Definition and Meaning of Rule 15 in Government Savings Promotion Rules 2018

Rule 15 of the Government Savings Promotion Rules 2018 outlines the guidelines governing the operational aspects and eligibility criteria for government savings schemes. This rule emphasizes the principles that ensure transparency, accountability, and accessibility in the management of savings accounts. It serves as a framework to guide individuals and institutions involved in the promotion and handling of government savings accounts, ensuring compliance with the stipulated legal and administrative measures.

Key Components of Rule 15

- Eligibility Criteria: Rule 15 elucidates the specific eligibility requirements for opening and managing government savings accounts, detailing who may benefit from these programs.

- Transparency Measures: It mandates that all terms and conditions associated with these savings schemes be clearly communicated to potential users, mitigating the risk of misinformation.

- Account Management: The rule establishes protocols for the proper management and operation of these accounts, ensuring that funds are safeguarded and that stakeholders can resolve issues effectively.

How to Use Rule 15 of Government Savings Promotion Rules 2018

To effectively utilize Rule 15 of the Government Savings Promotion Rules 2018, stakeholders must familiarize themselves with its provisions and guidelines. This involves understanding the procedures for account opening, maintenance, and closure, as well as the rights and obligations of account holders.

Practical Steps to Use Rule 15

- Read the Full Text: Obtain and review the complete text of Rule 15 to grasp its full scope and implications.

- Determine Eligibility: Assess personal or institutional eligibility against the criteria outlined in the rule.

- Follow Procedures: Adhere to the procedures laid out for account operations, ensuring compliance with all stated requirements.

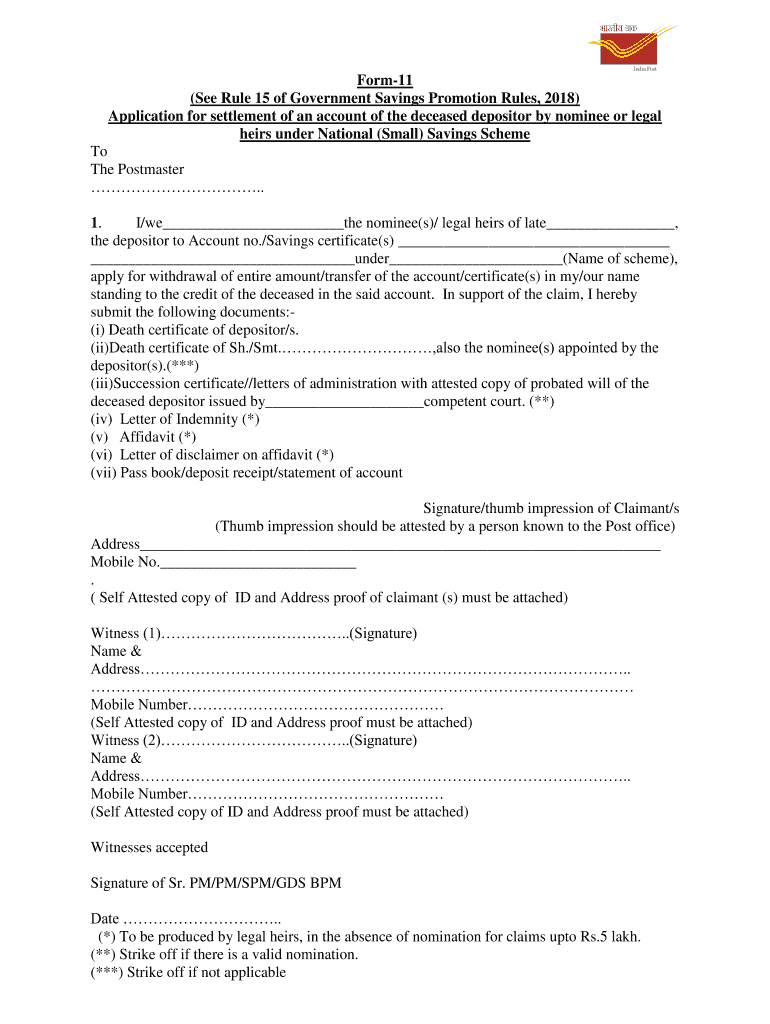

Steps to Complete the Requirements of Rule 15

Completing the requirements under Rule 15 involves an organized approach to following regulatory protocols for government savings accounts. The steps can be summarized as follows:

- Gather Required Documents: Collect all necessary identification and documentation to certify eligibility, such as proof of residency and financial statements.

- Fill Out Application Forms: Complete the application forms as prescribed, ensuring all sections are filled out accurately to avoid delays.

- Submit for Approval: Submit the application along with the aforementioned documents either online or in person, per the guidance provided in Rule 15.

- Await Confirmation: Monitor the status of the application, complying with any additional requests for information or documentation from the authorities.

Who Typically Uses Rule 15 of Government Savings Promotion Rules 2018

Rule 15 is particularly relevant for various stakeholders involved in government savings schemes, including:

- Individuals: General public members looking to open savings accounts under the government’s schemes, seeking to benefit from the associated interest rates and security features.

- Financial Institutions: Banks and financial organizations that administer these savings accounts must comply with Rule 15 to promote transparency and maintain operational integrity.

- Regulatory Bodies: Government agencies overseeing the implementation of savings promotion rules and ensuring compliance across the sector rely on Rule 15 principles.

Important Terms Related to Rule 15 of Government Savings Promotion Rules 2018

Understanding key terminology associated with Rule 15 enhances clarity regarding its application:

- Nominee: A person designated to receive the depositing individual’s funds in the event of their demise.

- Savings Account: A financial account that allows for deposits while providing interest on the balance.

- Eligibility Criteria: Specific requirements that individuals or institutions must meet to qualify for opening and operating government savings accounts.

- Account Closure: The process of officially terminating a savings account, including the necessary steps to reclaim funds.

By familiarizing oneself with these terms, individuals can navigate Rule 15 more effectively.