Definition and Meaning of Form 5471

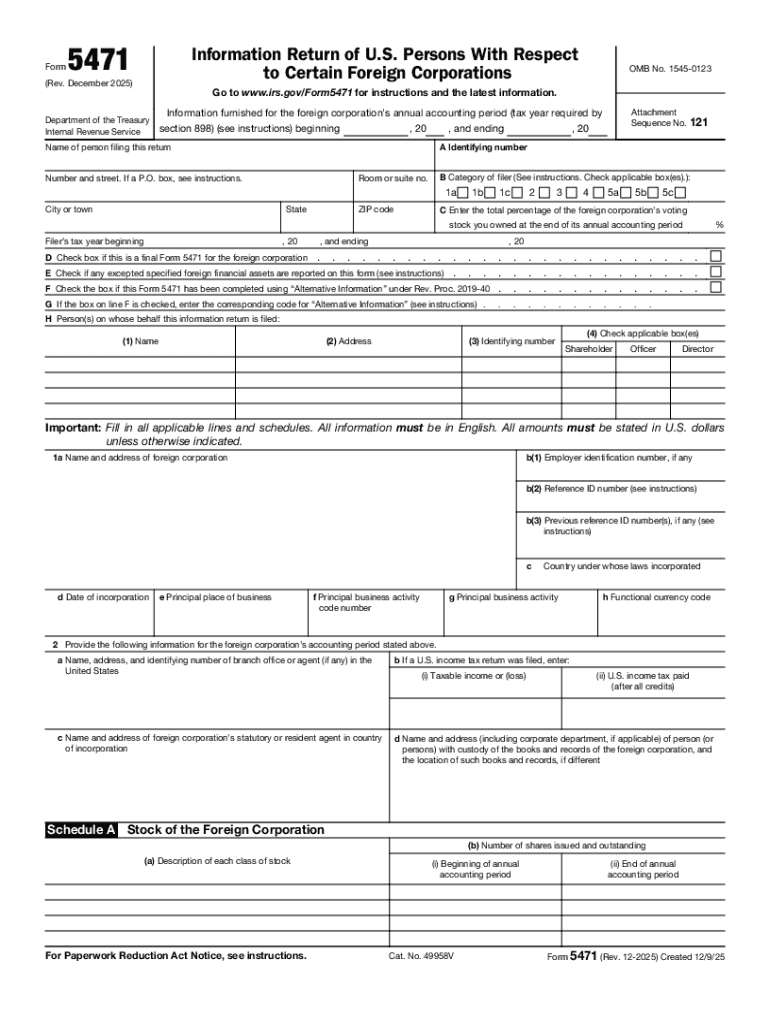

Form 5471, titled "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," is a critical document required by the Internal Revenue Service (IRS) for certain U.S. citizens, residents, and entities involved with foreign corporations. It is used to report the financial interest the U.S. individuals or entities have in foreign corporations and to ensure compliance with U.S. tax laws regarding international financial dealings. Accurate completion of this form is essential for maintaining transparency and compliance in international financial transactions.

Significance in U.S. Tax Compliance

Form 5471 plays a crucial role in the United States' efforts to monitor and tax foreign income. U.S. taxpayers who own or control certain foreign corporations must file this form to provide detailed information about these entities, including income, assets, and shareholding patterns. This requirement is part of the larger framework of U.S. tax regulations aimed at preventing tax evasion through the use of offshore accounts and entities.

Filing Deadlines and Important Dates

Accurate and timely submission of Form 5471 is vital. It is due along with your individual or corporate income tax return, typically on April 15 for calendar year filers. If you are granted a filing extension for your tax return, the deadline for Form 5471 is automatically extended. However, being late can result in significant penalties, emphasizing the necessity for punctuality.

Potential Extensions

Taxpayers may obtain an automatic six-month extension to October 15 by filing Form 4868 (for individuals) or Form 7004 (for businesses). This extension applies to Form 5471 as well, providing more time for complicated reporting requirements. However, it's crucial to note that while filing may be extended, the payment of any taxes due is not.

Steps to Complete the Form 5471

Form 5471 is a complex document composed of several schedules, each corresponding to specific reporting requirements about the foreign corporation's financial details. Here is a structured approach to completing the form:

-

Gather Relevant Information: Collect documents related to the foreign corporation, including financial statements, ownership records, and previous Form 5471 filings.

-

Identify Reporting Requirements: Determine which categories and schedules are applicable based on the filer’s relationship to the foreign corporation. There are five categories, each with distinct filing requirements.

-

Complete General Information: This includes the filer’s identity, tax identification number, the corporation's name, address, and other identifying details.

-

Fill Out Applicable Schedules: Complete schedules such as income statement analysis, balance sheet details, and owner/shareholder information. Each schedule covers different aspects of the corporation’s operations and financials.

-

Review Tax Credits and Deductions: Evaluate applicable U.S. tax treatments, foreign tax credits, and deductions, ensuring you accurately capture tax liabilities to avoid double taxation.

-

Consult IRS Instructions: Refer to the detailed IRS instructions for Form 5471 to ensure compliance with specific legal requirements and for clarification on technical queries.

Who Typically Uses Form 5471

Form 5471 must be filed by several types of U.S. taxpayers involved with foreign corporations, including:

- U.S. citizens and residents: Who are officers, directors, or shareholders in controlled foreign corporations (CFCs).

- U.S. domestic corporations: That own a significant stake in a foreign corporation.

- Certain foreign corporations: With U.S. shareholders that meet specific ownership thresholds.

Importance for Corporations

Corporations involved in owning or transacting with foreign subsidiaries must ensure compliance with Form 5471 to avoid potential penalties and maintain their corporate integrity. Many large multinational corporations regularly file this form as part of their international tax strategy.

Penalties for Non-Compliance

Failure to file Form 5471 on time or furnishing incorrect information can lead to severe penalties. As of the current regulations, non-compliance can result in substantial monetary fines beginning at $10,000 per form and can increase with continued failure to comply. Additionally, there are increased risks of attracting IRS scrutiny, audits, and further disciplinary actions.

Avoidance and Mitigation Strategies

To avoid these penalties, U.S. persons and corporations should:

- Ensure Timeliness: File the form within the set deadlines.

- Verify Accuracy: Double-check details to avoid inaccuracies or omissions.

- Consult Tax Professionals: Engage with professionals well-versed in international tax law and IRS requirements for foreign corporation reporting.

Key Elements of the Form 5471

Understanding the key components of Form 5471 is essential:

-

Schedules A to M: Cover various aspects of the foreign corporation including income, balance sheets, and other financial activities.

-

Category of Filers: Determine specific sections based on one's role, whether a director, officer, or significant shareholder.

-

Ownership Information: Includes detailed lists of U.S. persons who are shareholders, their respective shares, and related financial interests.

Important Considerations

An effective filing will accurately reflect the foreign corporation’s financial standing and the U.S. person’s interest in it. Consider seeking professional guidance for complex corporate structures or uncertain tax implications.

IRS Guidelines on Form 5471

The IRS provides comprehensive guidelines on how to fill out Form 5471, which can be accessed on the IRS website. These provide essential instructions and updates on legal changes, schedule explanations, and clarification on complex reporting scenarios.

Engaging with these guidelines ensures that taxpayers remain compliant with the latest tax laws and understand the implications of international dealings. Seeking consultation for intricate cases is recommended to maintain adherence and avoid legal complications.