Definition & Meaning

The "Private Equity Representation Letter - Equity Institutional" is a formal document used in the private equity sector. It serves as an official communication tool between investment entities and investors, detailing critical aspects such as the terms of investment, representation agreements, and pertinent operational details.

Purpose and Utility

- Confirms the relationship, responsibilities, and expectations between the investment issuer and the investor.

- Outlines specific investment details, including the nature of the financial arrangements and associated legal rights.

- Provides institutional assurance and forms part of compliance documentation within private equity transactions.

Practical Example

A private equity firm may issue this letter to an investor to specify details of their committed investment in a newly launched fund, ensuring transparency and clarity in their partnership.

Key Elements of the Private Equity Representation Letter

Investment Information

- Investment Name: Identifies the specific fund or project the investment pertains to.

- Account Number: Unique identifier for tracking investment transactions within an institution's systems.

- Investment Entity: Name and legal structure of the firm or entity facilitating the investment.

Contact Details

- Address, City, State, ZIP Code: Complete mailing and location details for official communications.

- Phone Number: Primary contact number to address any queries or correspondence.

Legal Clauses

- Ensure that all legal obligations are clearly articulated to prevent misunderstandings.

- Typically include confidentiality clauses and terms governing dispute resolution.

How to Use the Private Equity Representation Letter

- Review Investment Details: Carefully read the investment name, account number, and other specifics to confirm accuracy.

- Verify Legal Terms: Understand any legal implications associated with the document, including any rights or obligations it establishes.

- Consult a Legal Advisor: It's advisable for investors to consult with their legal advisors to comprehend fully the terms set out in the letter.

Why Use the Private Equity Representation Letter

Benefits

- Establishes a formalized process for private equity investments, ensuring all parties are on the same page.

- Streamlines communication between investment managers and investors, minimizing potential disputes.

Importance in Compliance

- Serves as a vital record for regulatory compliance and audit trails.

- It helps maintain transparent financial relationships and supports due diligence processes.

Steps to Complete the Private Equity Representation Letter

- Complete Investment Details: Fill out the investment's name and account number accurately.

- Enter Contact Information: Provide detailed address and contact information for both the investment entity and investor.

- Sign and Date: Authorized representatives must sign and date the letter to confirm agreement to the terms.

Who Typically Uses the Private Equity Representation Letter

Primary Users

- Investment Issuers: Entities like fund managers or institutional investors responsible for creating and distributing the letter.

- Investors: Individuals, trusts, or institutional investors responsible for acknowledging receipt and agreement to terms.

Additional Users

- Legal Firms: Assist in drafting and reviewing terms to ensure compliance with current laws.

- Financial Advisors: Help interpret investment details and clarify any implications for their clients.

Legal Use of the Private Equity Representation Letter

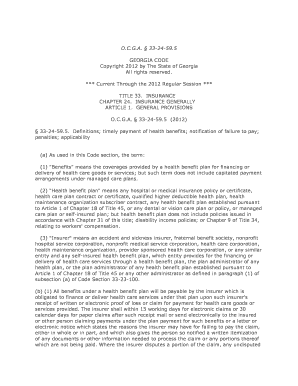

Compliance Requirements

- Adheres to federal and state regulations governing investment practices in the United States.

- Frequently used as part of a broader legal documentation package required for transacting private equity investments.

Legal Consequences

- Failure to accurately complete or adhere to the terms outlined in this letter can result in financial penalties or other legal actions.

Examples of Using the Private Equity Representation Letter

Scenario 1: New Fund Launch

A private equity firm issues these letters to potential investors detailing their commitment to a new fund focused on renewable energy projects.

Scenario 2: Compliance Record

An investment entity uses these letters during audits to demonstrate compliance with investment agreements and to highlight transparent communication processes with stakeholders.

Important Terms Related to the Private Equity Representation Letter

Glossary

- Investment Issuer: The entity responsible for managing the investment fund.

- Private Equity: A type of capital investment made into private entities.

By focusing on these critical aspects of the "Private Equity Representation Letter - Equity Institutional," users can ensure an in-depth understanding of its role, usage, and importance within the private equity investment sphere.