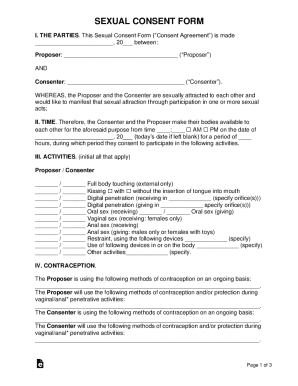

Definition & Meaning

A Bookkeeper Contract Template is a standardized document that establishes the terms and conditions for the provision of bookkeeping services between a bookkeeper and their client. It typically outlines the responsibilities of the bookkeeper, compensation arrangements, confidentiality requirements, and other legal obligations. This type of contract serves as a foundational agreement to ensure clarity and transparency in the professional relationship.

Components of the Contract

- Scope of Services: Clearly defines the bookkeeping tasks the professional is expected to perform.

- Compensation Details: Specifies payment rates, whether hourly or fixed, and billing procedures.

- Confidentiality Obligations: Ensures both parties agree to maintain the confidentiality of sensitive business information.

- Indemnification Clauses: Protects each party from liability due to the actions of the other.

- Governing Law: Indicates which state laws will govern the agreement.

How to Use the Bookkeeper Contract Template

Utilizing a Bookkeeper Contract Template involves customizing the document to reflect the specific needs and agreements of the involved parties. The template acts as a flexible framework, accommodating a range of services and contractual relationships in bookkeeping.

Steps to Customize

- Identify the Parties: Clearly name the bookkeeper and the client, including any business details.

- Define Services: Adjust the scope of services to fit the exact needs of the client.

- Set Payment Terms: Agree upon and document the payment terms, whether it’s per hour or project-based.

- Incorporate Specific Clauses: Include specific clauses relevant to privacy, indemnification, and others that suit both parties.

- Review and Finalize: Both parties should review the document thoroughly before signing.

Key Elements of the Bookkeeper Contract Template

The Bookkeeper Contract Template includes several key sections that provide a comprehensive and legally sound framework for the engagement.

Main Elements

- Service Inclusions: Specific services covered under the agreement, such as monthly accounting, payroll services, or quarterly tax filings.

- Contract Duration: Start and end dates of the engagement, including renewal terms if applicable.

- Termination Conditions: Conditions under which the contract can be terminated by either party.

- Intellectual Property Rights: Who owns the data and bookkeeping work once completed.

Importance of Detail

Detailed sections help reduce misunderstandings and provide a clear process for managing disputes, should they arise.

Important Terms Related to Bookkeeper Contract Template

Understanding key terms within the contract is essential for both drafting and executing the document correctly.

Common Terms

- Independent Contractor: Defines the bookkeeper's status as a non-employee, affecting taxes and legal liabilities.

- Non-Disclosure Agreement (NDA): Highlights confidentiality, preventing both parties from disclosing sensitive information without permission.

- Force Majeure: Covers unexpected events that might allow for contract suspension.

- Remedies: Outlines actions in case of a breach, including potential mediation or legal avenues.

Who Typically Uses the Bookkeeper Contract Template

The Bookkeeper Contract Template is primarily utilized by small to medium-size businesses looking to formally engage a bookkeeper's services. It is equally beneficial for bookkeepers to protect their interests and define client expectations.

Typical Users

- Freelance Bookkeepers: Who offer their services to various clients, ensuring clear terms with each engagement.

- Small Business Owners: Seeking to maintain organized financial records and require professional help to do so.

Benefits to Users

Clearly defined agreements protect against future disputes, provide clarity in professional relationships, and establish a professional standard for both bookkeepers and businesses.

Steps to Complete the Bookkeeper Contract Template

Successfully completing a Bookkeeper Contract Template involves several critical steps to ensure all elements are correctly filled in and legally binding.

Step-by-Step Process

- Compile Necessary Information: Gather all required business details of both bookkeeper and client.

- Fill in the Template Fields: Input information into sections pertaining to services, payment, and terms.

- Review Legal Language: Ensure all wording and terms are legally accurate and conform to state laws.

- Negotiate and Finalize Terms: Discuss and agree on any modifications with the other party.

- Sign and Execute: Both parties sign the contract, making it legally binding.

Additional Tips

Consulting a legal professional can ensure that the template satisfactorily meets specific needs and adheres to any applicable legal requirements.

Legal Use of the Bookkeeper Contract Template

The Bookkeeper Contract Template must comply with U.S. federal and state-specific laws to be enforceable. It should include any state-specific requirements or clauses to ensure legality.

Legal Considerations

- Consideration and Mutual Consent: Both parties should agree without duress and exchange something of value.

- Adherence to Tax Laws: Ensure the independent status and appropriate tax forms are utilized.

- State-Specific Regulations: Be aware of any local legal variations that may impact the contract's enforceability.

Practical Scenario

Should any disputes arise regarding services or compensation, having an enforceable contract will provide a legal pathway for resolution.

Business Types That Benefit Most from Bookkeeper Contract Template

Specific business types frequently benefit from utilizing a Bookkeeper Contract Template due to the nature of their operations and accounting needs.

Beneficial Scenarios

- Startups: Where initial financial organization is critical for future operations.

- Retail Businesses: Needing detailed transaction records for inventory and tax purposes.

- Service Industries: That require regular accounting updates given fluctuating revenue streams.

Advantages Over Generic Contracts

Utilizing a specialized template ensures that industry-specific needs and expectations are met, reducing the likelihood of future complications or misunderstandings.