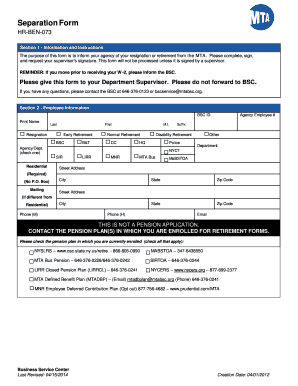

Definition and Meaning

The Form of Detached Assignment for U.S. Small Business Administration Loan Pool or Guaranteed Interest Certificates is a document used for transferring ownership of SBA loan pool certificates or guaranteed interest certificates. This form is crucial in delineating the responsibilities and rights transferred during a sale or reassignment of these financial instruments. It acts as a legal proof of transfer, ensuring that the new owner gains all applicable rights, such as interest payments and principal repayment schedules, under a specified loan pool or guaranteed interest agreement established by the SBA.

How to Use the Form

The form is used to officially document the transfer of SBA loan pool certificates. Here's a step-by-step guide to using it:

-

Identify Parties Involved: Clearly state the names and addresses of both the current and new owners.

-

Describe the Certificates: Include detailed descriptions such as the certificate number, loan pool details, and any other identifiers.

-

Declare Agreement Terms: Specify the terms and conditions under which the transfer is taking place.

-

Authorize Signatures: Acquire signatures from both parties involved to authenticate the document.

-

Submission: Submit the completed form to the designated Fiscal Transfer Agent for official processing.

Steps to Complete the Form

-

Obtain the Form: Request or download the form from the SBA or the designated Fiscal Transfer Agent's website.

-

Fill in Identification Details: Enter the relevant information for both the assignor (the current owner) and the assignee (the new owner).

-

Certificate Details: Provide exhaustive details about the specific certificates being transferred.

-

Declaration: Both parties should declare their consent to the terms and sign the form.

-

Review Compliance: Ensure all details align with SBA regulations.

-

Submission: Submit the form either electronically or via mail as instructed by the Fiscal Transfer Agent.

Key Elements of the Form

- Transferor and Transferee Information: Essential data about both parties involved in the transaction.

- Certificate Details: Specifics of the certificate, including pool number and face value.

- Transfer Terms: Conditions under which the transfer is made.

- Signatures: Legal binding through appropriate signatures.

- Notarization: In some cases, notarization may be required to validate the form.

Who Typically Uses the Form

The primary users of this form are:

- Financial Institutions: Banks and other lenders who engage in the secondary market of SBA loan pools.

- Investors: Individuals or entities purchasing interests in SBA loan pools as investment opportunities.

- Business Owners: Engaging in strategic financial transactions involving SBA-supported loans.

Legal Use of the Form

The form is a legal document used to fulfill regulatory requirements for the transfer of loan pool interests under the U.S. SBA guidelines. It establishes a clear, legally binding transition of ownership, which is critical for maintaining compliance with federal regulations governing SBA loan instruments.

Submission and Filing

Forms can be submitted either through online channels or mailed to the address provided by the Fiscal Transfer Agent. It's important to confirm the preferred submission method before sending the form. Timely submission as per the guidelines is crucial to avoid any discrepancies in the transfer process.

Important Terms Related to the Form

- Loan Pool Certificate: This refers to a security backed by an SBA-guaranteed loan pool.

- Fiscal Transfer Agent: The entity responsible for processing and recording the transfer.

- Assignor: The current holder of the certificate, wishing to transfer it.

- Assignee: The new recipient or buyer of the certificate.

- SBA Compliance: Adhering to regulations set forth by the Small Business Administration.

Eligibility Criteria

To be eligible for a detached assignment, both parties need to be approved by the SBA and meet specific financial stability criteria. The assignor must have clear ownership of the certificate, while the assignee is typically required to prove financial capability to hold and benefit from the certificate’s proceeds.

This configuration presents key aspects of the form, its applications, legal implications, and detailed instructions for successful completion. This ensures that individuals and institutions engaging in these transactions are equipped with the right information for a smooth process.