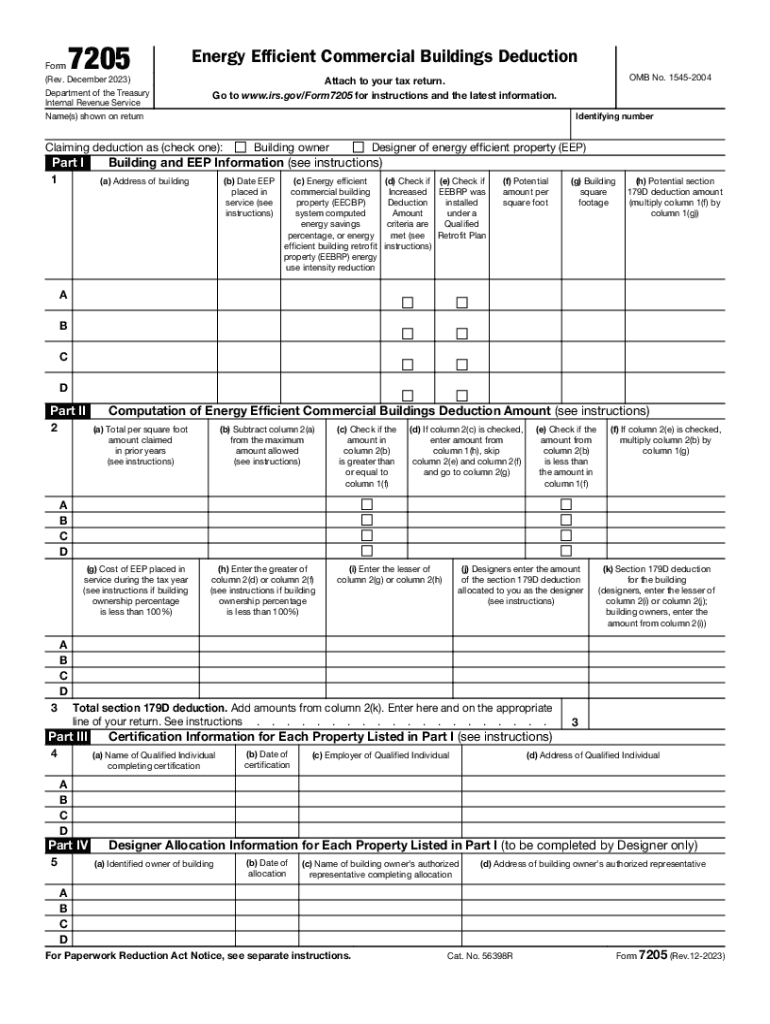

Definition and Meaning of Form 7205

Form 7205, officially known as the "Energy Efficient Commercial Buildings Deduction," is a crucial document used by businesses in the United States to claim tax deductions associated with energy efficiency improvements in commercial buildings. This form is an integral part of tax documentation for companies investing in energy conservation initiatives, allowing them to benefit financially from eco-friendly upgrades. The deduction incentivizes companies to enhance the energy efficiency of their facilities, contributing to reduced energy consumption and lower operational costs.

How to Use Form 7205 for Tax Deductions

Businesses utilize Form 7205 by identifying specific improvements made to their buildings, such as upgrades to lighting systems, heating, ventilation, air conditioning (HVAC) units, or installment of energy-efficient windows and insulation.

- Determine Eligibility: Assess whether the upgrades meet the IRS standards for energy efficiency.

- Gather Documentation: Collect invoices, contracts, and certifications that validate the energy-efficient improvements.

- Complete the Form: Enter the necessary information, including the types of upgrades and associated costs.

- Consult Tax Professionals: Engage with tax advisors to ensure all deductions are accurately claimed and comply with IRS regulations.

Practical examples include companies replacing outdated lighting with LED systems or upgrading HVAC systems to more efficient models.

Steps to Complete Form 7205

Completing Form 7205 involves a detailed process to ensure all eligible deductions are accurately reported. The steps include:

- Review IRS Guidelines: Familiarize yourself with the requirements set out by the IRS for claiming energy efficiency deductions.

- Fill in Identifying Information: Provide the business name, tax identification number, and contact details.

- Detail Energy Improvements: List the specific energy-efficient upgrades undertaken, including their descriptions and costs.

- Calculate Deductions: Use the form to compute the tax deduction for each eligible improvement, guided by the IRS instructions.

Taxpayers should maintain thorough records of all improvements and consult the IRS's guidelines or a tax consultant for any complexities specific to their case.

Eligibility Criteria for Using Form 7205

Businesses seeking to utilize Form 7205 must ensure compliance with several eligibility criteria:

- Commercial Property: The property in question must be a commercial building located within the United States.

- Qualified Improvements: The upgrades must contribute significant energy savings and meet IRS's specified energy efficiency standards.

- Proper Documentation: All energy-efficient improvements should be documented with appropriate certificates, receipts, or contracts.

It's important for businesses to verify these criteria before filing to avoid penalties or rejected claims.

Filing Deadlines and Important Dates for Form 7205

Timeliness is critical when submitting Form 7205. Key considerations include:

- Annual Filing Deadline: The form should be filed with your regular tax returns by the typical IRS deadline for business taxes, usually April 15.

- Extension Filing: If a filing extension is granted for your business, the same extension applies to Form 7205.

- Important Dates for Documentation: Ensure that all improvements are dated within the tax year for which the deduction is claimed.

Being aware of and adhering to these deadlines help prevent late filing penalties and ensure eligibility for deductions.

Key Terms Related to Form 7205

Understanding the terminology related to Form 7205 is vital for correctly filing it. Key terms include:

- Energy Efficient Property: Improvements or equipment specifically designed to reduce energy usage.

- Qualified Individual: The person responsible for ensuring that the building improvements meet the criteria for energy efficiency.

- Deduction Limits: The maximum allowable deduction limits for energy-efficient improvements as specified by the IRS.

Familiarity with these terms can mitigate errors and streamline the documentation process.

IRS Guidelines for Form 7205

The IRS provides comprehensive guidelines on how to accurately complete and file Form 7205. Important considerations include:

- Documentation Requirements: Requirements for submissions, including certifications and calculation methods for deductions.

- Deduction Calculations: Instructions on how to compute the allowable deductions for specific types of energy-efficient improvements.

- Amendments and Updates: Periodic amendments to the guidelines necessitate regular review to ensure continual compliance.

Businesses are encouraged to regularly consult these guidelines to stay compliant with tax policies and maximize their deductions.

Penalties for Non-Compliance with Form 7205

Non-compliance with the requirements for Form 7205 can result in significant penalties:

- Denial of Deductions: Ineligible or improperly documented claims can be denied, leading to loss of tax benefits.

- Fines and Interest: Incorrect filing or failure to file can result in IRS penalties, late fees, and accruing interest.

- Audit Risks: Non-compliance can trigger audits, requiring detailed justification of claimed deductions.

Businesses must maintain thorough and accurate records to safeguard against these potential penalties.