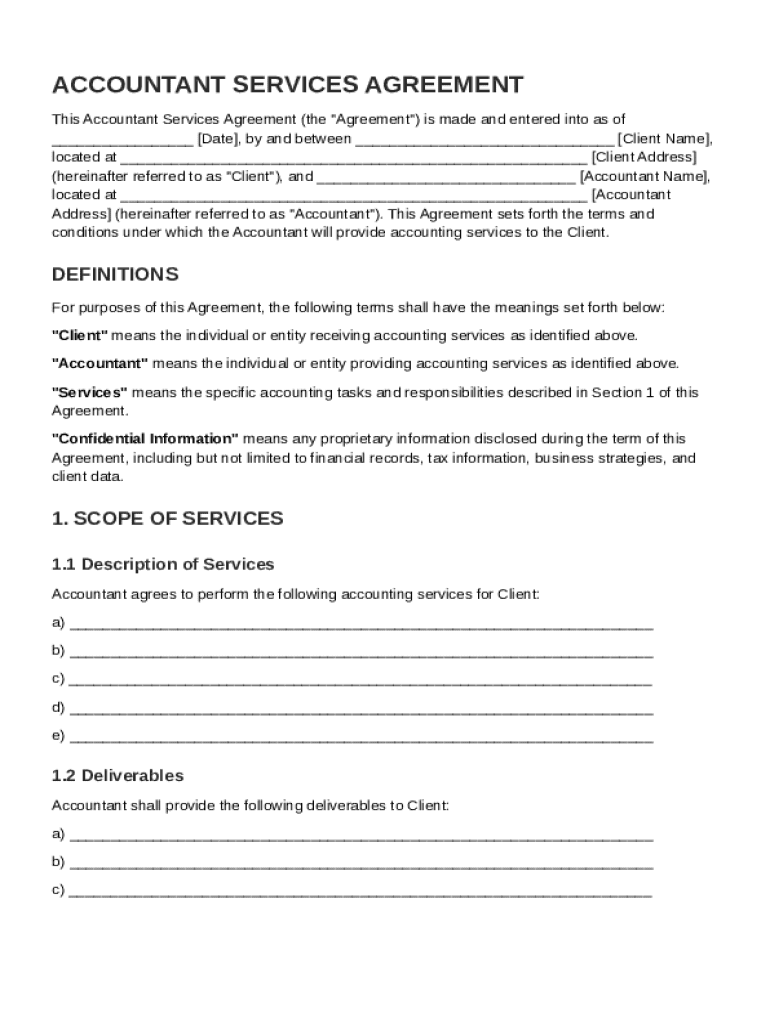

Definition and Meaning of Accountant Contract Template

The Accountant Contract Template is a structured document that details the terms and conditions under which accounting services are provided from an accountant to a client. It encompasses key aspects such as the scope of services, compensation arrangements, confidentiality agreements, liability limitations, and termination conditions. This template serves as a legal framework, ensuring both parties understand their responsibilities and expectations, thereby minimizing the risk of disputes. Providing a clear and concise definition of each element ensures both parties are aligned on all terms from the outset.

Key Components

- Scope of Services: Specifies the detailed description of the accounting tasks to be performed, including bookkeeping, tax preparation, financial analysis, and auditing.

- Compensation Details: Outlines the fee structure, payment schedule, and any other financial arrangements.

- Confidentiality Obligations: Establishes the requirement for the accountant to keep all financial information of the client private and secure.

- Termination Conditions: Explains the conditions under which either party can terminate the agreement, including required notices and penalties (if applicable).

Real-World Application

An accountant working with a small business can use this template to formalize the service relationship, ensuring there is a written record of every agreed term. This not only protects the interests of both parties but also provides clarity on specific service expectations and deliverables.

How to Use the Accountant Contract Template

To effectively use the Accountant Contract Template, follow a thorough step-by-step process to ensure accuracy and relevancy of the contract to your specific needs.

Step-by-Step Instructions

-

Review Terms: Begin by carefully reviewing the template to understand each section. Take note of any terms that may require customization or additional consultation with a legal expert.

-

Customize Information: Input specific details such as business names, contact information, and service descriptions. Ensure the compensation details accurately reflect any verbal agreements previously discussed.

-

Include Additional Clauses: Depending on the nature of the services, you might need to add clauses related to intellectual property rights, indemnity provisions, or jurisdiction specifics.

-

Legal Review: Before finalizing, have a legal professional review the contract to ensure compliance with local laws and regulatory expectations.

-

Execution: Once both parties have reviewed the template and agreed upon the terms, it can be signed and dated to formalize the agreement.

