Definition and Meaning of Acceptance of Successor Trustee Form

The acceptance of successor trustee form is a legal document that signifies an individual's or entity's agreement to serve as the successor trustee of a trust after the previous trustee has resigned, passed away, or been removed. This form is essential for officially recognizing the new trustee's role and responsibilities in managing the trust and its assets. It serves as a formal acknowledgment of the appointment and sets the stage for the successor trustee to carry out their duties in accordance with the trust's terms.

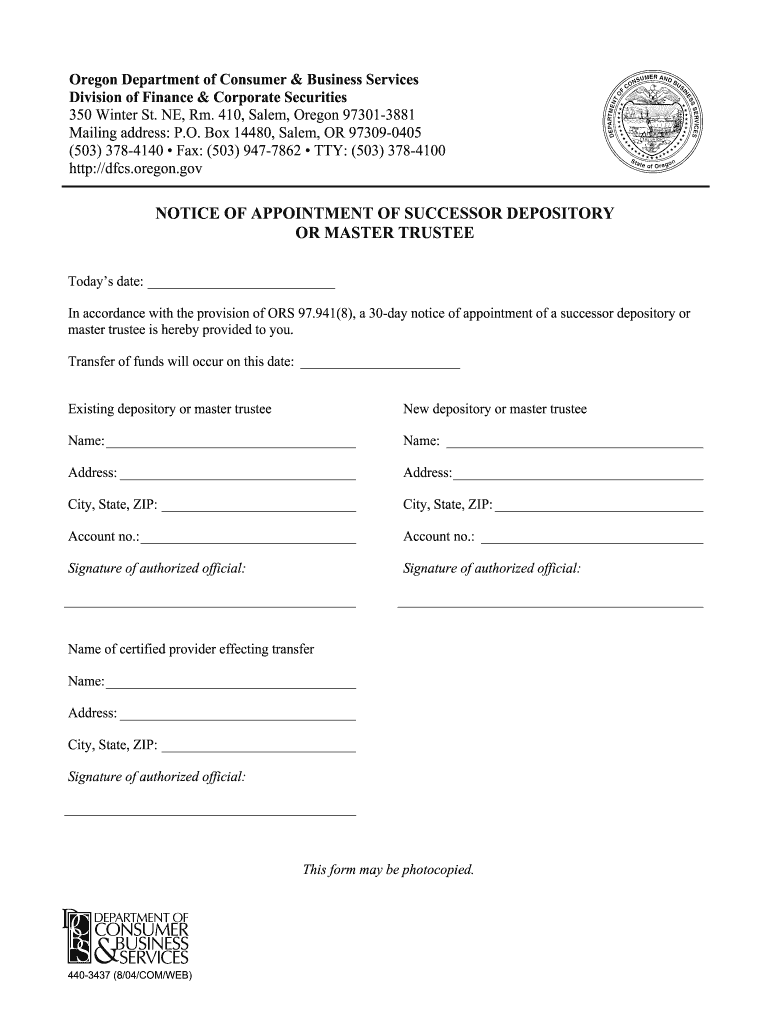

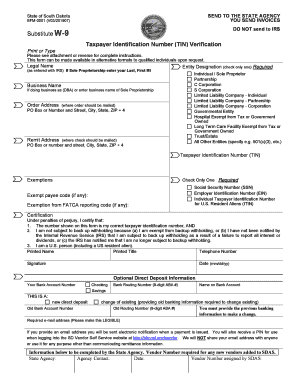

This document typically requires the successor trustee to provide personal information, including their name, address, and contact details. Moreover, it often includes a declaration where the individual confirms they are willing and able to assume the responsibilities associated with the role, which may include managing investments, distributing assets, and ensuring compliance with applicable laws. By executing this form, the successor trustee agrees to act in the best interest of the beneficiaries as outlined in the trust agreement.

Understanding the importance of this form is crucial, as it not only facilitates a smooth transition of responsibilities but also protects the rights of beneficiaries by providing a clear record of who is responsible for managing the trust's affairs.

