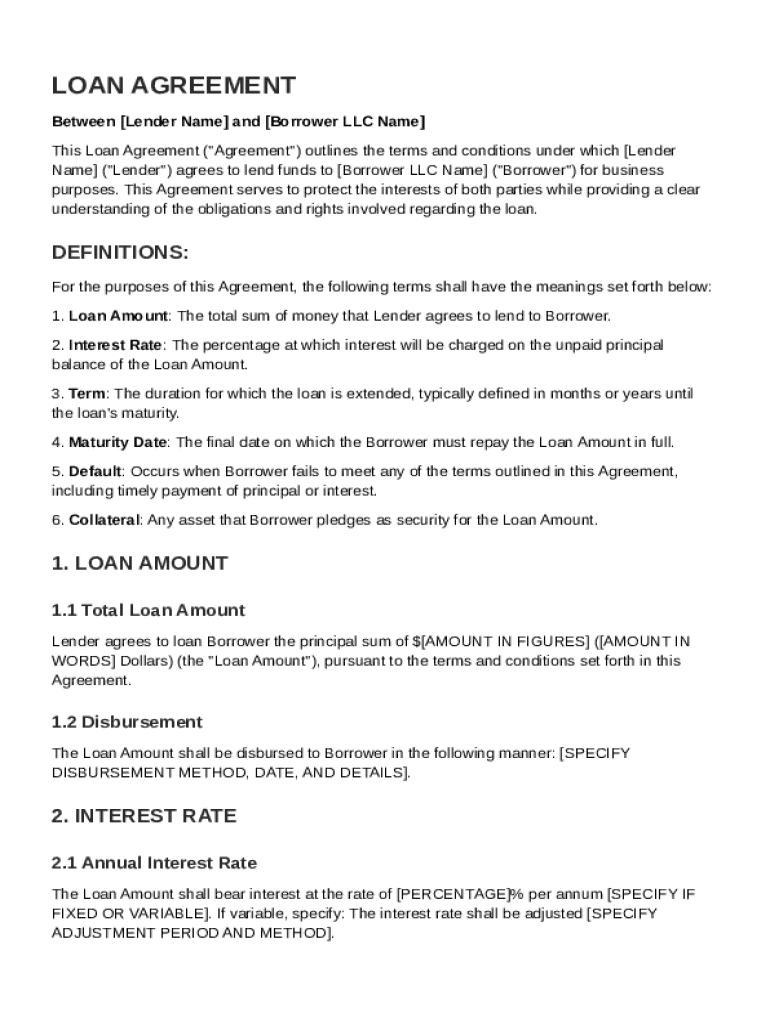

Definition and Meaning of LLC Loan Agreement Template

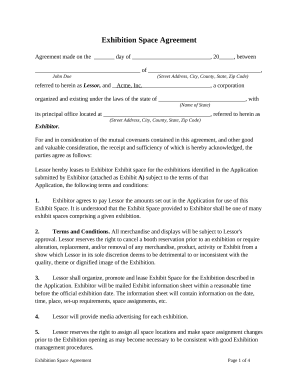

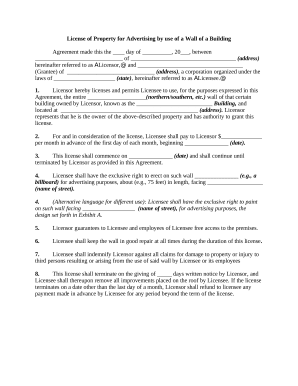

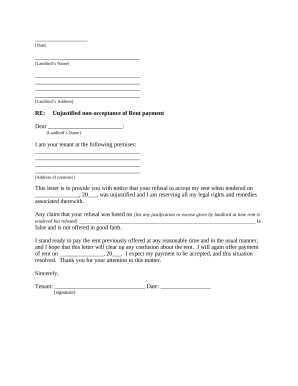

An LLC Loan Agreement Template is a structured document that outlines the terms and conditions of a loan agreement between a lender and a borrower, typically framed for a Limited Liability Company (LLC). This template serves as a standardized format, providing a legal framework to detail the obligations of both parties involved in a business loan. The agreement typically includes crucial details like loan amount, interest rate, repayment schedule, and collateral requirements. It not only protects the interests of both parties but also ensures clarity and enforceability of the loan provisions.

Key Components

- Loan Amount: Specifies the total sum provided by the lender to the borrower.

- Interest Rate: Details the cost of borrowing, usually expressed as an annual percentage.

