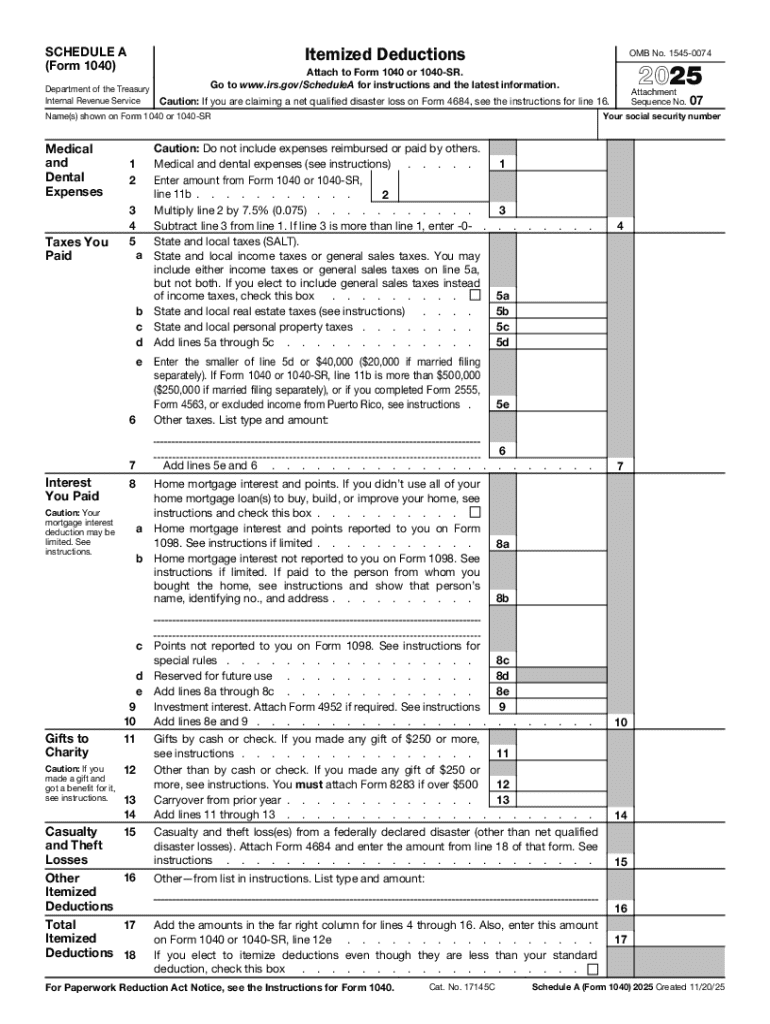

Definition and Meaning of 2025 Schedule A (Form 1040) Itemized Deductions

The 2025 Schedule A (Form 1040) Itemized Deductions is an IRS form used by taxpayers in the United States to report specific deductions that can reduce their taxable income. This form allows you to itemize particular expenses instead of taking the standard deduction, potentially lowering your overall tax bill if the total itemized deductions exceed the standard deduction amount. Common expenditures included in this form are medical expenses, mortgage interest, state taxes, and charitable contributions.

Understanding Itemized Deductions

- Medical and Dental Expenses: Deduct unreimbursed payments for medical care exceeding 7.5% of your adjusted gross income.

- State and Local Taxes: Includes property taxes and either income or sales taxes, capped at $10,000.

- Mortgage Interest: Deduct interest paid on loans secured by your first and second homes, subject to limits based on when the debt was incurred.

- Charitable Donations: Contributions to qualified organizations are deductible, with different limits based on income and donation type.

How to Use the 2025 Schedule A (Form 1040) Itemized Deductions

Using Schedule A entails compiling eligible expenses and detailing them on the form. This process requires thorough record-keeping and knowledge of deduction categories.

Steps to Itemize Deductions

- Gather Documentation: Collect receipts, bank statements, and any records validating your expenses.

- Calculate Each Category: Sum expenses for each deduction category, ensuring they qualify based on IRS rules.

- Compare to Standard Deduction: Evaluate if itemizing results in a greater reduction in taxable income than the standard deduction.

- Complete Schedule A: Enter calculated amounts into the respective lines of the form, following instructions carefully to avoid errors.

Steps to Complete the 2025 Schedule A (Form 1040)Itemized Deductions

Filling out the Schedule A involves several detailed steps to ensure compliance and accuracy.

Detailed Instructions

- Section 1 – Medical Expenses: Record total expenses, subtract 7.5% of your adjusted gross income, and enter the remainder.

- Section 2 – Taxes Paid: List deductible state and local taxes, ensuring the cumulative total does not exceed $10,000.

- Section 3 – Interest Paid: Document mortgage interest and points, adhering to IRS limits.

- Section 4 – Charitable Contributions: Add up all monetary and non-monetary donations, referencing IRS publication guidelines for valuation.

- Section 5 – Casualty and Theft Losses: If applicable, report losses only if they are from a federally declared disaster, after applying a 10% threshold of adjusted gross income.

Who Typically Uses the 2025 Schedule A (Form 1040)Itemized Deductions

While the standard deduction suits many, Schedule A is particularly beneficial for individuals with higher expenses in specific categories.

Typical Users

- Homeowners with Significant Mortgage Interest: Those paying substantial amounts in mortgage interest can greatly benefit.

- Taxpayers in States with High Income or Property Taxes: Itemizing is advantageous when these taxes significantly exceed the new limits.

- Charitable Contributors: Individuals with sizable donations will find itemizing advantageous.

- Individuals with High Medical Expenses: Those with significant unreimbursed medical bills may benefit from this deduction.

Important Terms Related to 2025 Schedule A (Form 1040) Itemized Deductions

Understanding key terminology is crucial for completing Schedule A correctly.

Glossary

- Adjusted Gross Income (AGI): Your gross income minus adjustments; used to calculate various limits in deductions.

- Thresholds: Specific limits for itemized deductions, such as those on medical expenses and taxes.

- Qualifying Organizations: For charitable deductions, contributions must go to IRS-recognized institutions.

- Limits and Caps: Certain deductions have ceilings, like the $10,000 cap on state and local taxes.

Required Documents for 2025 Schedule A (Form 1040) Itemized Deductions

Compiled documentation ensures accuracy in reporting deductible expenses.

Necessary Records

- Receipts for Medical Expenses: Keep thorough documentation of out-of-pocket payments.

- Mortgage Interest Statements: Form 1098 from lenders provides necessary interest information.

- Donation Receipts: Obtain acknowledgment letters for all charitable contributions.

- Tax Payment Records: Statements from local government authorities listing property taxes paid.

Filing Deadlines and Important Dates for 2025 Schedule A

Timely submission of Schedule A is essential for compliance.

Key Dates

- April 15, 2026: Standard deadline for filing the 2025 tax return, including Schedule A.

- October 15, 2026: Extended deadline if you have filed for an extension, using Form 4868.

Understanding these blocks deeply integrates the 2025 Schedule A into the broader tax preparation process, ensuring accurate and strategic use of itemized deductions.