Definition and Meaning

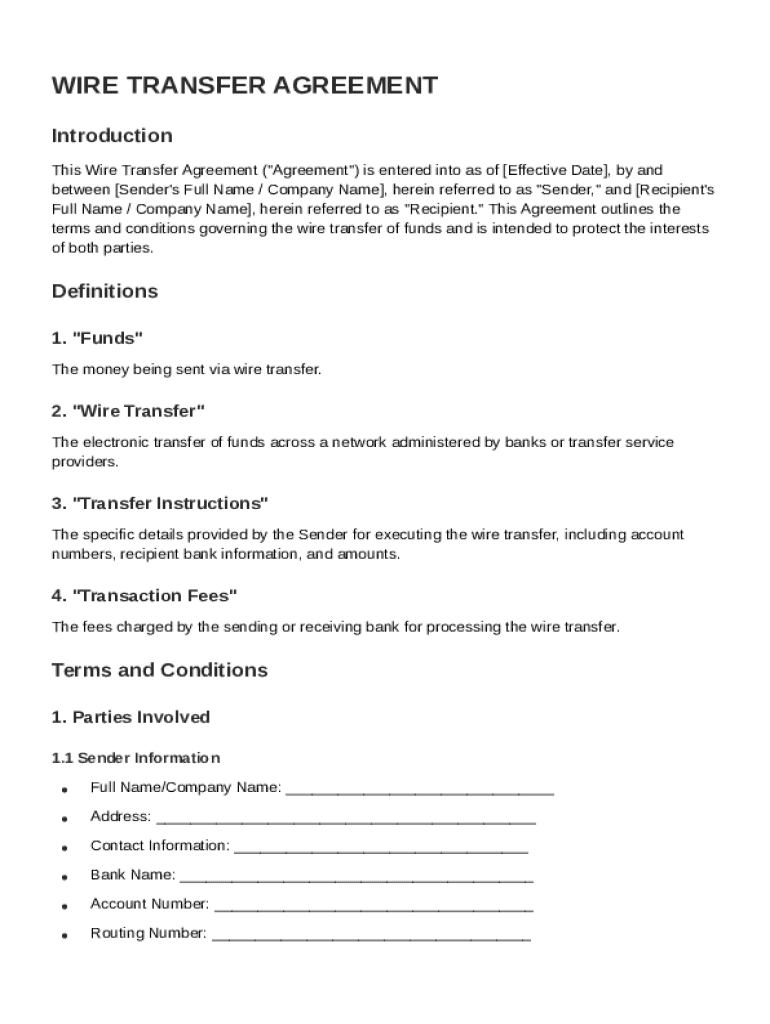

The Wire Transfer Agreement Template is a critical document outlining the terms and conditions under which funds are transferred electronically between two parties: a Sender and a Recipient. This agreement includes comprehensive details such as definitions of key terms, the identities of the involved parties, transfer amounts, and timing guidelines. It is designed to safeguard both parties' interests by formalizing the transaction process and specifying legal obligations.

An essential function of this template is to detail the authorization processes required for initiating transfers, highlighting the procedural integrity of the transaction. Additionally, the document clarifies liability clauses to address potential risks and financial disputes. The agreement also serves as a binding contract, ensuring compliance with applicable governing laws specific to wire transfers in the United States.

Key Elements of the Wire Transfer Agreement Template

A Wire Transfer Agreement Template comprises several critical components that ensure the secure and efficient transfer of funds. These elements are meticulously crafted to cover every transactional aspect:

- Parties Involved: Clearly identifies the Sender and the Recipient, along with any intermediaries facilitating the transfer.

- Transfer Amounts and Limits: Specifies the exact sum being transferred and any pre-set limits to mitigate risk.

- Transaction Fees: Outlines any associated costs, detailing who is responsible for covering these fees.

- Timing and Delivery: Provides timelines for processing the transfer and any guaranteed delivery times.

- Authorization and Security Protocols: Lays out the required authorization steps and security measures, like multi-factor authentication, to protect against unauthorized transfers.

