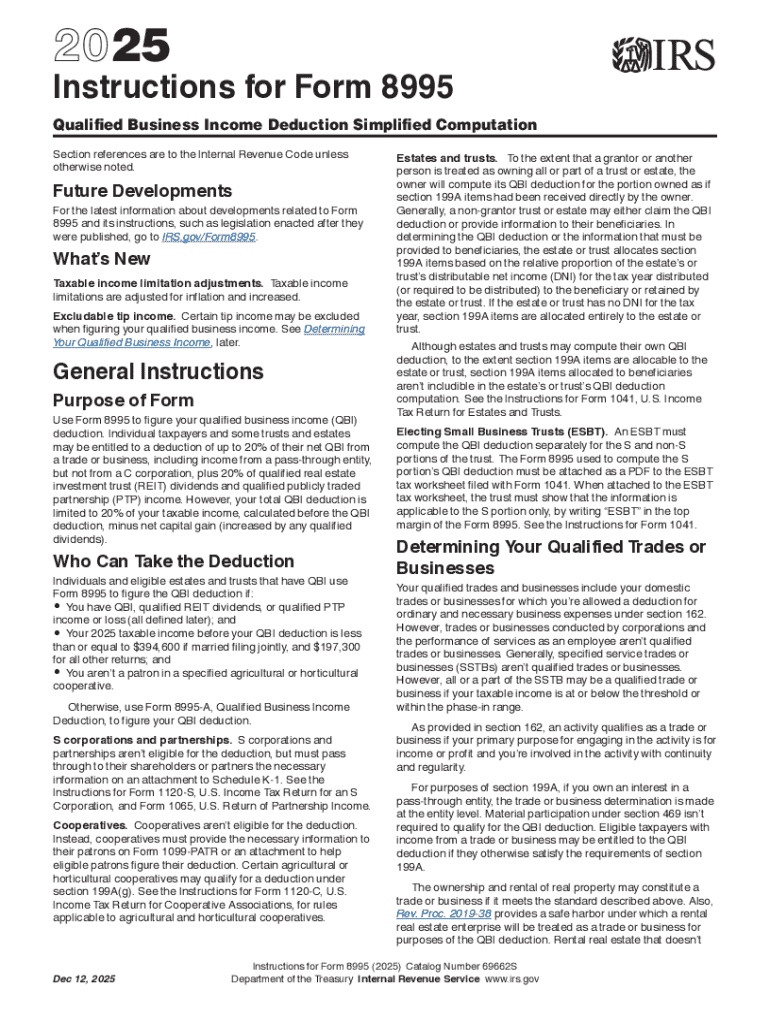

Definition and Purpose of the 2025 Instructions for Form 8995

The 2025 Instructions for Form 8995 are designed to guide taxpayers in claiming the Qualified Business Income (QBI) Deduction using a simplified approach. These instructions pertain to individuals, including sole proprietors, partnerships, S corporations, and some trusts and estates, who wish to deduct up to 20% of their qualified business income from their taxable income. The purpose of these instructions is to provide clear and concise guidelines for accurately calculating and reporting this deduction, aligning with the Internal Revenue Code provisions.

Key Elements of the Form

- Qualified Business Income (QBI): Income from eligible business activities, excluding investment income like capital gains or losses.

- Threshold Limits: The deduction may be subject to phase-outs or limitations based on the taxpayer's income level.

- Specified Service Trade or Business (SSTB): Special rules apply for certain service-based businesses, possibly impacting eligibility.

- W-2 Wages and Qualified Property: Consideration of wages paid by the business and the acquisition of qualified property affects deduction calculations.

Steps to Completing Form 8995

Completing the Form 8995 involves a systematic process where taxpayers must provide specific details related to their business income. This segment outlines the steps necessary to ensure an accurate submission:

- Gather Required Documents: Collect all relevant documentation, including income statements, W-2 forms, and records of qualified property.

- Calculate QBI: Determine your business’s qualified income, deductible elements, and significant expenses.

- Apply Thresholds: Assess if your income level falls within the deduction limits, accounting for thresholds that might affect the deduction percentage.

- Form Completion: Carefully fill out each section, ensuring all the information aligns with IRS requirements.