Common Customizations

- Service-Specific Adjustments: Tailor the descriptions of the accounting services to make them as accurate and relevant to the client’s business needs.

- Payment Terms: Adjust the payment frequency and conditions to reflect the financial practices of the specific engagement, such as hourly, monthly, or project-based fees.

Key Elements of the Accountant Contract Template

Understanding the essential components of the Accountant Contract Template is crucial for ensuring that all critical aspects of the accounting engagement are covered.

Major Elements

- Responsibilities of Both Parties: Clearly indicate the duties and obligations of both the accountant and the client, leaving no room for ambiguity.

- Liability and Indemnity: Define the extent of accountability for both parties, with emphasis on indemnity clauses to protect against potential claims.

- Governing Law: Specify the legal jurisdiction that will govern the contract to prevent jurisdictional disputes.

Practical Scenarios

An accountant providing services to a multi-state corporation needs to include specific governing laws to ensure that the contract holds up across different states. Additionally, if the services involve sensitive information, the confidentiality clause needs to be robust and may require further legal language enhancements.

Legal Use of the Accountant Contract Template

The legal aspect of the Accountant Contract Template is vital, as it ensures the document can serve as an enforceable contract in legal proceedings if disputes arise.

Important Legal Considerations

- Enforceability: Each section of the template should be drafted in accordance with federal and state regulations to ensure that it is legally binding.

- Adherence to Common Law: Align the template with common law principles, such as fairness and mutual consent.

- Amendments and Revisions: Mention the process for making amendments to the contract, ensuring both parties have a clear understanding of how modifications can occur.

Legal Case Studies

Consider a situation where a client sues for breach of contract. An accurately drafted Accountant Contract Template becomes pivotal in court to prove the accountant fulfilled their contractual obligations, highlighting the importance of all legal provisions within the template.

Important Terms Related to Accountant Contract Template

Knowledge of specific terminology used in accounting contracts can enhance understanding and communication between parties.

Common Terms

- Invoice: A request for payment for services provided, usually including a breakdown of hours worked or tasks completed.

- Retainer: A fee paid in advance for future accounting services, often used to secure the accountant's availability.

- Net Payment: The amount after all deductions have been made, including taxes or service fees.

Application Examples

An accountant preparing periodic financial statements for a client needs to understand these terms to issue accurate invoices that align with the agreed compensation structure within the contract.

Examples of Using the Accountant Contract Template

Practical examples provide insights into how various clauses and sections of the template might be implemented in actual business scenarios.

Real-Life Instances

- Small Business Accountancy: A bakery owner hires an accountant to manage payroll and financial reporting. The template defines the services and ensures all parties consent to the frequency of report submissions and consultations.

- Non-Profit Organization: Engage an accountant to handle budgeting and audits. Using the contract template ensures transparency in financial dealings and reflects specific reporting requirements mandated by regulatory bodies.

Variation in Usage

In multinational firms, clauses are adapted to reflect currency exchange considerations and international tax laws, demonstrating the template's flexibility to cater to diverse business needs.

State-Specific Rules for the Accountant Contract Template

Understanding state-specific regulations is crucial to drafting a compliant Accountant Contract Template that meets all legal obligations.

Varying State Requirements

- Regulatory Compliance: Different states may have unique guidelines regarding tax filing, reporting deadlines, or professional certifications that must be explicitly acknowledged in the contract.

- Jurisdictional Variations: Laws pertaining to non-compete clauses, or service termination can vary by state, requiring tailored contract language to ensure enforceability.

Examples Across States

In California, there may be specific disclosure requirements related to data privacy, necessitating additional contract language. In contrast, a New York-based accountant may encounter distinct employment classification rules affecting contract terms for hiring additional support staff.

Steps to Complete the Accountant Contract Template

A systematic approach is vital for completing the Accountant Contract Template efficiently and effectively.

Completion Process

-

Gather Required Information: Collect necessary details about both parties involved, including legal names, addresses, and relevant business identification numbers.

-

Fill in Template: Methodically complete each section of the template, ensuring accuracy and relevance of the information provided.

-

Review and Revise: Conduct a thorough review to identify any incomplete fields or inconsistencies, making revisions where necessary.

-

Seek Professional Guidance: If any part of the template includes legal complexities, consult with a legal expert to ensure full compliance with applicable laws.

-

Finalize and Save: Once all details are confirmed, save a finalized version and distribute copies to all parties involved for their records.

Practical Implementation

Assuming an accountant is completing a contract with a new tech startup, it's critical to include specific details related to intellectual property and confidentiality to safeguard sensitive data exchanged during the service provision.