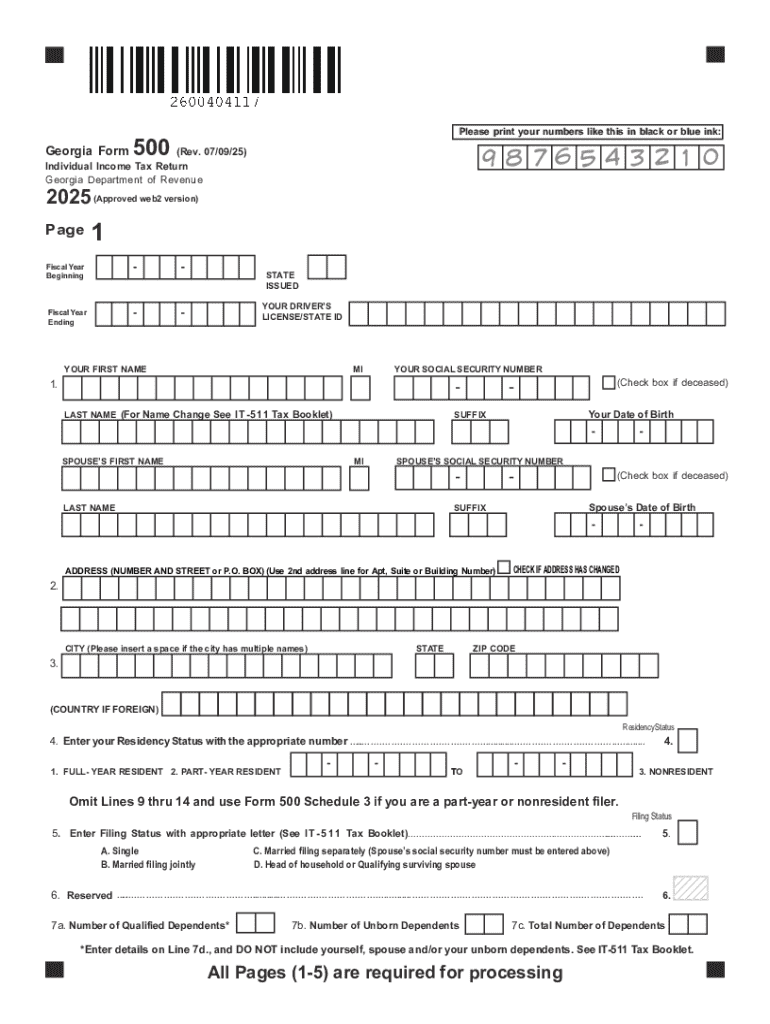

Understanding the Georgia Blank Tax Forms

The Georgia Blank Tax Forms are essential documents issued by the Georgia Department of Revenue, specifically designed to streamline the individual income tax return process. These forms are crafted to ensure legal compliance, accurate tax reporting, and efficient tax filing for residents of Georgia. Understanding the structure and purpose of these forms is crucial for taxpayers to navigate their fiscal responsibilities successfully.

Utilizing the Georgia Blank Tax Forms

Georgia Blank Tax Forms serve various functions for taxpayers and businesses. Primarily, they provide a comprehensive framework for declaring income, deductions, and credits, thereby facilitating transparent and accurate income reporting. For individuals and businesses, these forms enable the systematic organization of financial data, ensuring that no crucial information is overlooked during the filing process.

- Tax Declaration: These forms help taxpayers declare their total income, including wages, salaries, and investment returns accurately.

- Deductions and Credits: Filers can itemize deductions and credits to potentially reduce their taxable income.

- Tax Liability Calculation: The forms aid in calculating the total tax liability, taking into account various state-specific factors.

Obtaining the Georgia Blank Tax Forms

Georgia Blank Tax Forms can be acquired through multiple channels, ensuring accessibility for all taxpayers. The Georgia Department of Revenue’s official website is the primary source for downloading these forms. Taxpayers can also obtain paper copies from local tax offices if preferred.

- Online Download: Visit the Georgia Department of Revenue website to download the latest version of the forms.

- Physical Copies: Request paper forms from local tax offices or public libraries that distribute tax information.

