Definition and Meaning of No Purchase Order No Pay Policy

The "No Purchase Order No Pay" policy mandates that all invoices submitted for payment must be accompanied by a valid purchase order (PO). This ensures that expenses are pre-approved and traceable, aligning with an organization's procurement strategy. It is primarily adopted to streamline financial control, reduce unauthorized spending, and enhance transparency in transaction processing.

How to Use the No Purchase Order No Pay Policy

To effectively implement this policy, organizations should take the following steps:

- Communicate the Policy: Ensure all suppliers and internal staff understand the rule that invoices without a purchase order number will not be processed.

- Require Purchase Orders: Implement an internal process where purchase orders are generated for all goods and services before procurement.

- Supplier Onboarding: Educate suppliers on the importance of including PO numbers in their invoices to ensure timely payments.

- Review Mechanisms: Establish a regular review process to monitor compliance with the policy and address any exceptions or issues.

Key Elements of the No Purchase Order No Pay Policy

- Purchase Order Requirement: A PO must be issued and approved before procurement.

- Invoice Matching: Invoices must match the details of the issued PO in terms of description, quantity, and price.

- Compliance Monitoring: Regular audits to ensure adherence to the policy.

- Exemptions: Clearly defined exemptions, if any, must be documented and communicated to stakeholders.

Steps to Complete a Compliance with the Policy

Ensuring compliance involves several steps:

- Creation of Purchase Orders: Responsible departments must create and approve purchase orders before engaging suppliers.

- Invoice Submission Process: Suppliers should submit invoices with the relevant PO number clearly indicated.

- Review and Authorization: Finance teams verify the alignment of invoices with POs, checking for discrepancies.

- Payment Approval: Once verified, the invoice is approved for payment.

Who Typically Uses the No Purchase Order No Pay Policy

This policy is commonly used by:

- Public Sector Entities: Includes government departments and local councils aiming for accountable spending.

- Large Corporations: Companies with extensive procurement operations to manage costs and improve oversight.

- Educational Institutions: Universities and schools to align procurement with budgetary controls.

Legal Use and Compliance Issues

Adhering to the No Purchase Order No Pay policy helps avoid legal issues related to unauthorized transactions:

- Contractual Integrity: Ensures all purchases are backed by a contractual agreement.

- Audit Trail: Provides a clear record of transactions for audits and investigations.

- Policy Enforcement: Aids organizations in enforcing procurement policies without legal disputes over unpaid invoices.

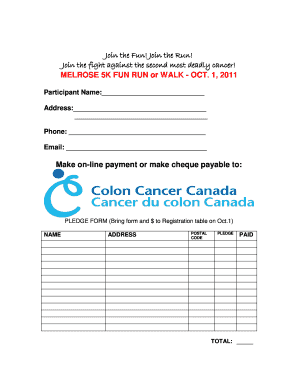

Examples of Using the No Purchase Order No Pay Policy

Consider a scenario where a nonprofit organization implements this policy:

- Scenario: The finance team finds a supplier invoice without a PO number and returns it with a request for correction.

- Outcome: The supplier subsequently includes the PO number on the revised invoice, ensuring compliance and prompt payment.

Important Terms Related to the Policy

Understanding terminology is crucial for proper implementation:

- Purchase Order (PO): A document issued by a buyer to a supplier indicating types, quantities, and prices for products or services.

- Invoice: A bill sent by the supplier to the purchaser specifying amounts due for provided goods or services.

- Compliance Audit: An internal review process verifying conformance with procurement policies.

State-Specific Rules and Variances

While the core principle remains consistent, specific state regulations may influence its application:

- New York: Public sector procurement policies may include additional environmental compliance requirements.

- California: Regulations may emphasize transparency and public reporting for government contracts.

- Texas: Certain exemptions exist for emergency procurement without a formal PO, following state legislation.