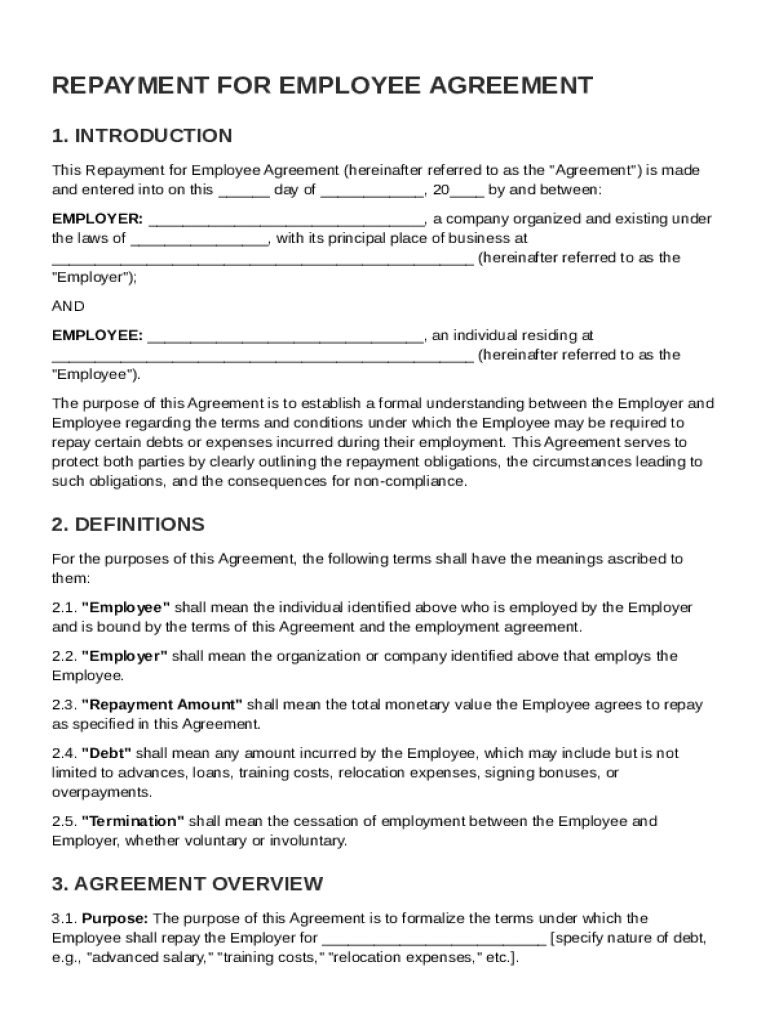

Definition and Purpose of the Repayment for Employee Agreement Template

The Repayment for Employee Agreement Template is a legal document designed to outline the terms and conditions under which an employee must repay debts or expenses incurred during their employment. This can include advances, loans, or reimbursements for expenses that were initially covered by the employer. The agreement provides a clear framework for repayment obligations, including the amount to be repaid, the method of repayment, and the timeline for fulfilling these obligations. By clearly defining these elements, the template helps to prevent misunderstandings and disputes between employers and employees.

Important Terms and Components

Understanding the key terms within the repayment agreement is crucial for both parties involved. The document typically includes:

- Loan or Advance Amount: The precise figure that the employee is required to repay.

- Repayment Schedule: Details of how and when the repayments should be made.

- Interest Rates: If applicable, the interest charged on the amount borrowed.

- Consequences of Non-Compliance: The repercussions faced by the employee if they do not adhere to the repayment terms.

- Confidentiality Clause: Ensures that the details of the agreement remain private between the parties involved.

Each of these components is designed to provide clarity and protect the interests of both the employer and the employee.

Steps to Complete the Template

Filling out the Repayment for Employee Agreement Template involves several key steps:

- Gather Information: Collect all necessary details about the loan or advance, including the amount, the date it was given, and any relevant documentation.

