within the PTA tasked with overseeing financial matters, including the review and processing of reimbursement requests.

Familiarity with these terms aids members in navigating the reimbursement process efficiently.

Legal Use of the PTA Reimbursement Form

The PTA reimbursement form must be completed and utilized in accordance with applicable laws and PTA regulations. Key considerations include:

-

Accountability: Members using this form must ensure that all claimed expenses are justifiable and relate directly to PTA activities. Misrepresentation can lead to legal consequences.

-

Tax Implications: Expenses reimbursed through the PTA do not typically constitute taxable income for members; however, members should consult tax professionals regarding personal tax implications related to reimbursements.

-

Compliance with State Laws: Different states may have distinct regulations regarding nonprofit organizations, and PTAs must ensure that their reimbursement practices align with these legal requirements.

-

Record-Keeping Requirements: It may be legally mandated that PTAs keep detailed records of all reimbursements for a set period, ensuring that documentation is available for audits or financial reviews.

Understanding these legal dimensions aids PTA members in making sound financial decisions while upholding ethical standards within the association.