Definition and Purpose of the Contrato De Intermediacion Bursatil

The "Contrato De Intermediacion Bursatil," or Brokerage Intermediation Contract, is a formal agreement designed to establish the terms and obligations between brokerage firms and their clients in the securities market. This contract outlines the services provided by the broker, the responsibilities of both parties, and the legal framework under which the brokerage operates. The primary function is to ensure a clear understanding of the brokerage's role in facilitating transactions, managing investments, and advising clients in the buying and selling of stocks and financial products.

- Services Covered: The contract typically includes services such as executing trades, providing investment advice, and managing assets.

- Responsibilities: Specifies the obligations of both the broker and the client, including how fees and commissions are handled.

- Regulatory Compliance: Ensures that all activities performed under the contract comply with U.S. securities regulations.

How to Use the Contrato De Intermediacion Bursatil

Navigating the use of a "Contrato De Intermediacion Bursatil" involves a few critical steps to ensure its effective application for both parties involved in the brokerage relationship.

Steps for Clients

- Review Clauses: Thoroughly examine the terms outlined to understand your rights, obligations, and the services provided.

- Clarify Expectations: Speak with the broker to delineate any ambiguities, especially concerning fees or investment strategies.

- Consult Legal Advice: It may be beneficial to involve legal counsel for a detailed interpretation to avoid any potential misunderstandings.

Steps for Brokers

- Define Services Clearly: Clearly articulate the services offered and any limitations to prevent misunderstanding.

- Outline Fees and Commissions: Ensure transparent disclosure of all costs associated with transactions and account management.

- Maintain Regulatory Adherence: Regularly review the contract for conformity with current securities laws and regulations.

How to Obtain the Contrato De Intermediacion Bursatil

Obtaining a "Contrato De Intermediacion Bursatil" is an essential step in forming a legally recognized brokerage relationship.

- Brokerage Firms: You can request this contract directly from registered brokerage firms or financial institutions.

- Online Platforms: Some online brokerage services offer digital versions of these contracts for ease of access.

- Financial Advisors: Financial advisors often provide these contracts as part of their client onboarding process.

Considerations Before Signing

- Credibility of the Broker: Verify the accreditation and experience of the brokerage firm offering the contract.

- Reputation Check: Look for customer reviews or any regulatory actions against the broker to ensure reliability.

Steps to Complete the Contrato De Intermediacion Bursatil

Completing the "Contrato De Intermediacion Bursatil" is a structured process that requires careful attention to detail.

- Personal Information: Accurately fill out all requested personal data and contact information.

- Service Selection: Clearly indicate the types of brokerage services you wish to engage in.

- Review Terms and Conditions: Ensure that all terms are understood and agreed upon by both parties.

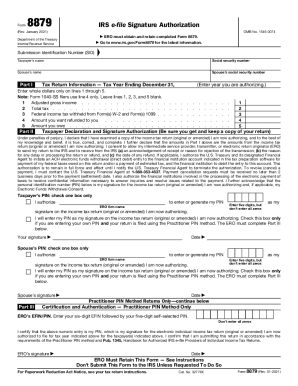

- Signature Requirements: Both the client and a representative of the brokerage must sign the contract, each saving a copy for records.

Key Elements of the Contrato De Intermediacion Bursatil

Several elements must be present in the contract to ensure its validity and effectiveness.

- Client Identification: Includes details like name, address, and contact information.

- Broker's Obligations: Specific responsibilities and services provided by the brokerage.

- Fee Structure: A comprehensive breakdown of all charges, including commissions and management fees.

- Dispute Resolution: Procedures for resolving any potential disputes that may arise between the broker and client.

- Termination Clauses: Conditions under which the contract may be terminated by either party.

Legal Use of the Contrato De Intermediacion Bursatil

A "Contrato De Intermediacion Bursatil" is governed by U.S. securities laws and regulations to protect the interests of both clients and brokers.

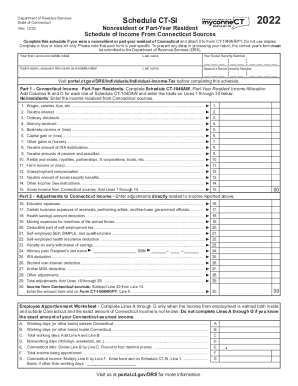

- Compliance Requirements: Brokers must comply with the rules set by the Securities and Exchange Commission (SEC) and other relevant bodies.

- Conflict of Interest Provisions: Legal safeguards to prevent brokers from benefiting unfairly from their position at the expense of the client.

Examples of Using the Contrato De Intermediacion Bursatil

Understanding practical applications can help clients and brokers make informed decisions.

- Case Study 1: A client uses the contract to engage a broker for stock trading, resulting in a diversified portfolio and capital growth.

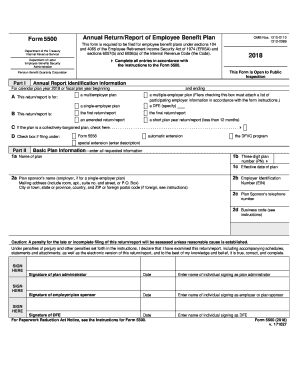

- Case Study 2: A business leverages the contract to secure brokerage services for managing employee investment plans.

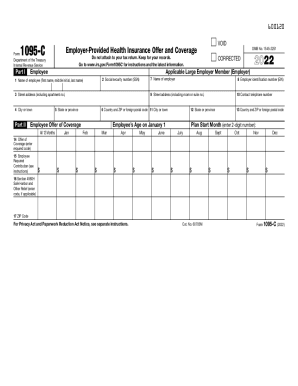

- Scenario: An individual with a retirement account uses the brokerage contract to ensure tailored financial advice and periodic portfolio reviews.

Who Typically Uses the Contrato De Intermediacion Bursatil

This contract is utilized by a variety of individuals and entities engaged in the securities market.

- Individual Investors: Those looking to invest in stocks, bonds, or mutual funds.

- Small Businesses: Companies seeking investment management for employee retirement plans.

- Institutional Clients: Large organizations requiring sophisticated trading services and financial strategies.

These blocks collectively provide a comprehensive overview of the "Contrato De Intermediacion Bursatil," tailoring the information to be both informative and practical for potential users in the United States.