Definition & Meaning

The opm-ri-20-120 is a form utilized primarily by retired Federal employees. Officially approved by the U.S. Office of Personnel Management (OPM), its primary purpose is to request a change to an unreduced annuity. Typically, this form is used when there has been a significant change in one's personal circumstances that affects their annuity arrangement, such as the end of a marriage. The form ensures that retirees can secure the correct annuity amounts following major life changes, effectively managing their retirement benefits in accordance with personal and legal provisions.

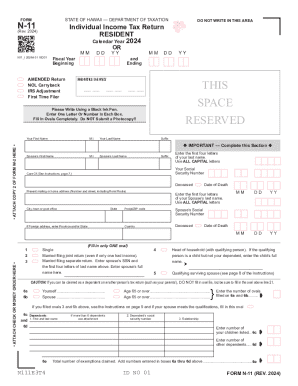

Steps to Complete the opm-ri-20-120

-

Identifying Personal Details: Start by providing personal identification information like your claim number and full name. It's crucial to ensure that all data is correctly entered to avoid processing delays.

-

Reason for Change: Specify why the change to an unreduced annuity is being requested. Common reasons include divorce, annulment, or the death of a spouse. This section must accurately reflect your circumstances.

-

Documentation: Attach supporting documents, such as a copy of a death certificate or a divorce decree, to substantiate the reasons for your request. Make sure these documents are certified copies if required.

-

Health Benefits Adjustment: If applicable, indicate whether you wish to adjust your health benefits coverage from self and family to self-only, especially if there are no other eligible family members.

-

Signature and Date: Finalize the form by signing and dating it. Confirm that all information is complete and accurate before submission.

How to Obtain the opm-ri-20-120

The opm-ri-20-120 form can be obtained through various channels. Typically, it is available directly from the U.S. Office of Personnel Management's website. Additionally, retirees can request the form by contacting the OPM Retirement Services via mail or phone. It's important to ensure that you are accessing the most current version of the form to avoid any compliance issues.

Who Typically Uses the opm-ri-20-120

This form is predominantly used by retired Federal employees who initially elected a reduced annuity to provide for a surviving spouse. The users are often individuals who have undergone personal changes that render the survivor annuity provision either unnecessary or fundamentally altered due to life events like divorce or the death of a spouse. By filing this form, retirees can adjust their annuity to better align with their new situation.

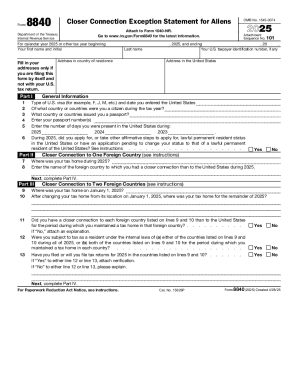

Legal Use of the opm-ri-20-120

The opm-ri-20-120 form is governed by specific regulatory requirements to ensure a lawful transition to an unreduced annuity. Compliance with the ESIGN Act provides the necessary legal framework for electronic submissions, guaranteeing legally binding changes. Retirees must adhere to the precise submission and documentation standards to ensure their requests are accepted and processed under federal laws.

Required Documents

Supporting documentation is critical when submitting the opm-ri-20-120. Essential documents usually include:

- A certified copy of a divorce decree, encompassing property settlements if applicable.

- A death certificate if a spouse has passed away.

- Any legal documentation that validates custody or guardianship changes that might affect annuity decisions.

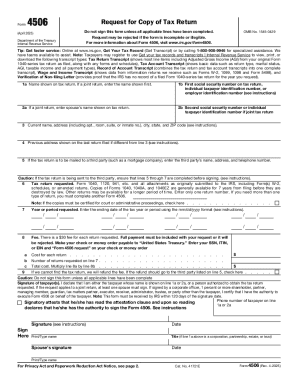

Form Submission Methods (Online / Mail / In-Person)

Retirees have multiple options for submitting the opm-ri-20-120 form. The most efficient method for many is the online submission through the OPM's official portal. For those preferring traditional methods, forms can be mailed directly to the OPM Retirement Services. Additionally, in-person submissions can be made by visiting local OPM offices, although this depends on the availability and proximity of these resources to the applicant.

Key Elements of the opm-ri-20-120

- Claim Number: Essential for identifying your case and ensuring accurate processing.

- Spouse Information: Details regarding the former spouse, if applicable.

- Reason Selection: Clearly marked reason for requesting annuity change.

- Supporting Documentation: Necessary to validate the change request.

- Health Benefits Adjustment: Option to change coverage levels.

Digital vs. Paper Version

The digital version of the opm-ri-20-120 offers convenient features such as secure electronic signatures and faster processing times. Using platforms like DocHub can simplify the editing and submission process, reducing errors and enhancing accessibility. Conversely, the paper version requires manual completion and mailing, which can be advantageous for those less comfortable with digital platforms or where digital access is limited.

Software Compatibility

Modern tax and filing software, including programs like TurboTax and QuickBooks, recognize the opm-ri-20-120 form, ensuring seamless integration into broader tax or financial planning workflows. These software solutions can help manage form submissions, track changes in retirement benefits, and ensure compliance with all applicable guidelines.

Eligibility Criteria

To be eligible to file the opm-ri-20-120, applicants must be retired Federal employees with a valid claim number. They should have previously opted for a reduced annuity, typically to benefit a spouse, and must now seek an adjustment due to changed personal circumstances. It's imperative that applicants still have access to their retirement benefit account details to accurately complete the form.