Definition and Meaning of Form 125-278

Form 125-278 pertains to the reporting requirements outlined by the Hope Tax Credit and Other Taxpayer Relief Act of 1997. This specific form is a critical document for postsecondary educational institutions in the United States. Its primary purpose is to ensure compliance with IRS mandates regarding educational tax credits. These tax credits aim to provide financial relief for taxpayers who incur educational expenses by acknowledging their spending through a structured reporting process.

Key Functions and Objectives

- Provides an official method for educational institutions to report tuition fees and other qualified expenses.

- Facilitates the claiming of the Hope Tax Credit, an important financial credit for eligible students and their families.

- Ensures that institutions comply with federal requirements by delivering necessary financial information to both students and the IRS.

How to Use Form 125-278

The application of Form 125-278 involves both educational institutions and students, each having specific roles to play in the process. Understanding how to accurately use this form is crucial for maintaining compliance and maximizing potential tax benefits.

Guide for Educational Institutions

- Collection of Student Data: Gather all required personal and financial information, including social security numbers or individual taxpayer identification numbers.

- Filing Requirements: Ensure that Form 1098-T is completed and submitted to the IRS for each eligible student.

Steps for Students

- Verification: Confirm that your enrolled school has filed Form 1098-T on your behalf.

- Documentation: Retain copies of Form 1098-T and any accompanying documentation for your personal tax records.

Obtaining Form 125-278

While students largely interact with Form 1098-T, educational institutions are responsible for obtaining and completing Form 125-278 as part of their reporting obligations.

Access Points

- Direct from Educational Institution: Institutions usually provide this as part of the annual tax information package to students.

- IRS Website: Institutions can download necessary forms and instructions directly from the IRS's official website.

- Professional Services: Utilize third-party software or accounting services for efficient and accurate filing.

Steps to Complete Form 125-278

Completing Form 125-278 requires a structured approach to ensure that all necessary elements are accurately captured and reported. This precise process ensures compliance with federal tax laws.

Detailed Steps

- Information Collection: Compile all relevant tuition and fee details, ensuring completeness.

- Form Preparation: Utilize IRS instructions to fill out the form accurately.

- Submission: Submit the form within required deadlines to avoid penalties.

Importance of Form 125-278

The strategic importance of Form 125-278 extends beyond mere compliance, offering benefits that reduce the financial burden on students and families while ensuring institutional adherence to federal regulations.

Benefits Highlighted

- Financial Relief: Enables students and families to claim tax credits, thereby reducing out-of-pocket expenses.

- Regulatory Compliance: Helps institutions avoid penalties associated with non-compliance, fostering an environment of accountability.

Typical Users of Form 125-278

The primary users of Form 125-278 are educational institutions, though its impact is felt most directly by students and their families.

Participant Breakdown

- Educational Institutions: Responsible for completing and filing the form.

- Students and Families: Indirect beneficiaries who receive the economic advantages provided by tax credits.

Key Elements of Form 125-278

An understanding of the crucial elements within Form 125-278 provides clarity on its role and execution. Each component of the form plays an integral role in fulfilling its purpose.

Core Components

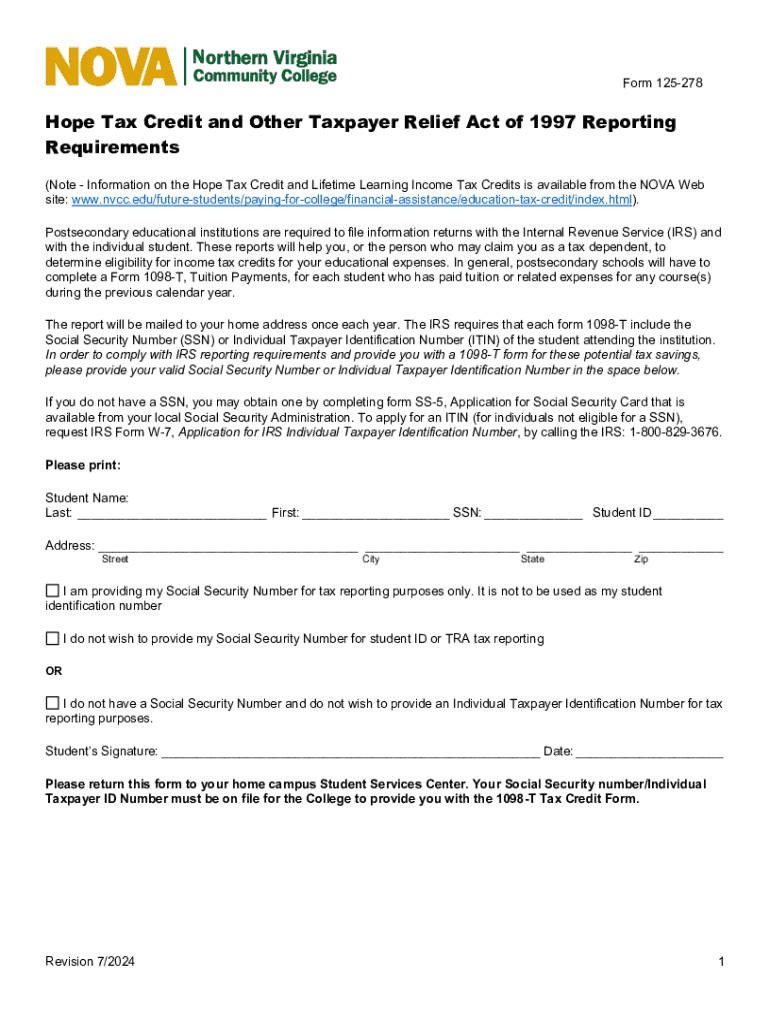

- Student Information: Captures identification data essential for personalized reporting.

- Tuition and Fee Details: Records all transactions related to educational expenses.

- Signature and Verification: Completion demands an authorized institutional signature for legitimacy.

IRS Guidelines

Adhering to specific IRS guidelines when managing Form 125-278 is essential for precision and legitimacy. These guidelines help standardize processes and outcomes.

Compliance Strategies

- Follow IRS instructions meticulously to maintain the accuracy and validity of submissions.

- Regularly update institutional processes in alignment with any IRS procedural changes or updates.

Filing Deadlines and Important Dates

Awareness of deadlines concerning Form 125-278 is vital for preventing fines and maintaining a smooth filing process.

Critical Timelines

- Submission Deadline for Institutions: Align submission dates with IRS mandates to ensure timely delivery.

- Student Reporting Periods: Understand the interplay between fiscal years and academic terms to provide accurate data.

Required Documents

To accurately file Form 125-278, institutions must reliably gather and submit several types of documentation.

Essential Documents

- Tuition Statements: Official records detailing student payments.

- Identification Numbers: Verified social security or taxpayer identification numbers associated with each student.