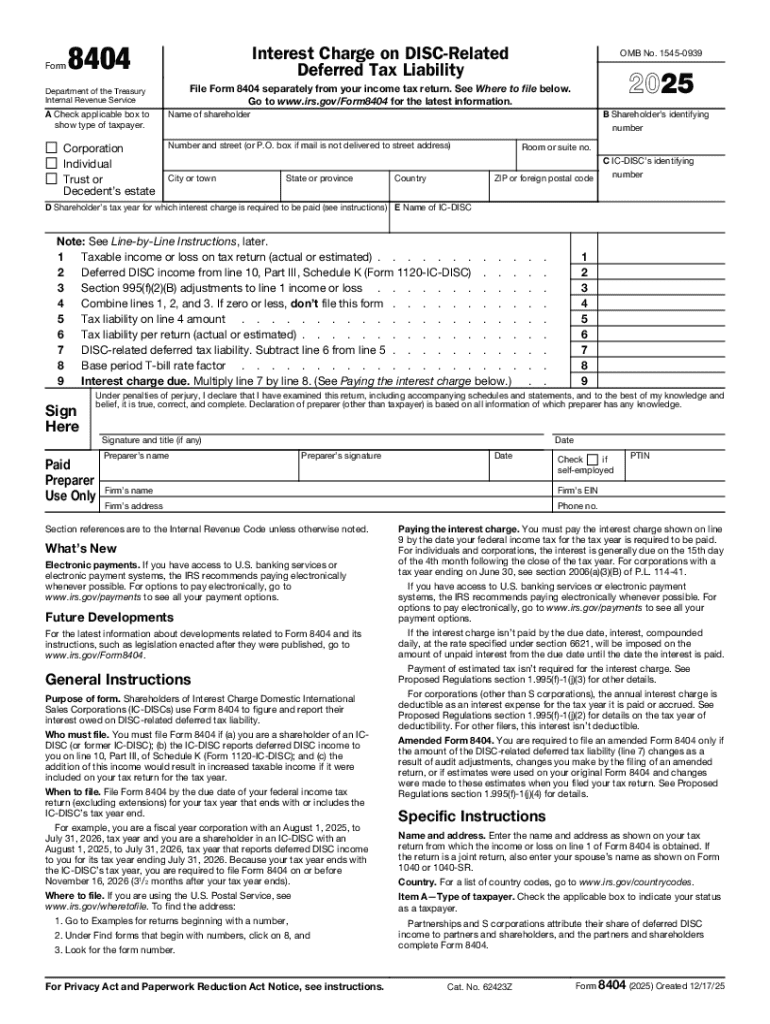

Definition and Purpose of 2025 Form 8404

The 2025 Form 8404, also known as the Interest Charge on DISC-Related Deferred Tax Liability, is a specialized tax form used by corporate entities to report specific deferred tax liability. This form is crucial for transactions involving Domestic International Sales Corporations (DISCs). It focuses on the calculation and reporting of interest on deferred taxes attributable to DISC-related entities.

Key Components of Form 8404

- Interest Charge: This section is dedicated to computing the interest that arises from deferred tax liabilities associated with DISC transactions.

- Taxpayer Information: Includes essential details about the corporation, individual, trust, or estate filing the form.

- Deferred Tax Liability Details: Details the specific items of deferred tax for accurately calculating the interest charge.

How to Obtain the 2025 Form 8404

Acquiring the 2025 Form 8404 can be achieved through several methods. It's essential to use the official and updated version for accuracy and compliance.

Official Sources

- IRS Website: Direct download is available on the IRS website in PDF format, ensuring you have the most current version.

- Tax Software: Platforms like TurboTax and QuickBooks often include access to necessary IRS forms, including Form 8404, which can be filled digitally.

Physical Copies

- IRS Offices: Visit local IRS offices to obtain a physical copy if preferred over a digital version.

- Postal Request: Request a physical copy to be mailed to your address through the IRS forms ordering service.

Steps to Complete the 2025 Form 8404

Filling out the 2025 Form 8404 correctly ensures compliance and avoids penalties. This step-by-step guidance will facilitate accurate completion.

Detailed Steps

- Gather Information: Collect all relevant financial documentation, including details on deferred tax liabilities related to DISC arrangements.

- Enter Taxpayer Data: Fill in your corporation's, individual’s, or trust’s identifying information in the appropriate sections.

- Calculate Interest: Use the provided guidelines and mathematical formulas within the form to accurately compute the interest due on deferred taxes.

- Verify Entries: Double-check all entries for accuracy, ensuring all calculations are correct and all fields are completed.

Submission

- Filing Location: Send the completed form to the address specified by the IRS for Form 8404 submissions. Verify the address for any changes on the IRS website.

Eligibility for Using 2025 Form 8404

Eligibility to file the 2025 Form 8404 is specific and pertains to those engaged in DISC-related activities.

Criteria

- Corporations Utilizing DISCs: Corporations that have set up a DISC for exporting goods are required to use this form to report interest on their deferred tax liabilities.

- Individuals and Trusts: Certain individuals or entities that hold shares in DISCs and defer related income may also need to file.

Ineligible Entities

- Non-DISC Entities: Corporations or individuals without DISC entities or deferred tax liabilities are not required to file this form.

IRS Guidelines for 2025 Form 8404

Adhering to IRS guidelines ensures that the form is completed and submitted correctly.

Key IRS Instructions

- Deadline Compliance: The form must be filed by the due date specified by the IRS to avoid penalties.

- Accurate Reporting: Ensures that all entries are precise, following the IRS’s detailed documentation instructions for this form.

- Mandatory Attachments: Include any necessary documentation or schedules referenced in the form instructions.

Filing Deadlines and Important Dates

Knowing the deadlines for Form 8404 is critical for maintaining compliance and avoiding penalties.

Key Dates

- Annual Filing Deadline: Typically aligns with corporate tax return deadlines but should be verified annually as changes can occur.

- Extension Availability: Corporations may file requests for extensions if additional time is needed to prepare and submit the form.

Penalties for Non-Compliance

Failure to file or errors in the Form 8404 can result in significant penalties.

Potential Penalties

- Monetary Fines: The IRS may impose fines for late filing, missing payments, or incorrect submissions.

- Accrual of Additional Interest: If the interest is underreported, additional charges on the outstanding amount can result.

Software Compatibility for Completing Form 8404

Using compatible software makes it easier to complete and file Form 8404 accurately.

Recommended Software

-

TurboTax: Offers comprehensive support for various tax forms, including calculations pertinent to Form 8404.

-

QuickBooks: Integrates directly with accounting information, simplifying data transfer and form completion.

-

DocHub: Users can edit, send, and store completed forms securely, with seamless integration to ensure data integrity.

Adhering to these guidelines and utilizing compatible resources will streamline the process of managing DISC-related deferred tax liabilities using the 2025 Form 8404.