Definition & Meaning

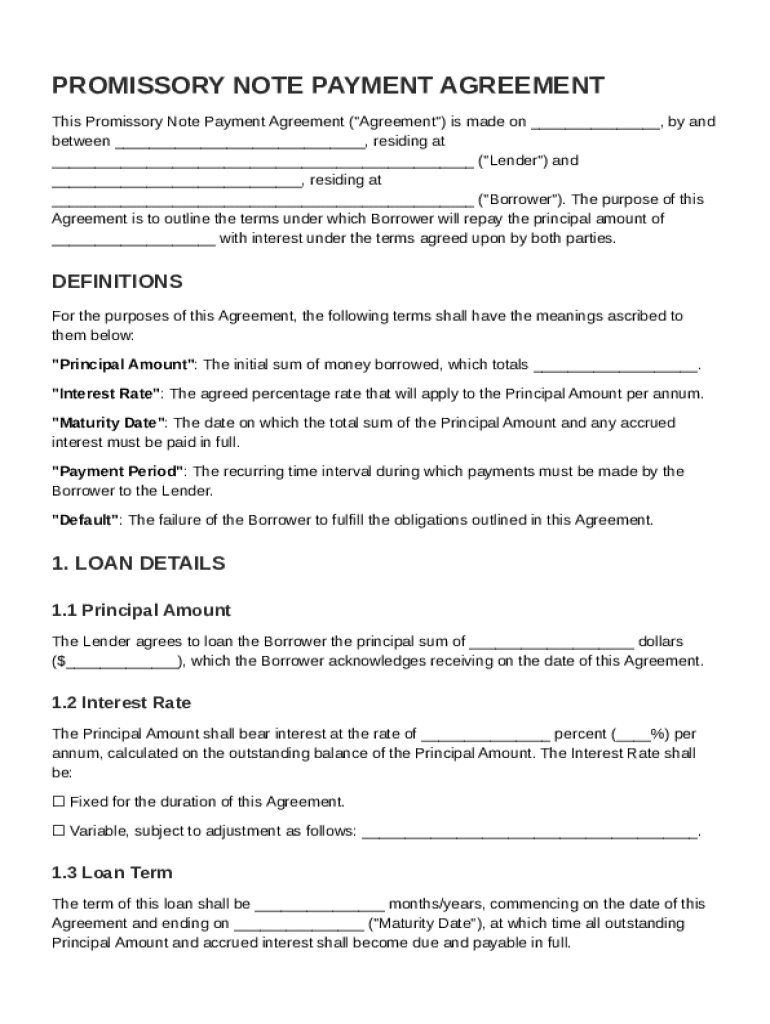

A Promissory Note Payment Agreement is a legal document that outlines the conditions under which a borrower promises to repay a lender. This agreement details the principal amount of the loan, the interest rate applied, payment due dates, and any specific conditions related to default. The document serves as a binding commitment between the two parties, specifying the obligations and rights of each. It helps ensure that the borrowing and lending arrangements are clearly understood and legally enforceable.

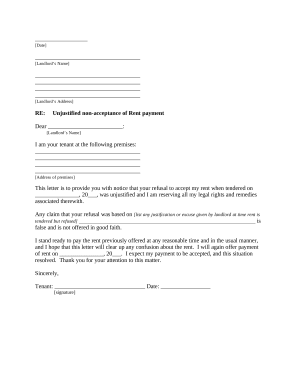

How to Use the Promissory Note Payment Agreement Template

Using a Promissory Note Payment Agreement Template allows parties to customize their loan agreement to fit specific terms. To use it effectively, first access the template through your document management platform, such as DocHub. Use the editing features to fill in necessary information, such as the names of the borrower and lender, loan amount, interest rate, and repayment schedule. The template guides you through the required fields, ensuring that all essential details are included. Pay particular attention to the sections reviewing default conditions, as these offer critical legal protections.

Key Elements of the Promissory Note Payment Agreement Template

The template includes several key sections critical to its effectiveness. These sections often include:

- Principal Amount: The total loan amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Schedule: Detailed schedule specifying when payments are due.

- Default Conditions: Terms outlining what constitutes a default and the penalties associated with it.

- Lender and Borrower Information: Identification information for both parties involved in the agreement.

These elements ensure clarity and legality, preventing disputes over the terms of the agreement.

Steps to Complete the Promissory Note Payment Agreement Template

- Collect Information: Gather all necessary information, including financial details of the loan and personal data for both parties.

- Access the Template: Open the template using a document editing platform such as DocHub.

- Input Data: Fill in all relevant fields, carefully checking for accuracy.

- Review Default Terms: Make sure the default terms and repayment conditions align with both parties' expectations.

- Sign the Agreement: Use a platform that supports electronic signatures to complete the signing process.

- Distribute Copies: Provide each party with a signed copy of the agreement to ensure transparency and mutual understanding.

State-Specific Rules for the Promissory Note Payment Agreement Template

Different states may have unique regulations regarding promissory notes. This includes variations in usury laws, which cap the maximum interest rate. Certain states may also have specific provisions about late fees and how they are calculated. It's important to check these rules before finalizing the agreement to ensure compliance with local legal standards. Consulting a legal professional familiar with state-specific regulations may also help mitigate legal risks.

Legal Use of the Promissory Note Payment Agreement Template

The Promissory Note Payment Agreement serves as a legally binding document, enforceable in court. For it to hold legal weight, the document must be properly executed, featuring accurate and honest information. It is critical that all involved parties fully understand the terms and agree to the conditions laid out in the agreement. Legal advice can ensure the document satisfies all judicial requirements in the respective jurisdiction.

Examples of Using the Promissory Note Payment Agreement Template

Promissory Note Payment Agreements are common in various scenarios. For instance, small business owners may use them to obtain startup funds from an investor. Individuals might also use a promissory note when borrowing money from family or friends. In all cases, the agreement ensures there is a clear understanding of the financial commitment, protecting not only the lender's investment but also maintaining the borrower's accountability.

Digital vs. Paper Version

With tools like DocHub, there is a clear shift towards using digital versions of the Promissory Note Payment Agreement. Digital versions allow for easier editing, signing, and sharing processes, often with enhanced security measures, such as encrypted transfers. These benefits, along with the convenience of handling documentation online without physical storage concerns, make digital agreements the preferred choice for many. However, some parties may still opt for paper agreements due to comfort levels or specific legal requirements necessitating physical signatures.