Definition and Significance of T2 Schedule 50

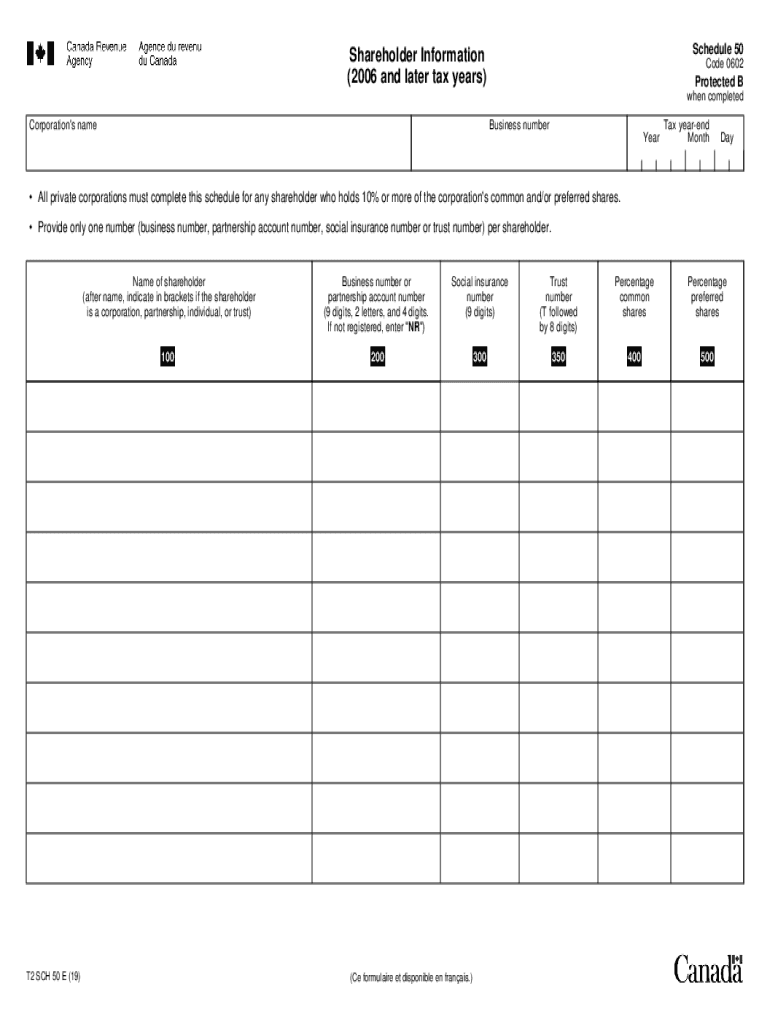

The t2 sch 50, also known as Schedule 50, is a form mandated by the Canada Revenue Agency (CRA) that private corporations must complete to report detailed information about shareholders who own ten percent or more of the corporation's common or preferred shares. This form primarily serves to increase transparency about corporate ownership structures, which is crucial for tax compliance and regulatory oversight. It collects vital details, including:

- Shareholder names

- Identification numbers (such as Social Security Numbers or corporate numbers)

- The percentage of shares held by each shareholder

By accurately completing the t2 sch 50, corporations help the CRA ensure that tax obligations are met appropriately.

Step-by-Step Guide to Completing the T2 Schedule 50

Filling out the t2 sch 50 involves several key steps. Following this guide will streamline the process.

-

Gather Necessary Information: Collect details for all qualifying shareholders. This includes their names, identification numbers, and percentage of shares owned.

-

Download or Access the Form: Obtain the t2 sch 50 form either from the CRA website or your tax software if it integrates with the CRA forms.

-

Input Shareholder Information: In the designated sections of the form, meticulously enter each shareholder's details.

-

Review Your Entries: Double-check all entered information for accuracy to avoid penalties and ensure compliance.

-

Submit the Form: The completed t2 sch 50 should accompany your T2 corporate income tax return. Choose your submission method: online, by mail, or in-person.

-

Keep Records: Maintain copies of the submitted form and supporting documents for your records to assist with future audits or inquiries.

Common User Groups for T2 Schedule 50

Typically, the t2 sch 50 is utilized by specific entities. Understanding the primary users can clarify the form's application:

- Private Corporations: Most frequently, private companies seeking to disclose shareholder information need the t2 sch 50.

- Tax Professionals: Accountants and tax advisors often prepare this form for their clients, ensuring compliance with CRA requirements.

- Shareholders and Directors: Individuals involved in corporate governance may need to be aware of this form, especially if they are significant shareholders.

Legal Implications of T2 Schedule 50

The t2 sch 50 serves not only as a reporting tool but also has legal ramifications for those who fail to comply:

- Penalties for Non-Compliance: Failure to file the t2 sch 50 may result in financial penalties imposed by the CRA. Accurate reporting is vital to avoid such consequences.

- Regulatory Oversight: This form support regulations aimed at preventing tax evasion and ensuring transparency in corporate governance.

Understanding the legal weight of the t2 sch 50 helps corporations maintain compliance while fulfilling their obligations to the CRA.

Key Components of T2 Schedule 50

Several elements make up the t2 sch 50, each designed to capture critical shareholder information:

- Shareholder Identification: Each shareholder must be uniquely identified, ensuring clarity on who holds ownership stakes.

- Ownership Stakes: Percentage ownership is crucial for the CRA to assess tax obligations and potential liabilities accurately.

- Contact Information: Providing up-to-date contact details aids in effective communication for any follow-up inquiries or requirements.

Thoroughly understanding these elements is essential for accurate reporting when completing the t2 sch 50.

Important Dates for T2 Schedule 50 Filing

Timeliness is critical when dealing with tax forms. The following deadlines are pertinent for the t2 sch 50:

- Filing Deadlines: Corporations need to submit the t2 sch 50 along with their annual T2 tax return, typically within six months of the end of their fiscal year.

- Payment Dates: If applicable, any taxes owed should also be settled by this date to avoid penalties.

Being aware of these timelines ensures compliance and helps manage corporate finances effectively.

Real-World Examples of T2 Schedule 50 Applications

Understanding how the t2 sch 50 functions in practical scenarios can enhance clarity. Here are common use cases:

- A Start-up Corporation: A new tech start-up with three founding shareholders must file the t2 sch 50 to report their respective ownership percentages as the company seeks funding.

- An Established Business: A long-standing manufacturing corporation undergoing ownership changes must file the t2 sch 50 to reflect the new ownership structure following a sale of shares to outside investors.

These examples highlight the significance of the t2 sch 50 in various corporate contexts and ownership scenarios.