Definition & Meaning

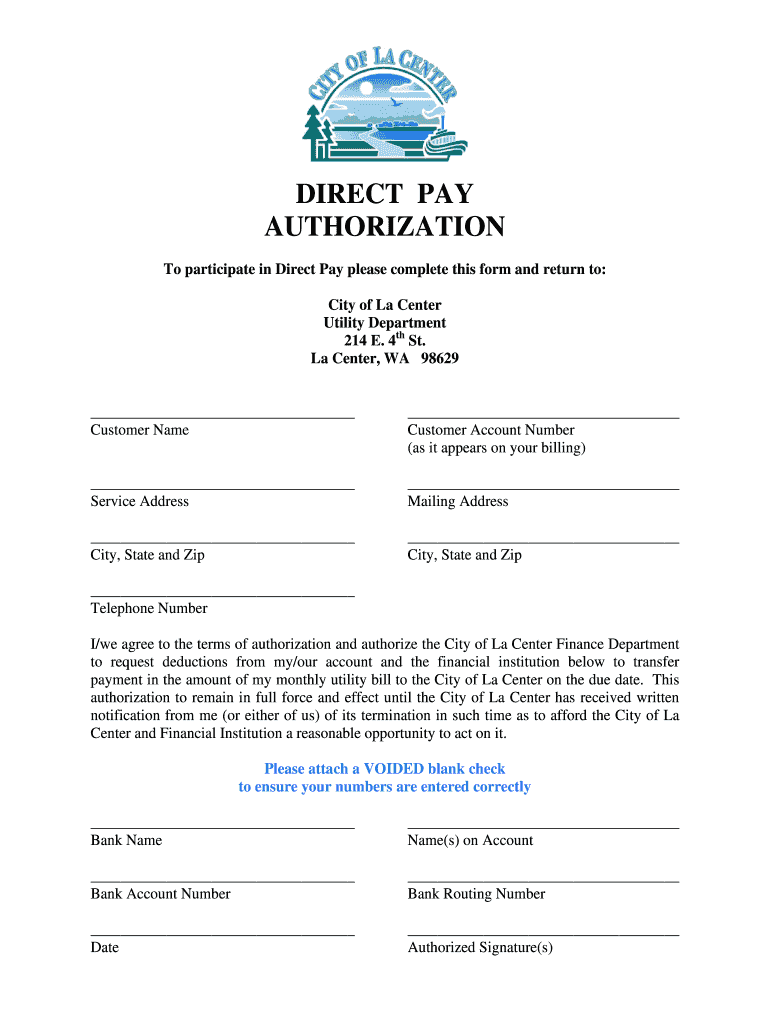

The Direct Pay Authorization form is a document used by customers of the City of La Center to facilitate automatic deductions from their bank accounts for monthly utility bill payments. This form serves as an agreement between the customer and the utility provider, allowing the provider to withdraw the specified amount from the customer's designated bank account on a recurring basis. The authorization simplifies the payment process for customers by eliminating the need for manual payments and ensuring timely payment of bills.

Key components of the Direct Pay Authorization include the customer's bank account details, terms of authorization, and conditions governing payment processing. Customers benefit from the convenience of not having to remember due dates or worry about late payments, while the utility provider gains assurance of receiving timely payments. It is important to understand the implications of granting such authorization, including the potential need to maintain sufficient funds in the account to cover automatic payments.

How to Use the Direct Pay Authorization

To effectively use the Direct Pay Authorization, customers need to follow a series of steps to ensure smooth processing and the avoidance of any complications. Here is a step-by-step guide:

-

Review the Form: Carefully read the entire form to understand the terms and conditions associated with direct pay authorization. Pay particular attention to the rights retained by the customer, such as the ability to terminate the agreement.

-

Provide Accurate Information: Fill out the required customer information, including your full name, address, account number, and banking details. This information is crucial for ensuring the correct account is debited.

-

Attach a Voided Check: Include a voided check with the form submission to verify your banking details. This step helps ensure that the account number and routing number are correctly recorded.

-

Submit the Form: Depending on the submission methods available, submit the completed form and voided check either online, by mail, or in person. Ensure that all information is correctly entered before submission to avoid processing delays.

-

Monitor Account Activity: After submitting the form, regularly check your bank account to verify that the correct amount is being debited as per the authorization agreement. Contact the utility provider immediately if any discrepancies arise.

By adhering to these steps, customers can streamline their utility bill payment process and avoid common pitfalls associated with direct payments.

Important Terms Related to Direct Pay Authorization

Understanding the terminology associated with Direct Pay Authorization is essential for clear comprehension and effective use of the form. Here are some key terms:

-

Authorization Agreement: A legally binding contract between the customer and the service provider, granting permission to automatically debit funds from the customer's bank account for specified payments.

-

Automatic Withdrawal: A process by which funds are automatically taken from a designated bank account on a predetermined schedule, usually for recurring bill payments.