- Outline Repayment Terms: Specify the agreed-upon repayment schedule, including frequency and amount of payments.

- Include Interest Details: If applicable, state the interest rate and how it is applied to the outstanding balance.

- Specify Consequences: Clearly outline what will happen in the event of default or late payment.

- Review and Sign: Both parties should carefully review the agreement to ensure accuracy and understanding before signing.

Each step is crucial to ensure that the agreement is legally binding and accurately reflects the intentions of both parties.

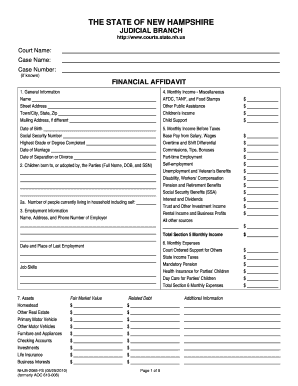

Legal Use and Compliance

The legal use of the Repayment for Employee Agreement Template entails ensuring that all statutory requirements are met. These agreements must comply with federal and state laws regarding employment and financial transactions. It is important to note that failure to comply with these requirements can result in the agreement being unenforceable. Employers often consult legal professionals to ensure the template meets all necessary legal criteria. The document should also include a governing law clause to specify which jurisdiction's laws will apply.

Reasons for Using the Template

Utilizing this template offers numerous benefits:

- Clarity and Transparency: Provides a clear outline of repayment terms to avoid disputes.

- Legal Assurance: Ensures the agreement complies with applicable laws, making it enforceable.

- Efficiency: Streamlines the repayment process with a standardized method.

- Protection: Safeguards the interests of both parties with clearly defined terms.

By employing this template, businesses can maintain transparent and efficient financial practices.

Who Typically Utilizes the Template

This template is commonly used by:

- Human Resources Departments: To formalize repayment arrangements with employees.

- Small and Medium Businesses (SMBs): For managing employee loans or advances.

- Legal Professionals: To draft customized agreements for their clients.

The template provides a standardized approach that can be adapted to suit a wide range of business contexts.

Examples and Scenarios of Usage

Consider a scenario where an employee receives a $5,000 advance to meet moving expenses for a job relocation. The employee and employer would use the Repayment for Employee Agreement Template to detail:

- The $5,000 advance and any interest.

- A repayment plan spanning six months with equal monthly deductions from the employee's salary.

- Consequences if the employee terminates employment before repayment completion.

Such agreements ensure that both parties are aware of their rights and responsibilities throughout the repayment process.

Variations and Alternatives

There are alternative forms that could serve similar purposes, such as:

- Promissory Notes: For straightforward loan agreements without additional employment-related terms.

- Expense Repayment Agreements: Focused specifically on reimbursing business-related expenses.

Each variation is tailored to specific circumstances and should be selected based on the unique needs of the business and the nature of the debt or advance involved.

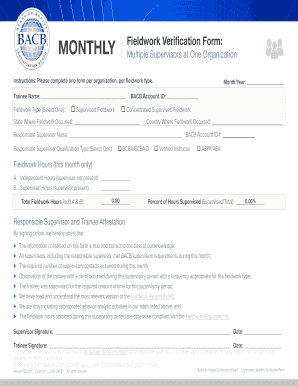

State-Specific Regulations

Each state in the U.S. may have distinct requirements or restrictions relating to employee repayment agreements. For instance, some states have specific limitations on wage deductions for loan repayments. It is important to review state labor laws to ensure compliance with local regulations. Consulting with a legal expert familiar with state-specific employment laws is advisable to avoid potential legal pitfalls.

Real-World Examples

Many companies utilize these templates to manage employee-related financial transactions. A tech start-up, for example, might use the template to provide an equipment loan program for new hires, detailing repayment terms in cases where the employee departs before full repayment. This template helps ensure fairness and clarity in employer-employee financial interactions.