Understanding the Pag-IBIG Change of Information Process

The Pag-IBIG Change of Information process is essential for employers and members needing to update their details linked to membership and contributions. Using the Employers Change of Information Form (ECIF) helps ensure that records are accurate and up to date.

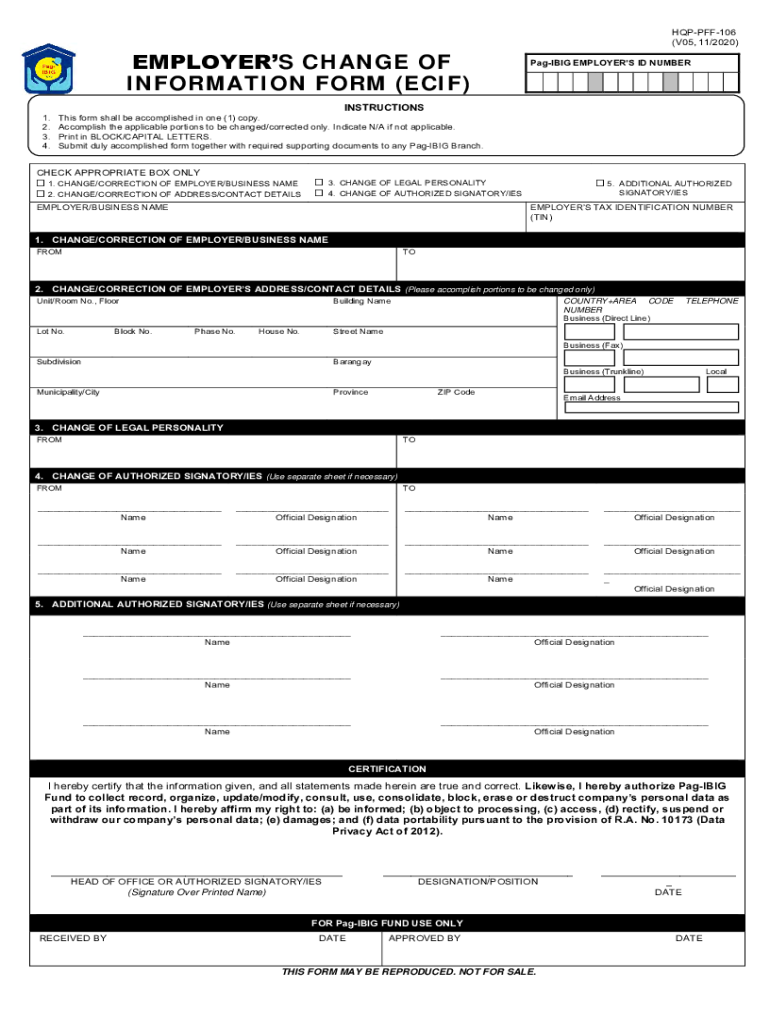

What is the Pag-IBIG Employers Change of Information Form (ECIF)?

The ECIF is a necessary document used by employers to amend their details in the Pag-IBIG system. This could include updating the business name, address, legal personality, or authorized signatories. This form is essential for maintaining compliance with Pag-IBIG Fund regulations.

Key Features of the ECIF

- Comprehensive Updates: Allows employers to update all relevant information without needing multiple forms.

- Structured Format: The form includes sections for every type of change, streamlining the completion process.

- Certification Requirement: To validate any updates, a certification section must be filled out by the head of the office or an authorized signatory.

Steps to Complete the Pag-IBIG ECIF

Completing the ECIF requires careful attention to detail to ensure compliance with Pag-IBIG regulations.

- Obtain the ECIF: Access the ECIF from the Pag-IBIG Fund website or appropriate office.

- Fill in Employer Details: Enter the business name, address, and other required information accurately.

- Indicate Changes: Clearly specify what information needs updating, referring to the corresponding fields on the form.

- Attach Supporting Documents: Include any necessary documents that validate the changes, such as business permits or identification of authorized signatories.

- Sign and Submit: The head of office or an authorized signatory must sign the form. Submit online or in person to the nearest Pag-IBIG office.

Important Documentation Required

To ensure that your ECIF is accepted without delays, gather the following documents:

- Valid Identification: Identification cards of the authorized signatories.

- Business Registration Documents: Documents that verify the business name and legal personality.

- Previous ECIF if Applicable: If you are making changes to existing details, include the last submitted ECIF.

Who Needs to Use the Pag-IBIG ECIF?

The ECIF is primarily for employers registered with Pag-IBIG Fund. This includes:

- Small to Large Businesses: Any registered employer needing to update information related to their Pag-IBIG contributions must use this form.

- Organizations: Non-profits, cooperatives, and other types of organizations must also adhere to these requirements when changes occur.

Common Scenarios for Using the ECIF

Various scenarios may prompt an employer to utilize the ECIF:

- Business Relocation: If a company moves to a different address, it is essential to reflect this change in Pag-IBIG records.

- Change in Legal Structure: Transitioning from a sole proprietorship to an LLC or corporation affects how the business is registered with Pag-IBIG.

- Alterations in Ownership: If the authorized signatories change due to ownership transfers or restructuring, the ECIF should be completed.

Online vs. In-Person Submission of the ECIF

Employers have the option to submit the ECIF either online or in person:

- Online Submission: Can often be more convenient, allowing for quicker processing times when the document is filed correctly.

- In-Person Submission: Recommended for employers needing direct assistance or confirmation from Pag-IBIG representatives.

Conclusion on Pag-IBIG Change of Information

Updating employer information through the Pag-IBIG ECIF is crucial for compliance and effective communication with the Pag-IBIG Fund. By ensuring that the required documentation is submitted properly and timely, employers can avoid disruptions in their business processes. For optimal results, always double-check the latest guidelines from Pag-IBIG and ensure all information is accurate and complete.