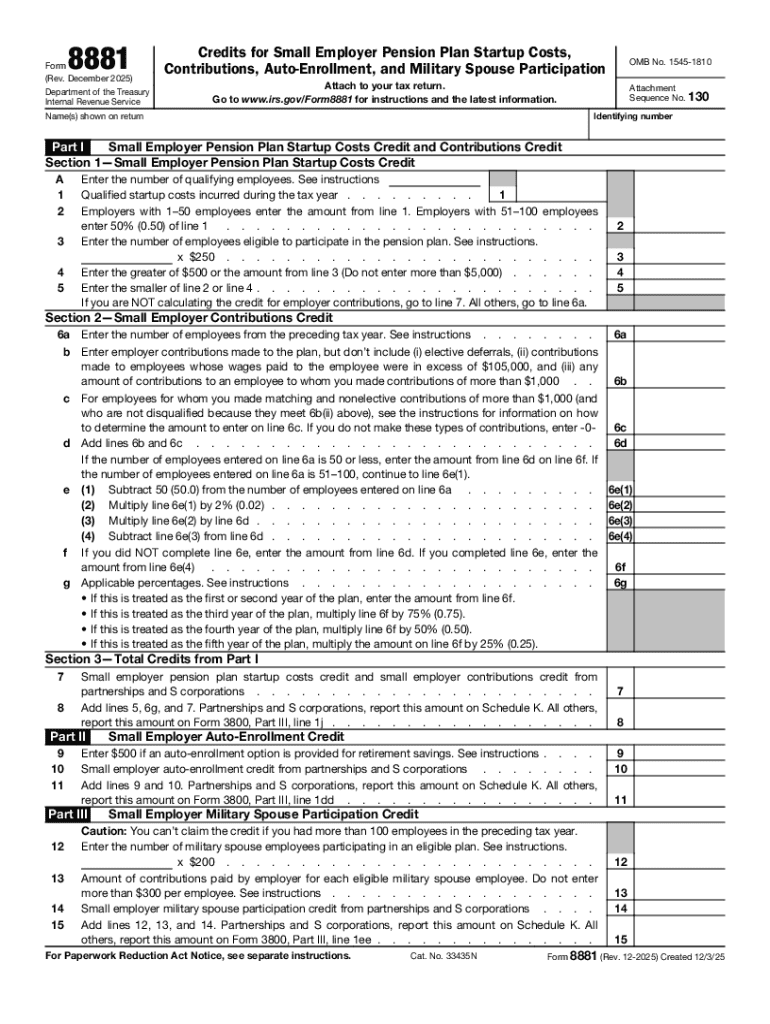

Definition & Meaning of IRS Form 8881

IRS Form 8881, titled "Credit for Small Employer Pension Plan Startup Costs," is a tax form issued by the Internal Revenue Service. It allows employers, especially small businesses, to claim tax credits for establishing and maintaining employee pension plans. The form primarily targets costs related to initiating 401(k) plans or similar retirement benefits, aiming to encourage businesses to provide such benefits to their workforce.

This form facilitates employers by offering financial incentives, helping to offset the initial costs associated with setting up these plans. By offering a credit rather than a deduction, Form 8881 directly reduces the amount of tax owed, making it highly advantageous for small business owners.

How to Use IRS Form 8881

Employers can use Form 8881 to claim a tax credit for their pension plan startup costs. These costs must be related to establishing a qualified retirement plan, including the costs of set up and administration, as well as employee education programs related to the plan.

- Identify Eligible Costs: Determine eligible expenses related to the setup of a qualified pension plan.

- Calculate the Credit: Use the form to calculate the credit, which can be up to $500 per year for the first three years of the plan.

- Complete Relevant Sections: Fill in the necessary information, such as the taxpayer identification number and employer details.

- File with Tax Return: Submit Form 8881 along with your annual tax return to claim the credit.

Employers should ensure all information is accurate and well-documented to support the claimed credit.

Steps to Complete IRS Form 8881

Completing Form 8881 involves a few straightforward steps:

- Gather Necessary Information: Collect details about your business, including your Employer Identification Number (EIN) and specifics of the retirement plan.

- Calculate Eligible Expenses: List all qualified startup expenses. Eligible costs may include setting up the plan and educating employees about the plan options.

- Calculate the Tax Credit: Insert the eligible expenses into the appropriate sections on the form to compute the credit.

- Finalize and Review: Review the form for accuracy. Ensure that all calculations are correct and all necessary sections are filled.

- Submit with Tax Returns: Attach the form to your organization's tax return to claim the credit.

Accuracy in this process is crucial to avoid disputes with the IRS and to ensure the claim is processed smoothly.

Eligible Costs Under IRS Form 8881

The credit calculation under Form 8881 involves specific costs associated with pension plan setup. These may include:

- Consultation Fees: Costs of consulting services for designing pension plans.

- Setup Costs: Expenses incurred in establishing and administering the plan.

- Educational Programs: Costs of informing employees about the benefits and details of the plan.

It's important to maintain accurate records and receipts for these costs to substantiate the tax credit claim.

Eligibility Criteria for IRS Form 8881

To qualify for the credit through Form 8881, businesses must meet certain criteria:

- Aimed at Small Employers: Usually, businesses with less than 100 employees are eligible.

- Active Participation: At least one employee must actively participate in the plan.

- New Plan: The credit is typically available for new plans rather than existing ones.

- Three-Year Limitation: The credit can only be claimed for the first three years after the plan is established.

Businesses should confirm their eligibility annually when filing the form to ensure compliance and accuracy in their claims.

Important Terms Related to IRS Form 8881

Understanding key terminology is critical when dealing with IRS Form 8881:

- Startup Costs: These are expenses involved in the initial setup of a retirement plan.

- Qualified Employer: Defined as a business meeting specific size and employment conditions to claim the credit.

- Tax Credit: Refers to a direct reduction of taxes owed, distinguished from tax deductions.

- Pension Plan: A retirement plan established by the employer for the benefit of employees.

Familiarity with these terms helps employers effectively manage and utilize Form 8881.

Filing Deadlines and Important Dates

Employers must be aware of key deadlines associated with Form 8881:

- Annual Tax Filing Deadline: Form must be filed in conjunction with your federal tax return by the tax deadline, usually April 15th.

- Extensions: Potential for filing tax extensions if more time is needed but does not affect the deadline for submitting Form 8881.

- Three-Year Claim Limit: Remember that the credit can only be claimed for the first three years of the plan's existence.

Maintaining awareness of these deadlines ensures compliance with IRS regulations and maximizes the financial benefits.

Penalties for Non-Compliance

Failure to properly file or comply with IRS requirements regarding Form 8881 may result in penalties:

- Disallowed Credit: Incorrect filings may lead to disallowed credits, resulting in higher taxable liabilities.

- Interest and Penalties: Unpaid taxes due to reduced credits may accrue interest and penalties.

- Audits: Improper or fraudulent credit claims may trigger audits or additional scrutiny from the IRS.

Employers should ensure meticulous adherence to filing guidelines to avoid these potential downsides.