Definition & Meaning

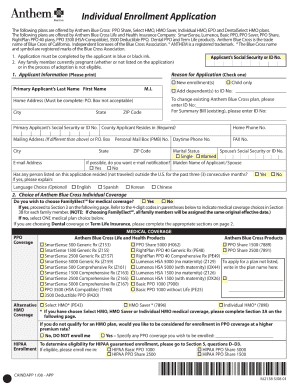

The Section 125 Cafeteria Plan Summary Plan Document (SPD) for Willamette University serves as a comprehensive guide detailing the structure, benefits, and operational procedures of the cafeteria plan. The cafeteria plan is a flexible employee benefit plan that allows participants to choose from a variety of benefits including Health Flexible Spending Accounts (FSA), Dependent Care Assistance, and Health Savings Accounts. By opting for pre-tax dollars to cover eligible expenses, participants can effectively reduce their taxable income, making the plan both a financial and strategic advantage for employees.

Key Elements of the Section 125 Cafeteria Plan SPD

Understanding the key components of the Section 125 Cafeteria Plan SPD is essential for fully leveraging its benefits:

- Health Flexible Spending Accounts (FSA): Allows participants to allocate a portion of their earnings for eligible medical expenses, not covered by insurance.

- Dependent Care Assistance: Provides assistance in managing care expenses for dependents, facilitating continued employment for caregivers.

- Adoption Assistance: Financial support for expenses related to the legal adoption process.

- Premium Reimbursement Arrangements: Enables employees to use pretax dollars to pay for health insurance premiums.

- Health Savings Accounts (HSA): A savings tool for medical expenses that also offers tax benefits, available under high-deductible health plans.

Who Typically Uses the Section 125 Cafeteria Plan SPD

Generally, the Section 125 Cafeteria Plan SPD is utilized by the following groups:

- Employees of Willamette University: Primary users who benefit from the wide range of options provided in the cafeteria plan.

- Human Resources and Benefits Coordinators: Professionals responsible for explaining the plan's benefits and options to employees.

- Financial Planners and Tax Advisors: Experts who provide guidance on maximizing tax savings through eligible pre-tax expenditures.

- Legal Advisors: Professionals who ensure compliance with tax laws and employment regulations concerning cafeteria plans.

Important Terms Related to Section 125 Cafeteria Plan SPD

Understanding key terminology is crucial for navigating the Sections of the Cafeteria Plan effectively:

- Eligible Expenses: Costs that qualify under the cafeteria plan for reimbursement or payment using pre-tax dollars.

- Pre-tax Dollars: Contributions made before tax deductions, which reduce taxable income.

- Plan Year: The 12-month period during which the plan is in effect and benefits are accessible.

- Enrollment Period: The specific window of time when employees can sign up for or make changes to their benefits.

- Qualified Beneficiary: Individuals eligible to receive benefits under the plan, including employees and their dependents.

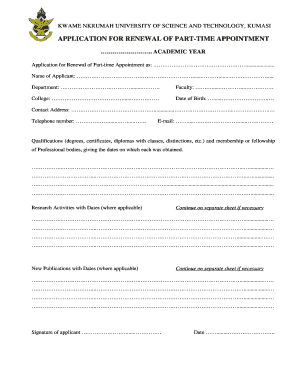

Steps to Complete the Section 125 Cafeteria Plan SPD

Completing the Section 125 Cafeteria Plan SPD involves several critical steps:

- Review Eligibility: Ensure you meet the eligibility criteria set forth by Willamette University.

- Evaluate Options: Examine the benefits and decide which options align best with your personal and financial needs.

- Complete Enrollment: Fill out necessary forms during the enrollment period, making sure to provide accurate information.

- Submit Necessary Documentation: Provide any required supporting documents for validation of dependent status or medical expenses.

- Set Pre-Tax Contributions: Define the amount you wish to allocate for pre-tax benefits such as FSA or HSA contributions.

- Confirmation: Receive confirmation on your benefits selection and review the summary of benefits.

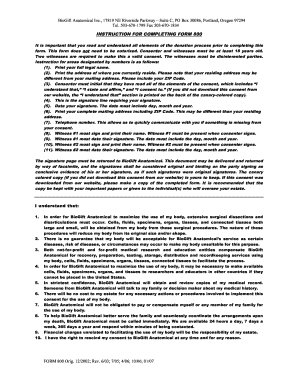

Legal Use of the Section 125 Cafeteria Plan SPD

The legal framework surrounding the Section 125 Cafeteria Plan SPD is pivotal for the plan's correct implementation:

- Compliance with IRS Regulations: The plan must adhere to IRS rules regarding pre-tax contributions and eligible expenses.

- Participant Disclosure Requirements: Adequate disclosure to all eligible employees about plan details and enrollment processes.

- Record-Keeping Practices: Maintenance of accurate records for all transactions and contributions to ensure compliance during audits.

IRS Guidelines

The Section 125 Cafeteria Plan must follow specific IRS guidelines, which govern:

- Non-Discrimination: The plan must be equitable without favoring highly compensated employees.

- Annual Limits: Complying with annual contribution limits set by the IRS for FSA and HSA accounts.

- Eligible Expenses: Adherence to the list of qualifying expenses as outlined by the IRS to ensure approved use of pre-tax dollars.

Filing Deadlines / Important Dates

Participants need to be aware of the following deadlines to maximize benefits:

- Open Enrollment Period: Typically occurs annually, allowing changes or elections in plan participation.

- Claim Submission Deadline: The cut-off date by which claims must be submitted for reimbursement for the plan year.

- Plan Year End: The conclusion of the plan's annual cycle, significant for reconciliation of unused benefits.