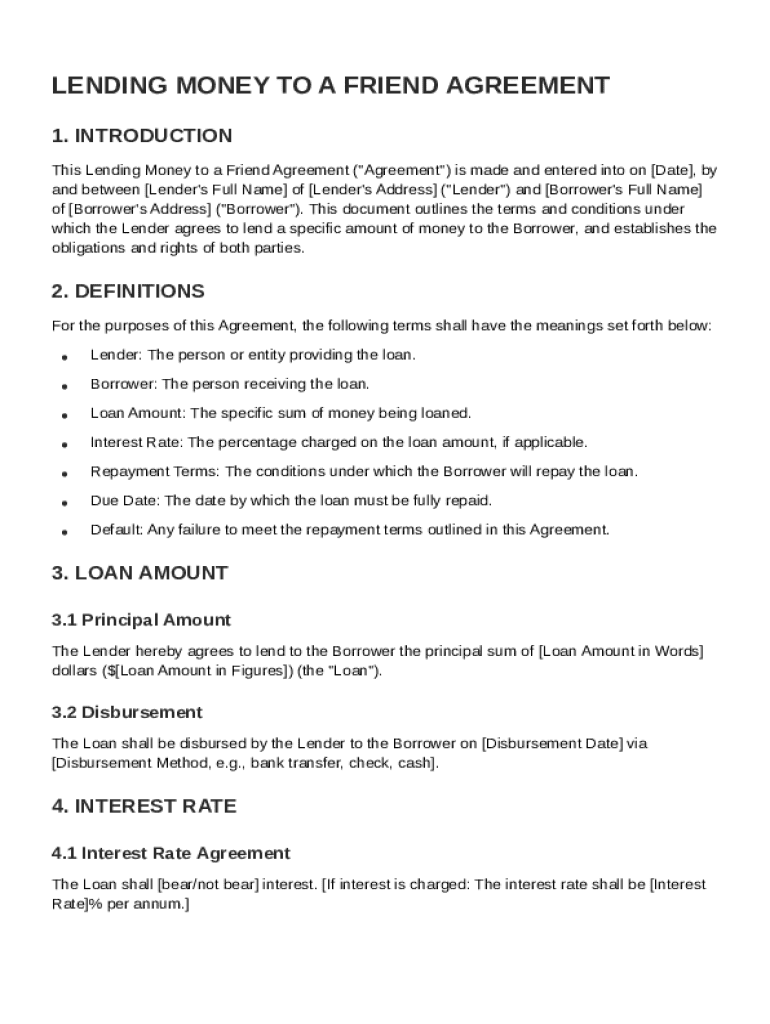

Definition & Meaning

The "Lending Money to a Friend Agreement Template" is a structured document that outlines the terms and conditions under which a loan is made by an individual to a friend. This template helps formalize the arrangement, protecting both the lender and the borrower by setting clear expectations. It typically includes definitions of key terms such as the loan amount, interest rates, and repayment schedules. By using this agreement, both parties have a legal framework to reference, reducing the potential for misunderstandings.

How to Use the Lending Money to a Friend Agreement Template

To effectively use the Lending Money to a Friend Agreement Template, start by reviewing the document for any pre-filled sections or examples that align with your specific needs. Ensure that all necessary fields are filled out accurately, including personal details of both parties, the loan amount, and agreed terms. Customization may also involve:

- Adjusting the interest rate as per mutual agreement.

- Clearly outlining the repayment timetable.

- Specifying any collateral involved.

Once personalized, both parties should review the document thoroughly before signing. This ensures that all terms are understood and agreed upon, minimizing disputes in the future.

Steps to Complete the Lending Money to a Friend Agreement Template

-

Personal Information: Enter the full names, addresses, and contact information of both the lender and the borrower.

-

Loan Details: Specify the loan amount and currency. Detail the interest rate, if applicable, and how it is calculated (simple or compound).

-

Repayment Terms: Clearly define the repayment schedule, including due dates and installments. Specify whether payments are to be made weekly, monthly, or in a lump sum.

-

Default Clauses: Insert conditions under which a default occurs, and the consequences that follow. This might include extra charges or revised repayment terms.

-

Signatures: Both parties should sign the document, ideally in the presence of a witness for additional credibility.

-

Copies: Retain copies for both parties and any involved third parties, such as a notary or legal adviser.

Key Elements of the Lending Money to a Friend Agreement Template

The template comprises several critical sections that must be filled accurately:

- Identification of Parties: Who the lender and borrower are.

- Loan Amount and Purpose: The specific financial specifics and the reason for the loan.

- Interest and Fees: Any extra costs that may apply.

- Repayment Schedule: Specifics on how and when payments must be made.

- Default Terms: What constitutes a default and its implications.

- Governing Law: Which state or jurisdiction will oversee any disputes.

- Miscellaneous Provisions: Other conditions, such as amendments and termination clauses.

Legal Use of the Lending Money to a Friend Agreement Template

This agreement acts as a legally binding document once signed. It's crucial to ensure its compliance with state-specific lending laws. Considerations include the legality of proposed interest rates and ensuring no clauses contradict consumer protection laws. It's advisable to consult a legal professional to ensure the agreement meets all legal standards and provides adequate protection for both parties involved.

State-Specific Rules for the Lending Money to a Friend Agreement Template

It's important to understand state variations in lending laws, such as usury laws that cap interest rates. For example:

- Some states may have stricter limits on allowable interest rates.

- Others might enforce specific protocols for the enforceability of informal agreements.

Ensure your document adheres to these guidelines by researching or consulting a local attorney.

Examples of Using the Lending Money to a Friend Agreement Template

This template is commonly used in scenarios such as:

- Financing a friend's small business startup.

- Personal loans between family members to help cover unexpected expenses.

- Assisting a friend with a down payment or tuition fees.

In each case, the agreement helps clarify the terms, protecting friendships by keeping the terms transparent.

Important Terms Related to the Lending Money to a Friend Agreement Template

Understanding the terminology is crucial for proper usage. Key terms include:

- Principal: The original sum of money lent.

- Interest Rate: The percentage charged on the principal over a period.

- Amortization: Spreading payments over multiple periods.

- Collateral: An asset pledged by the borrower to secure the loan.

Comprehending these terms ensures both parties are on the same page, preventing potential disputes and misunderstandings over the loan's lifecycle.