Definition & Meaning

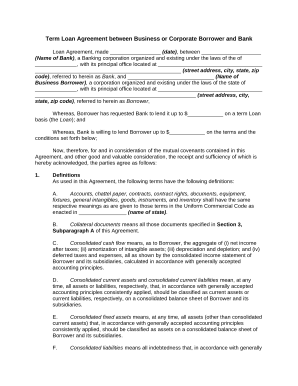

A Lending Agreement Template serves as a foundational document in lending transactions, formalizing the contract between a lender and a borrower. This template outlines critical terms, including the loan amount, interest rate, repayment schedule, and conditions for default. The agreement ensures that both parties have a clear understanding of their rights and obligations, providing a legal framework for the transaction. The structure of the lending agreement helps prevent misunderstandings by detailing the terms under which the loan is extended and repaid. It also outlines any collateral requirements, highlighting the lender's right to repossess the asset if the borrower defaults.

Key Elements of the Lending Agreement Template

Understanding the core components of a Lending Agreement Template is essential. These elements typically include:

-

Loan Amount and Interest Rate: Specifies the total amount borrowed and the applicable interest rate. For instance, a loan of $100,000 with an annual interest rate of 5%.

-

Repayment Terms: Defines how and when payments will be made, such as monthly installments over a five-year period.

-

Collateral Provisions: Details any assets pledged as security for the loan, including provisions for collateral repossession.

-

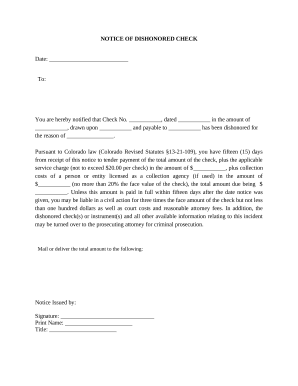

Default Conditions: Outlines circumstances under which the borrower is considered to be in default, like missing payments or failing to meet other contractual obligations.

-

Governing Law: Specifies the jurisdiction's laws that govern the agreement, ensuring legal clarity.

How to Use the Lending Agreement Template

Using the Lending Agreement Template involves several steps to ensure the document meets both parties' needs. First, download the template from a reliable source like DocHub. Once downloaded, review the template to ensure it covers all necessary terms and conditions pertinent to the transaction. Customize the document by inserting specific details, such as the names of the parties, loan terms, and repayment options. It's advisable to consult with a legal expert to ensure the template complies with relevant laws and regulations. After finalizing the details, both parties should sign the agreement using DocHub’s electronic signature feature, making the contract legally binding.

Steps to Complete the Lending Agreement Template

Completing a Lending Agreement Template involves a systematic approach to guarantee accuracy and legal compliance:

-

Review Template: Start by reviewing the template to understand its structure and required information.

-

Input Basic Information: Enter the lender’s and borrower’s names, addresses, and contact details.

-

Define Loan Terms: Specify the loan amount, interest rate, and repayment schedule.

-

Add Collateral Details: If applicable, provide a description of any collateral securing the loan.

-

Set Default Terms: Clearly outline what constitutes a default and repercussions for the borrower.

-

Legal Review: Have a legal professional review the template to ensure it’s complete and complies with state laws.

-

Finalization: Once both parties are satisfied, complete the document with signatures from both the lender and borrower.

Legal Use of the Lending Agreement Template

Lending Agreement Templates must be used in compliance with applicable laws to be enforceable. In the U.S., this means adhering to state-specific lending laws and regulations. These templates should clearly state the governing law, typically based on the lender's location or where the transaction occurs. Legal counsel may be necessary to navigate local laws and ensure the template's enforceability. Additionally, all parties must have the capacity to enter a contract, meaning they are legally able to understand and agree to the terms laid out in the document. This consideration helps prevent future disputes and validates the agreement's legality.

State-Specific Rules for the Lending Agreement Template

Laws around lending agreements can vary significantly by state. For example, some states may have stricter usury laws that cap the interest rate lenders can charge. It's essential to tailor the Lending Agreement Template to address these variations. For instance, California law mandates clear disclosure of terms, while New York imposes constraints on late fees. Consulting with local legal experts ensures the agreement complies with state-specific rules, reducing the risk of invalidation. Understanding state-specific legal restrictions helps parties maintain compliance and uphold the agreement’s validity.

Who Typically Uses the Lending Agreement Template

Lending Agreement Templates are widely used by various entities across different sectors. Banks and financial institutions use them to formalize loans to individuals and businesses. Private lenders, including individuals providing personal loans, also rely on these templates to ensure legal protection. Moreover, business owners securing funds to expand operations might leverage these templates to define terms with investors or partners. The versatility of the lending agreement template makes it a crucial tool for anyone engaged in lending or borrowing activities, ensuring structured and transparent financial transactions.

Important Terms Related to Lending Agreement Template

Several key terms are integral to understanding and utilizing a Lending Agreement Template effectively:

-

Principal: The initial loan amount borrowed, excluding interest.

-

Amortization: The process of spreading payments over multiple periods, typically involving both interest and principal in each payment.

-

Prepayment Penalties: Fees charged if the borrower repays the loan before the due date.

-

Acceleration Clause: A provision that allows the lender to demand immediate repayment if specific conditions, like default, are met.

-

Covenants: Conditions the borrower must adhere to, such as maintaining insurance or meeting financial benchmarks.

Grasping these terms is crucial for understanding the obligations and privileges within a lending agreement, ensuring all parties are aligned with the contract’s stipulations.