Definition & Meaning

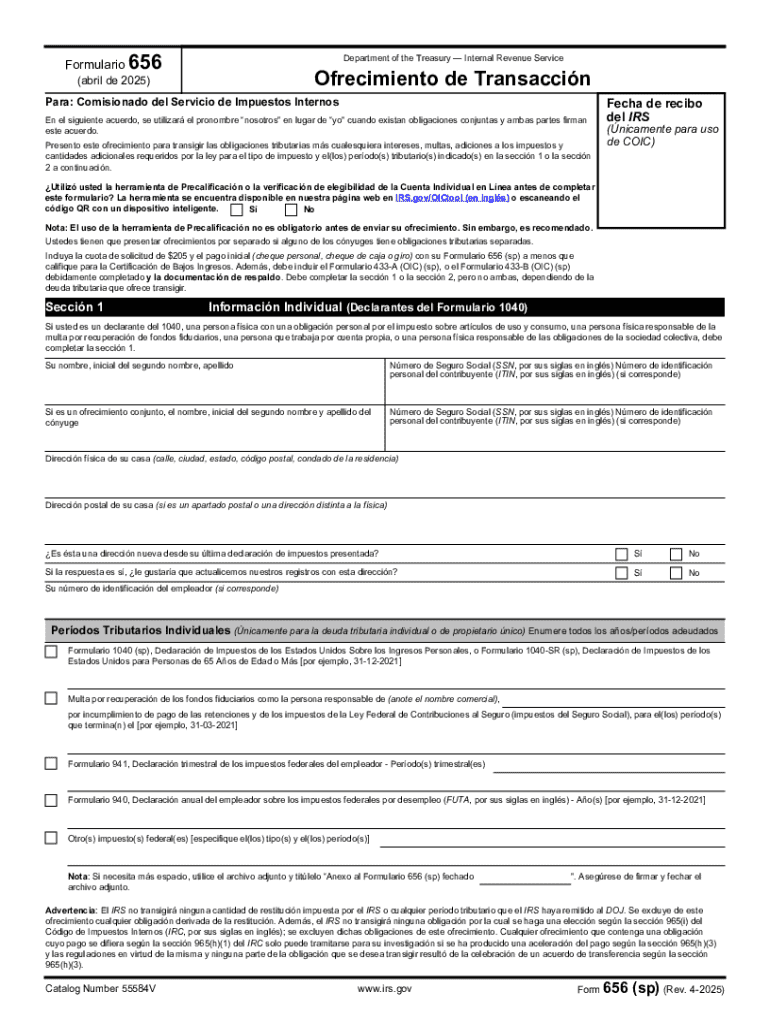

Form 656 (sp) (Rev 4-2025) Offer in Compromise (Spanish Version) is a formal application used by taxpayers to propose a settlement with the IRS for resolving outstanding tax liabilities. This form serves as a request for the IRS to accept an amount less than the total tax debt, thereby assisting individuals or businesses facing genuine financial hardship. The Spanish version ensures accessibility for Spanish-speaking taxpayers, offering them the opportunity to apply for tax relief in their preferred language.

Key Purposes

- Financial Relief: Helps taxpayers who are unable to pay their full tax dues by settling their debts for less than the owed amount.

- Language Accessibility: Provides Spanish-speaking individuals with an equally comprehensive tool to engage with IRS processes.

- Legal Documentation: Acts as a legal agreement between the applicant and the IRS once accepted.

Eligibility Criteria

Eligibility criteria for submitting Form 656 (sp) require taxpayers to meet specific conditions demonstrating financial hardship or inability to pay the full tax liability. The IRS evaluates applicants based on factors such as income, expenses, assets, and overall financial situation.

Main Requirements

- Proven Hardship: Taxpayers must illustrate that paying the full amount would cause significant financial difficulties.

- Truthful Disclosure: Applicants must provide accurate and complete financial disclosure on related forms.

- Tax Compliance: Applicants should have filed all required federal tax returns and be up to date with estimated tax payments if required.

Financial Situation Assessment

- Income Analysis: Documentation of total monthly income, including wages, investments, and alternative sources.

- Expenses Documentation: Proof of necessary living expenses compared to IRS national standards.

Steps to Complete the Form 656 (sp) (Rev 4-2025) Offer in Compromise (Spanish Version)

Completing the Form 656 (sp) effectively involves laying out a comprehensive financial profile and determining a reasonable offer amount.

Detailed Process

- Gather Financial Documentation: Collect income records, expense reports, and asset details.

- Fill Out Personal Information: Input all personal details accurately, including names, addresses, taxpayer IDs, and contact information.

- Calculate Offer Amount: Use the IRS’s instructions and guidelines to calculate a realistic and acceptable offer based on your financial situation.

- Provide Supporting Documentation: Attach evidence supporting your financial claims, such as bank statements and pay stubs.

- Submit the Form: Send the accurately completed form either online, through the mail, or in person, following IRS submission guidelines.

How to Obtain the Form 656 (sp) (Rev 4-2025) Offer in Compromise (Spanish Version)

Obtaining the Form 656 (sp) is a straightforward process, whether accessed online or through IRS facilities.

Options to Acquire the Form

- IRS Website: Download directly from the official IRS site, ensuring the latest version is used.

- IRS Offices: Visit local IRS taxpayer assistance centers for physical copies.

- Professional Accountants or Tax Services: These professionals often provide necessary forms during consultation sessions.

IRS Guidelines

Understanding IRS guidelines for Form 656 (sp) is crucial for ensuring compliance and improving approval chances.

Core Guidelines

- Accuracy Requirement: Every detail must be accurate to avoid delays or rejections.

- Disclosure Standards: Honest and thorough financial disclosures are mandatory to back the offer proposal.

- Compliance Requirement: Ensure all prior tax debts are in good standing before submission.

Red Flags

- Inconsistent Information: Misalignment between submitted forms and IRS records can trigger scrutiny.

- Recent Luxurious Expenditures: Unnecessary or luxury expenses might lead to rejection if they portray a misleading financial hardship picture.

Legal Use of the Form 656 (sp) (Rev 4-2025) Offer in Compromise (Spanish Version)

The legal use of this form includes settling tax liabilities under specific conditions legally recognizable by the IRS. Accurate submission and compliance under given legislations bind the IRS to review and potentially accept an offer if it meets predefined criteria.

Legal Framework

- Legal Binding Agreement: Accepted offers result in a binding resolution between the taxpayer and IRS.

- Post-Approval Obligations: Taxpayers must adhere to future tax compliance post-approval.

Required Documents

Supporting documentation is integral to the acceptance of Form 656 (sp), as it validates the financial claims made by the applicant.

Essential Documentation

- Proof of Income: Pay stubs, business earnings records if self-employed.

- Asset Documentation: Asset valuation reports, title deeds, or vehicle registration for asset disclosures.

- Expense Reports: Receipts or organized lists of monthly expenses including utilities, rent/mortgage, and other necessities.

Form Submission Methods (Online / Mail / In-Person)

Multiple submission methods provide flexibility for taxpayers to file Form 656 (sp) according to their personal convenience and preference.

Submission Modes

- Online Submission: Fastest method via IRS’s secure online portal, allowing swift document processing.

- Mail Submission: Traditional mailing ensures a hard copy reaches IRS, ideal for those uncomfortable with digital processes.

- In-Person Submissions: Provides instant support and verification at IRS centers, useful for those needing assistance.

Conclusion

These major content blocks and guidelines provide in-depth coverage and understanding of the Form 656 (sp) (Rev 4-2025) Offer in Compromise (Spanish Version), ensuring users can submit effectively and in full compliance with the IRS’s requirements.