- Third-Party Software: Use tax preparation software programs that integrate Georgia state tax forms into their systems.

Steps to Complete the Georgia Blank Tax Forms

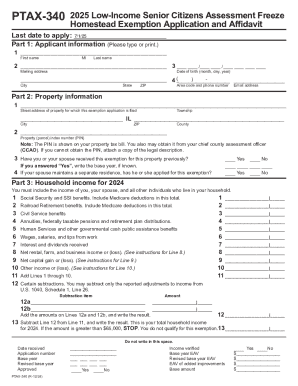

Completing the Georgia Blank Tax Forms requires careful attention to detail and adherence to instructions provided by the Department of Revenue. Here is a structured step-by-step guide:

- Gather Necessary Documentation: Collect W-2s, 1099s, and other income statements.

- Fill Out Personal Information: Provide identity details such as name, address, and Social Security number.

- Report Income: Enter total income from all sources accurately.

- Itemize Deductions and Credits: Carefully document eligible deductions and any credits.

- Calculate Tax Liability: Use the form’s instructions to compute the amount of tax owed or refund due.

- Review and Sign: Double-check all details for accuracy before signing the form.

Importance of Printing Georgia Blank Tax Forms

Printing the Georgia Blank Tax Forms is crucial for multiple reasons, especially for individuals who prefer to maintain hard copies for record-keeping. It also allows taxpayers to manually fill in details if digital submission is not feasible.

- Record-Keeping: Helps maintain a tangible record of tax filings for future reference.

- Review Process: Enables easy review and correction of errors before final submission.

- Manual Filing: Allows for physical submission when digital options are limited.

Typical Users of Georgia Blank Tax Forms

The Georgia Blank Tax Forms cater to a broad spectrum of taxpayers. These include individual filers, small businesses, and corporate entities operating within Georgia. Each user has specific reasons for utilizing these forms depending on their fiscal responsibilities.

- Individuals: Use these forms for personal income tax reporting.

- Small Businesses: File these forms to report state-level business income and expenses.

- Corporations: Required to declare corporate earnings and calculate state taxes accordingly.

Key Terms Related to Georgia Blank Tax Forms

Understanding key terms associated with Georgia Blank Tax Forms ensures accuracy and compliance.

- Adjusted Gross Income (AGI): A crucial figure that represents total income after certain deductions.

- Tax Credits: Direct reductions to the tax owed, essential for minimizing liabilities.

- Exemptions: Specific allowances that reduce taxable income.

Legal Compliance and Use of Georgia Blank Tax Forms

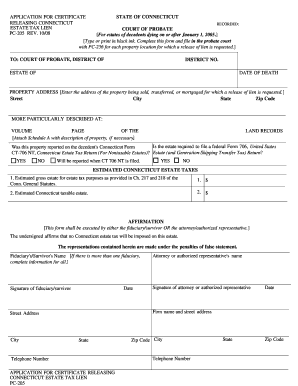

Adhering to legal guidelines while using Georgia Blank Tax Forms is paramount for avoiding penalties. The forms must be filled out accurately, and all provided information should align with IRS regulations.

- Compliance Requirements: Details must be accurate and truthful.

- Legal Signature: Forms must be legally signed to authenticate the filing process.

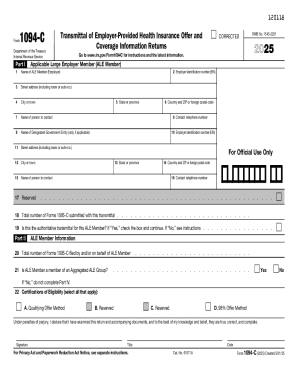

Elements of Georgia Blank Tax Forms

Each section of the Georgia Blank Tax Forms serves a purpose, ensuring complete financial disclosure and compliance.

- Personal and Income Details: Captures individual and employment information.

- Deductions and Taxable Income: Documents deductions and income to compute tax obligations.

- Final Tax Calculation: Provides a summary of total tax owed or refundable amounts.

Each of these sections requires focused attention to ensure that taxpayers do not encounter errors or need costly corrections post-filing.