- Review and Submit: Double-check the form for any errors or omissions before submission.

Important Considerations:

- Filing Status: Whether filing jointly or separately will impact the deduction amount.

- Multiple Business Streams: How to report QBI if derived from more than one business activity.

Who Typically Uses Form 8995?

The 2025 Instructions for Form 8995 are primarily utilized by taxpayers involved in various business structures, including:

- Sole Proprietors: Individuals reporting business profits directly on their individual tax returns.

- Small Business Owners: Those who operate as LLCs, partnerships, or S corporations.

- Eligible Service Providers: Firms in specified service industries that pass income threshold limits.

- Trustees and Estates: Trusts or estates with qualified business income requiring deduction assessments.

Business Entity Types:

- Limited Liability Companies (LLCs): Documenting income and ensuring compliance with QBI regulations.

- Partnerships and Corporations: Partner incomes, distributions, and wages require particular documentation and calculation.

Eligibility Criteria for the QBI Deduction

Eligibility for the QBI deduction under the 2025 Instructions for Form 8995 necessitates meeting certain criteria:

- Engagement in a Trade or Business: Must derive income from qualified U.S. business activities.

- Income Limitations: Adjusted Gross Income (AGI) must fall below specific thresholds for full deduction eligibility.

- Non-Recognition of Investment Income: Excludes capital gains, dividends, and interest income from deduction calculations.

Exceptions and Special Considerations:

- Specified Services Restrictions: Professionals in health, law, or accounting services might face additional limitations unless income levels are below specific exceptions.

- Aggregation Rules: The option to combine income from multiple business activities to comply with deduction limits.

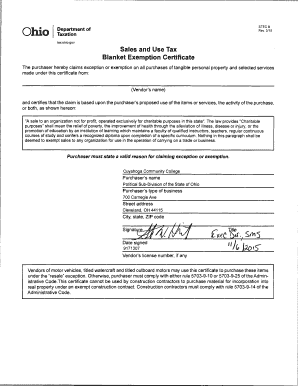

Legal Use and IRS Guidelines

Adhering to the 2025 Instructions for Form 8995 ensures legal compliance and accuracy in reporting the QBI deduction:

Important IRS Guidelines:

- Accurate Reporting: Ensure all entries accurately reflect business income sources and amounts.

- Compliance with Tax Code: Maintain adherence to tax rules and regulations as updated by the IRS for the relevant tax year.

- Documentation Requirements: Retain necessary records and documents supporting the deduction claimed.

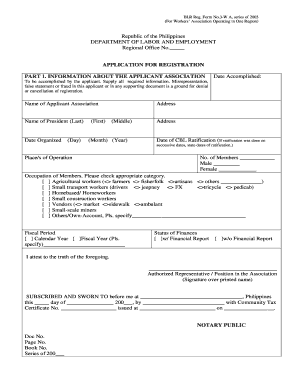

State-Specific Considerations

While Form 8995 addresses federal deductions, state-specific rules might impact how this deduction is reported or calculated:

- State Income Tax Variations: Different states might have specific rules affecting the allowable deduction or recognition of QBI.

- Filing Requirements: Certain states may require additional forms or declarations for state tax purposes.

Filing Deadlines and Submission Methods

Understanding the filing deadlines and methods of submission for Form 8995 is crucial to avoid penalties:

Important Dates:

- Standard Filing Deadline: Typically April 15 of the following year, unless extended by federal mandates.

- Extensions and Penalties: Failure to file or inaccuracies can result in penalties; extensions may be applicable under special circumstances.

Submission Methods:

- Electronic Filing: Preferred method for quick and secure submission, accommodating IRS e-file guidelines.

- Paper Filing Options: Alternative for those not utilizing electronic platforms, subject to postal timings and conditions.

Common Taxpayer Scenarios

Understanding scenarios where taxpayers might commonly face challenges with Form 8995:

- Self-Employed Individuals: Balancing diverse income streams and accounting for personal business expenses.

- Retired Professionals: Transitioning businesses and determining ongoing eligibility for QBI deductions.

- Students and Side Businesses: Young entrepreneurs managing part-time businesses alongside academic commitments.