- Liability Clauses: Details responsibility in the event of errors or delays, ensuring both parties understand their obligations and recourse options.

- Governing Law: Specifies which jurisdiction's laws will govern the agreement, crucial for resolving potential disputes.

Understanding these elements supports accurate, efficient, and secure wire transfers, fostering trust between both parties involved.

Steps to Complete the Wire Transfer Agreement Template

Successfully completing a Wire Transfer Agreement Template involves several essential steps:

- Gather Information: Collect necessary details about both parties, including names, contact information, and bank account details.

- Specify Transfer Details: Record the amount of money to be transferred, any associated transaction fees, and the purpose of the transfer.

- Define Authorization Protocols: Clearly outline the security measures and authorization steps needed to initiate the transfer.

- Include Liability and Governing Law Clauses: Clearly articulate the liability clauses and specify the governing law for the agreement.

- Review and Sign: Ensure all parties thoroughly review the agreement terms. Once reviewed, both parties should sign to acknowledge and consent to the terms outlined.

Legal Use of the Wire Transfer Agreement Template

The Wire Transfer Agreement Template serves as a legally binding document that offers protection to both the Sender and Recipient. Within the United States, it adheres to the Uniform Commercial Code (UCC) provisions governing electronic funds transfers, ensuring compliance with legal standards.

- Regulatory Compliance: The agreement must align with federal regulations, including the Electronic Fund Transfer Act (EFTA), which governs consumer rights during electronic transactions.

- Audit Trail: Provides clear documentation in the event of regulatory reviews or internal audits, maintaining transparency.

- Enforceability: Ensures that all parties are legally obligated to comply with the agreement, preventing contractual breaches and offering legal recourse if necessary.

State-Specific Rules

While wire transfers are largely regulated at the national level in the United States, certain states may have additional rules or requirements:

- California: State-specific regulations may require additional disclosures for consumer protection.

- New York: Stringent anti-fraud measures are often recommended to enhance the security of high-value transactions.

- Texas: May necessitate conforming to state disclosure laws and identity verification mandates.

It is essential to consult legal experts or financial advisors to ensure compliance with state-specific regulations when dealing with wire transfers.

Software Compatibility

The Wire Transfer Agreement Template can be seamlessly integrated and utilized with various software platforms for enhanced efficiency and accuracy:

- DocHub Integration: Offers robust features for editing and storing agreement templates, facilitating streamlined digital workflows.

- QuickBooks and TurboTax: Provides compatibility with popular financial software, enabling easy management of transaction records and financial reporting.

- Adobe Acrobat: Supports fillable PDF formats, allowing users to complete and sign documents electronically without needing hard copies.

Compatibility with such systems not only ensures ease of use but also enhances the security and integrity of the document management process.

Who Typically Uses the Wire Transfer Agreement Template

A diverse range of individuals and business entities utilize the Wire Transfer Agreement Template to secure electronic transactions:

- Financial Institutions: Banks and credit unions frequently draft these agreements to regulate transfers and mitigate risks.

- Businesses: Companies engaging in international trade or requiring large-scale fund transfers use this template to formalize agreements with suppliers and clients.

- Individuals: High-net-worth individuals use these agreements to manage large-scale personal transactions securely.

Understanding who typically uses these templates helps tailor them to suit specific needs, ensuring all necessary clauses are included to meet user requirements.

Penalties for Non-Compliance

Non-compliance with the terms outlined in a Wire Transfer Agreement Template can lead to significant consequences:

- Financial Penalties: Parties may incur fines or fees imposed by financial institutions for unauthorized transactions or breaches of agreement terms.

- Legal Consequences: Violating the agreement can result in lawsuits or legal disputes, particularly if one party suffers financial loss due to non-compliance.

- Reputation Damage: Businesses failing to adhere to transfer agreements risk damaging their reputation, impacting client trust and future business opportunities.

It is crucial for all involved parties to fully understand and adhere to the agreement terms to avoid these potential penalties.