- Repayment Schedule: Outlines the timeline and conditions for returning the borrowed funds.

- Collateral: Describes any assets pledged by the borrower to secure the loan.

How to Use the LLC Loan Agreement Template

Using an LLC Loan Agreement Template involves several steps to ensure all necessary details are adequately captured and agreed upon. Users must input specific values in the provided sections of the template, creating a tailored and enforceable agreement for their particular transaction.

Steps for Completion

- Identify Parties: Clearly state the legal names of the lender and borrower.

- Detail Loan Terms: Enter the specific loan amount, interest rates, and repayment conditions.

- Define Collateral: If applicable, describe any assets used as security for the loan.

- Review and Edit: Use document editing tools to customize clauses as necessary for the business context.

Key Elements of the LLC Loan Agreement Template

The LLC Loan Agreement Template incorporates various essential elements that define the scope and enforceability of the loan arrangement. Each element must be clearly and accurately detailed to avoid disputes and ensure compliance with legal standards.

Essential Clauses

- Payment Terms: Including the method and frequency of payments.

- Default Provisions: Conditions under which the borrower is considered in default.

- Amendment Clauses: Procedures for modifying the agreement post-execution.

- Governing Law: Specifies which jurisdiction's laws will apply to the agreement.

Legal Use of the LLC Loan Agreement Template

The LLC Loan Agreement Template serves not only as a practical instrument to formalize loan agreements but also adheres to legal prerequisites, ensuring that the contract is valid and legally binding upon all parties involved.

Compliance and Enforceability

To ensure the template's use results in a legally enforceable document, users must:

- Ensure all parties involved are legally capable of entering into a contract.

- Ensure all terms within the agreement comply with local, state, and federal laws.

- Include provisions for legal representation and recourse in the event of disputes.

Steps to Complete the LLC Loan Agreement Template

Completing an LLC Loan Agreement Template effectively requires attention to detailed documentation of all aspects related to the loan transaction. The steps focus on ensuring all sections are filled correctly and consistently across the document.

- Gather Information: Collect all necessary information about both parties and the specific loan terms.

- Input Data: Fill in all relevant sections of the template with precision, referencing legal documents as needed for accuracy.

- Use Tools: Utilize document editing software to easily manipulate and finalize the loan agreement.

- Verification: Have all parties review and acknowledge the terms to prevent future conflicts.

- Signature: Apply legally binding electronic signatures, ensuring compliance with the ESIGN Act for digital agreements.

Required Documents for the LLC Loan Agreement Template

To accurately fill out the LLC Loan Agreement Template and substantiate the agreement's terms, specific documentation is required for both parties.

Essential Documentation

- Identification: Legal identification of both the lender and the borrowing LLC.

- Financial Statements: Recent financial documents of the borrowing company showing its ability to repay.

- Asset Documentation: Proof of the collateral's value and ownership status, if applicable.

- Existing Loan Agreements: Documentation of any other existing financial obligations of the borrower.

Steps to Obtain the LLC Loan Agreement Template

Acquiring the LLC Loan Agreement Template involves accessing reliable platforms that offer legally vetted templates. The process is relatively straightforward and ensures that users have access to a comprehensive template ready for customization.

Acquisition Process

- Select Source: Visit reputable document management platforms like DocHub.

- Template Search: Search specifically for the LLC Loan Agreement Template.

- Download: Access and download the template in a compatible format such as PDF or DOC.

- Save: Store the template securely within your document management system for future use.

Who Typically Uses the LLC Loan Agreement Template

The LLC Loan Agreement Template is widely utilized across various entities and sectors, predominantly by businesses structured as LLCs engaging in financial borrowing from potentially diverse lending sources.

User Profiles

- Small to Medium Enterprises (SMEs): Using structured agreements to secure growth capital.

- Financial Institutions: Providing template agreements for standardized lending practices.

- Legal Professionals: Assisting clients in drafting comprehensive contract agreements.

- Individual Investors: Formalizing personal loans given to business entities.

State-Specific Rules for the LLC Loan Agreement Template

While the LLC Loan Agreement Template provides a universal framework, individual U.S. states may have specific requirements or modifications necessary for the agreement to be fully compliant with state laws.

Considerations for Compliance

- Interest Rate Limits: Ensure that the agreement adheres to state-mandated usury laws.

- Collateral Regulations: State-specific rules around acceptable security interests.

- Legal Provisions: Incorporate any state-specific clauses or disclosures required by local legislation.

- Enforcement Rights: Understanding how state laws impact enforcement or dispute resolution options.