Understanding the ING Beneficiary Designation Form

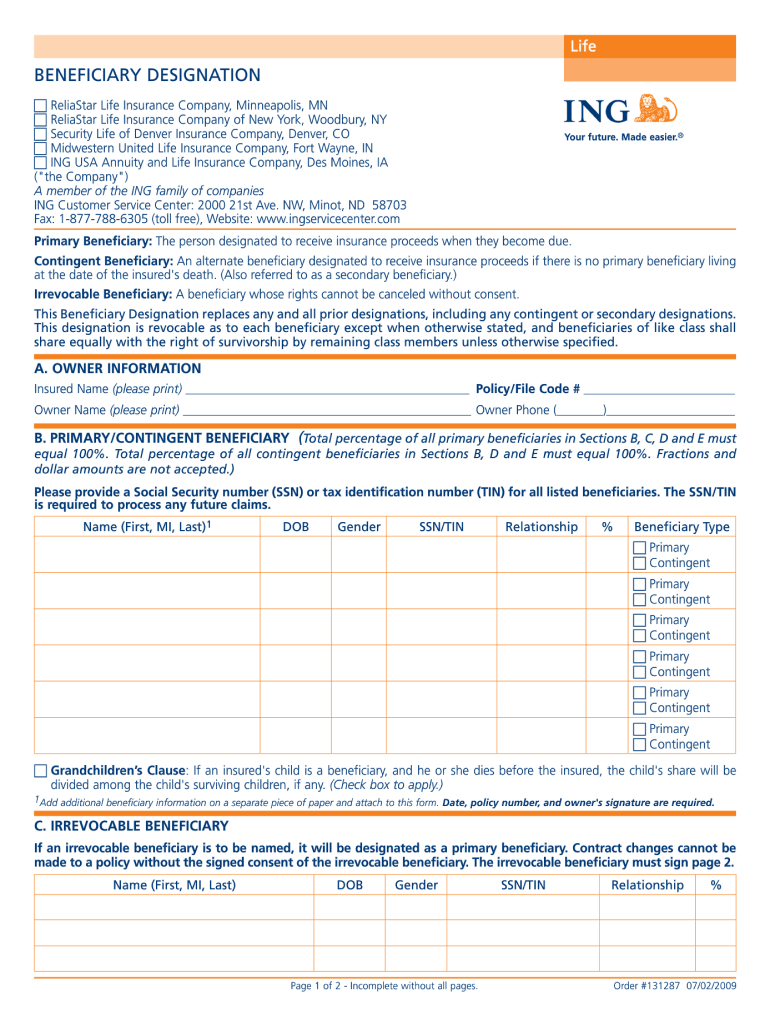

The ING beneficiary designation form is a critical document used for designating primary and contingent beneficiaries for life insurance policies or annuities. This form not only facilitates the management of beneficiaries but also ensures clarity in how benefits will be distributed upon the account holder’s passing.

Key Components of the Form

-

Owner Information: The account or policy owner must provide their full name, address, and contact information. This section establishes who holds the policy and reinforces their right to designate beneficiaries.

-

Beneficiary Details: It is essential to accurately fill out the details of the beneficiaries. This includes names, relationships, and Social Security numbers. Having complete information helps prevent potential disputes regarding beneficiary claims.

-

Irrevocable Beneficiaries: The form may allow for the designation of irrevocable beneficiaries, meaning their rights cannot be changed without their consent. This can be crucial for ensuring the financial security of dependents who rely on policy benefits.

Steps to Complete the ING Beneficiary Form

-

Gather Required Information: Collect personal details about the policy owner and the beneficiaries. Ensure that each beneficiary's information is accurate and complete.

-

Fill Out the Form: Carefully input the gathered information into the form, ensuring clarity and legibility. Double-check for any typos or missing data which could lead to future complications.

-

Sign and Date the Form: After completing the form, the owner must sign and date it to indicate that the information is correct and that they understand the implications of the designations made.

-

Submit the Form: Depending on the provider's requirements, the completed form may need to be submitted online, via mail, or in person. Ensure compliance with any specific submission guidelines to avoid delays.

Importance of Updating Beneficiary Designations

Beneficiary designations are not set in stone; they should be regularly reviewed and updated based on life changes such as marriage, divorce, birth of a child, or death of a beneficiary. Failure to update designations can lead to unintended distributions, potentially causing family disputes or leaving dependents unprotected.

Legal Considerations Affecting Beneficiary Designation

The designation of beneficiaries is governed by state laws, which may vary significantly. It is vital to understand these regulations, as different jurisdictions can have unique requirements for valid beneficiary designations. Additionally, specific terms or conditions tied to irrevocable beneficiaries may necessitate legal counsel to interpret.

Examples of Complex Scenarios with Beneficiary Designations

-

Multiple Beneficiaries: A policy owner may choose to split benefits among several beneficiaries. The form should clearly specify the percentage of benefits each will receive to avoid confusion.

-

Trust as Beneficiary: If a trust is designated as a beneficiary, the form should include the trust's name and relevant identification. This can streamline the process of benefit distribution according to the trust's terms.

-

Minor Beneficiaries: When naming minors as beneficiaries, it's vital to consider guardianship aspects. Most states will require a legal guardian to be appointed to manage the minor's funds until they reach the age of majority.

Conclusion: The Significance of Correct Beneficiary Designations

Accurately completing the ING beneficiary designation form is a crucial step in ensuring that the intended individuals receive benefits without delay or dispute. Understanding the nuances of how to fill out these forms, along with the legal implications, is essential for responsible financial management and family security.