Steps to Complete the Acceptance of Successor Trustee Form

Completing the acceptance of successor trustee form involves several important steps. Ensuring accuracy and thoroughness during this process is crucial for the legal validity of the document.

-

Obtain the Form: Start by acquiring the appropriate acceptance of successor trustee form. This can often be downloaded from legal websites, or you might consult with a legal professional.

-

Fill in Personal Information: Provide your full name, address, and contact information in the designated sections of the form.

-

Review Trust Documents: Read through the relevant trust documents carefully to understand your responsibilities and the powers granted to you as trustee.

-

Declare Acceptance: In the designated area, you must explicitly state your acceptance of the role and that you agree to fulfill the duties outlined in the trust agreement. Be sure to indicate your understanding of these responsibilities.

-

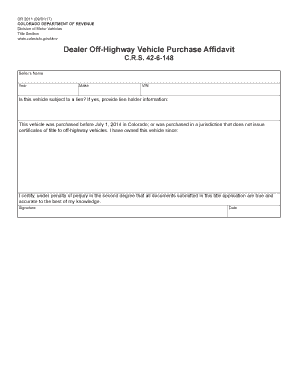

Sign and Date the Form: After filling out all pertinent sections, sign and date the form to confirm your acceptance. Include any required witnesses or notarization, if necessary, according to state law.

-

Submit the Form: Deliver the completed form to any relevant parties, which may include the beneficiaries of the trust or the court if needed.

By following these steps, you ensure that the acceptance of your role as successor trustee is both official and legally recognized.

Key Elements of the Acceptance of Successor Trustee Form

Understanding the key elements included in the acceptance of successor trustee form can clarify its usage and importance. The primary components of this form encompass:

-

Personal Information: This section captures the successor trustee's full legal name, address, and contact information, essential for identification.

-

Trust Information: Details regarding the trust should be noted, including its name, the original trustee's name, and any relevant governing documents.

-

Statement of Acceptance: This is a crucial clause where the successor trustee formally accepts the appointment. It outlines their responsibility to act in accordance with the trust's terms and applicable law.

-

Signatures: The form must include the signature of the successor trustee, and in some cases, acceptance by other authorized individuals or a notary public.

-

Date of Acceptance: A date stamp indicating when the form was completed and signed provides a clear record of the acceptance.

By ensuring these elements are present, the form fulfills its purpose as a legal acknowledgment of the successor trustee’s role.

Important Terms Related to the Acceptance of Successor Trustee Form

Familiarizing oneself with terms associated with the acceptance of successor trustee form enhances comprehension and effective communication in legal contexts. Key terms include:

-

Trustee: An individual or entity entrusted with managing the assets of a trust for the benefit of its beneficiaries.

-

Beneficiaries: Persons or entities entitled to receive benefits or assets from the trust.

-

Probate: The legal process through which a deceased person's assets are distributed; it often becomes involved when a trust is contested or not executed properly.

-

Trust Instrument: The legal document establishing the trust and outlining its terms and conditions.

-

Successor Trustee: An individual or entity that takes over the responsibilities of the trustee upon the original trustee’s resignation, incapacity, or death.

Understanding these terms can aid in navigating discussions or legal documents pertaining to trusts and ensure clarity around the roles involved.

State-Specific Rules for the Acceptance of Successor Trustee Form

Each state in the U.S. may have specific regulations and requirements for the acceptance of successor trustee form. Being aware of these local guidelines is essential for compliance. Key factors include:

-

State Laws: Various states have different statutes governing trusts, including how successor trustees are appointed and the processes for notifying interested parties.

-

Notarization Requirements: Some states may require the acceptance form to be notarized for it to be considered valid.

-

Witness Signatures: Certain jurisdictions might stipulate that the acceptance must be signed in the presence of witnesses.

-

Court Approval: In cases where the original trustee's exit is contentious or unclear, some states may require court approval for the successor trustee's appointment, necessitating additional steps.

-

Reporting Obligations: States may impose specific reporting requirements on trustees, particularly concerning the initial actions taken upon acceptance.

By understanding and adhering to these state-specific rules, successor trustees can avoid legal pitfalls and ensure a smooth transition in managing the trust.