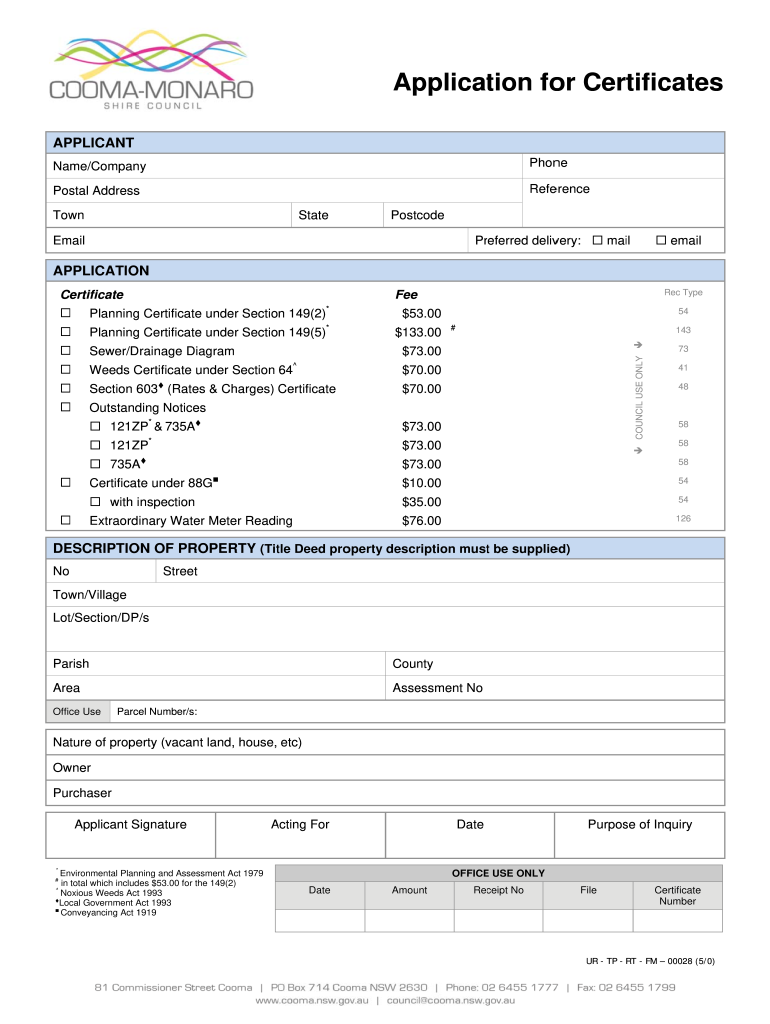

Definition and Meaning of the Centrelink Medical Form SA332A

The Centrelink medical form SA332A serves as a critical document used in Australia, specifically for individuals seeking medical verification when applying for certain welfare benefits. This form is particularly relevant for those applying for disability support, carer payments, or other concessions that require proof of medical conditions. The SA332A form acts as a means for healthcare providers to validate the medical circumstances of the applicant, affirming the impact of their condition on daily living or work capabilities.

The form typically requires detailed input from a qualified medical professional, who must provide insights into the patient's health status, diagnosis, and treatment plans. This verification is essential to ensure that benefits distributed are appropriately allocated based on genuine needs.

Key Features of the SA332A Form

- Purpose: To confirm medical conditions affecting an individual's ability to work or study.

- Users: Primarily used by individuals applying for financial support due to health issues.

- Referral Requirement: Generally, a healthcare professional must complete the sections pertaining to the applicant's health.

How to Obtain the Centrelink Medical Form SA332A

Acquiring the SA332A form is straightforward and can be done through several channels. It is primarily available from the official Centrelink website, where it can be downloaded as a PDF. Additionally, those without internet access can request a physical copy at local Centrelink service centres.

Steps to Obtain the Form

- Visit the Centrelink Website: Navigate to the relevant section concerning medical forms.