-

Voided Check: A check marked "VOID" and submitted along with the Direct Pay Authorization form to verify the customer's bank account details.

-

Recurring Payments: Payments scheduled to occur regularly, often monthly, to meet ongoing financial obligations such as utility bills.

-

Terms and Conditions: The specific requirements and regulations outlined within the Direct Pay Authorization form that govern the use and execution of direct payments.

Gaining familiarity with these terms will enhance a user's ability to successfully manage their payments and address any issues that may arise.

Steps to Complete the Direct Pay Authorization

Completing the Direct Pay Authorization form involves several key steps that ensure successful enrollment in automatic payment plans. Follow these detailed steps:

-

Gather Information: Collect the necessary personal and bank account information, including a checkbook for the voided check requirement.

-

Fill Out the Form: Enter the requested details in the appropriate fields of the form, ensuring accuracy in every aspect. Common details include your name, utility account number, bank name, account number, and routing number.

-

Review the Agreement: Before submission, thoroughly read the terms of authorization to ensure complete understanding of all obligations and rights.

-

Attach the Voided Check: Securely attach the voided check to the form, ensuring it is legible and contains the correct routing and account numbers.

-

Choose the Submission Method: Determine whether the form can be submitted online, via mail, or in person. Select the method that provides the most convenience and security.

-

Submit the Form: Send the completed form along with the voided check according to the chosen method and meet any specific submission deadlines.

-

Confirmation and Follow-Up: Wait for confirmation of receipt and processing from the utility provider. Follow up if confirmation is not received within the expected timeframe and verify that payments are being processed correctly thereafter.

By meticulously following these steps, you can securely establish a reliable payment arrangement with your utility provider.

Legal Use of the Direct Pay Authorization

The Direct Pay Authorization form is governed by specific legal provisions that ensure both customer rights and provider responsibilities are safeguarded. Its legal use requires adherence to the following principles:

-

Authorization and Consent: Customers must provide explicit consent for automatic account debits through a duly executed authorization form. This consent must be freely given and subject to revocation by the customer at any time.

-

Termination Rights: Customers retain the right to terminate the agreement, typically by providing written notice to the utility provider. This protects the customer from unwanted or unauthorized transactions.

-

Error Resolution: Should errors occur in the processing of payments, customers have the right to contest these charges and seek resolution either directly with the bank or through the utility provider.

-

Recordkeeping: Both parties should retain copies of the authorization form and any related correspondence or documentation as proof of agreement and for future reference.

Compliance with these legal frameworks ensures that the Direct Pay Authorization is used ethically and responsibly, protecting all parties involved.

Key Elements of the Direct Pay Authorization

Several key elements are integral to the Direct Pay Authorization form, each contributing to its effectiveness and reliability:

-

Customer Information: This section captures all necessary details about the customer, including contact information and utility account numbers.

-

Banking Details: Accurate banking information, including bank account and routing numbers, is crucial for initiating and processing automatic payments.

-

Terms of Payment: A detailed outline of how payments will be deducted, including due dates, amounts, and frequency, ensures clarity regarding financial commitments.

-

Authorization and Agreement: A section detailing the conditions under which payments are authorized, including the customer’s rights to revoke consent and dispute charges.

-

Verification Methods: Methods such as including a voided check ensure that the banking details provided match those used for processing payments.

Each of these elements plays a pivotal role in ensuring the Direct Pay Authorization functions smoothly and is an effective tool for managing payments.

Form Submission Methods (Online / Mail / In-Person)

The Direct Pay Authorization form can be submitted through various channels, each catering to different user preferences and convenience needs. Here are the common methods:

-

Online Submission: Many utility providers offer an online portal for submitting the authorization form. This method is typically the fastest and allows for immediate confirmation of receipt.

-

Mail Submission: Customers can also submit their forms via traditional mail. This method requires careful consideration of delivery times and the need for additional postage.

-

In-Person Submission: For those who prefer a more direct approach, submitting the form in person provides an opportunity for immediate confirmation and resolution of any queries.

Choosing the most suitable submission method depends on factors such as urgency, personal preference, and availability of submission avenues by the utility provider.

Examples of Using the Direct Pay Authorization

The Direct Pay Authorization is routinely used in various scenarios that exemplify its utility and reliability in managing recurring payments. Here are some practical examples:

-

Utility Bill Payments: A common use case involves setting up automatic payments for monthly utility bills such as water, electricity, and gas, providing peace of mind against missed due dates.

-

Loan Installments: For loan repayments, the authorization ensures timely payment deduction, aiding in maintaining a positive payment history.

-

Subscription Services: Many customers use direct pay authorizations for regular subscriptions to services such as internet, cable, or magazine subscriptions, ensuring continual service without interruptions.

Each scenario underscores the form's capacity to streamline financial obligations, ensuring efficiency and reducing manual intervention in payment processes.