- Locate the SA332A: Search for the form using its name or code.

- Download the PDF: Click on the download link to save it to your device, or print it directly if you have access to a printer.

- Request Assistance: For individuals needing additional help, contacting Centrelink's customer service can clarify any questions or provide alternate methods for obtaining the form.

Steps to Complete the Centrelink Medical Form SA332A

Filling out the SA332A form requires careful attention to detail to ensure all necessary information is correctly provided. The completion process involves both the applicant and their healthcare provider.

Detailed Steps for Completion

- Personal Information: The applicant must fill in their personal details like full name, address, date of birth, and Contact details.

- Medical Practitioner’s Section: This part should be filled out by a qualified healthcare provider, who must enter their details, including name, registration number, and contact information.

- Medical Condition Description: The healthcare provider should describe the medical condition, its onset, and its impact on the applicant’s daily activities.

- Treatment and Prognosis: Information about ongoing treatments, medications, or therapies must be provided along with the expected prognosis.

- Signatures: Both the applicant and the healthcare provider must sign the form to confirm that the information provided is accurate and truthful.

Importance of the Centrelink Medical Form SA332A

The SA332A form plays a vital role in the welfare system, serving as a mechanism to ensure that only eligible individuals receive benefits. Its importance extends beyond mere paperwork; it safeguards the integrity of support programs by requiring medical verification.

Significance of Completing the SA332A

- Verification of Claims: The form acts as a check against fraudulent claims for benefits.

- Access to Support: A properly filled form can significantly impact an individual’s ability to access necessary financial support, thus ensuring their quality of life.

- Benefits Tailored to Needs: By securing accurate medical information, Centrelink can tailor support services effectively, which benefits both the clients and the system.

Who Typically Uses the Centrelink Medical Form SA332A

The SA332A form is primarily used by individuals seeking certain welfare benefits through Centrelink, particularly those with medical conditions that affect their work or daily living.

Common Users Include:

- Individuals with Disabilities: Those needing to claim disability support often rely on this form for validation.

- Caregivers: Those applying for carer payments on behalf of someone with a medical condition will require the SA332A to provide proof of the individual’s health status.

- Senior Citizens: Older adults applying for health-related allowances may also utilize this form.

Key Elements of the Centrelink Medical Form SA332A

Understanding the specific sections and requirements is critical for properly using the SA332A form. Key elements include detailed information about medical conditions and the healthcare provider’s assessments.

Important Sections of the Form

- Applicant Information: Essential personal details that identify the individual seeking assistance.

- Medical Condition Details: Comprehensive descriptions that outline the diagnosis, the impact on daily life, and any treatments being undertaken.

- Provider Information: Details of the healthcare professional verifying the medical information, essential for the form's authentication.

Legal Use of the Centrelink Medical Form SA332A

The SA332A form must be used according to legal standards. It ensures that all applications for benefits are verifiable and that only legitimate claims are honored.

Legal Validity and Compliance

- Healthcare Provider’s Role: Medical practitioners must adhere to privacy laws when completing the form, ensuring that patient confidentiality is maintained.

- Compliance with Centrelink Regulations: Users must ensure the form is filled out accurately and submitted according to official guidelines to avoid penalties or delays in processing benefits.

- Fraud Prevention: Misuse of the form can lead to legal repercussions, emphasizing the serious nature of its completion and submission.

Step-by-Step Process for Submission of the Centrelink Medical Form SA332A

Submitting the completed SA332A form can be done through various methods, each having specific instructions to ensure the document is processed efficiently.

Submission Methods

- Online via MyGov: If registered with MyGov, users can submit the form directly through their account.

- In-Person Submission: For those who prefer or require direct interaction, visiting a local Centrelink office allows for personal submission.

- By Mail: Users can send the completed form to the designated address provided by Centrelink, ensuring it is sent securely.

This structured, detailed content provides comprehensive guidance on the centrelink medical form SA332A, covering all critical aspects of its use, completion, significance, and submission.