Definition and Meaning

A Framework of Analysis for Financial Reporting Reforms in the United refers to a structured approach aimed at evaluating and improving existing financial reporting procedures. This framework is designed to ensure transparency, accountability, and accuracy in financial statements, aligning them with contemporary standards and practices. Financial reporting reforms encompass a variety of guideline updates, procedural enhancements, and systemic changes that aim to address previously identified shortcomings in financial disclosures and reporting methodologies.

Core Objectives:

- Evaluate current financial reporting standards.

- Introduce new methodologies for accurate financial representation.

- Align financial reporting practices with global standards.

Context and Importance:

Such frameworks are essential in light of historical financial scandals and the evolving economic landscape, ensuring ethical and comprehensive financial declarations. By addressing the limitations of past practices, they offer a pathway to restore trust in financial reporting.

Key Elements of the Framework

The core components of this analytical framework include detailed guidelines on financial document preparation, adherence to compliance standards, and updates on regulatory changes. These elements form the backbone of any legitimate reform in financial reporting within the United and are crucial for the integrity of economic data.

Main Elements:

- Compliance Standards: Updated protocols to ensure legal and ethical consistency in financial reporting.

- Regulatory Changes: Adaptation to evolving laws to maintain congruence with national and international regulations.

- Documentation Guidelines: Specific instructions on how to accurately present financial data.

Importance of Each Element:

These components not only streamline the reporting process but also reduce errors and potential fraudulent activity, enhancing the reliability of financial reports.

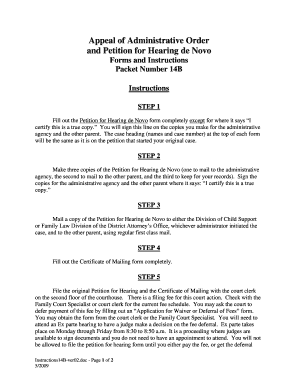

Steps to Complete the Framework

To effectively utilize A Framework of Analysis for Financial Reporting Reforms in the United, thorough steps must be undertaken to complete and implement the process. The steps involve evaluation, planning, execution, and review procedures to ensure successful adoption.

Detailed Steps:

- Initial Assessment: Evaluate existing financial reporting practices.

- Gap Analysis: Identify discrepancies between current practices and proposed reforms.

- Strategic Planning: Develop a roadmap to close the identified gaps.

- Implementation: Roll out the new practices across financial departments.

- Monitoring and Review: Continuously assess the effectiveness of the reforms and make adjustments as necessary.

Practical Scenario:

Incorporating a technological platform that automates compliance checks to minimize manual errors and streamline the reporting workflow ensures smoother transitions and reliability in financial disclosures.

Who Typically Uses the Framework

The framework is primarily utilized by finance professionals, accountants, auditors, and regulatory bodies within the United who are responsible for preparing, reviewing, or overseeing financial reports.

Users Include:

- Accountants: To ensure adherence to the latest reporting standards.

- Auditors: For verifying the accuracy and compliance of financial documents.

- Regulatory Authorities: To ensure that financial institutions meet legal requirements.

Importance for Each User Group:

These entities rely on the framework to achieve precise, trustworthy financial reporting, which is fundamental for maintaining the credibility of financial institutions.

Legal Use and Compliance

Ensuring legal compliance is a critical aspect of A Framework of Analysis for Financial Reporting Reforms in the United. The framework outlines the legal precedents and requirements essential for legitimate financial reporting.

Legal Considerations:

- Regulatory Compliance: Adhering to current legislative requirements.

- Ethical Standards: Following prescribed ethical guidelines to prevent fraud.

- Audit Trails: Maintaining comprehensive records to facilitate audits and reviews.

Impact of Non-Compliance:

Non-compliance can lead to significant penalties, legal repercussions, and damaged reputations for individuals and organizations, emphasizing the importance of adhering to the framework.

Important Terms Related to the Framework

Understanding the terminology associated with financial reporting reforms is crucial for effective utilization of the framework. These terms include specific jargon and technical references integral to financial documentation.

Key Terms:

- Deregulation: The reduction of regulatory constraints in financial markets.

- Neoliberal Policies: Strategies favoring free-market capitalism, often linked to deregulation and corporate freedom.

- Sarbanes-Oxley Act: A U.S. federal law enacted to enhance corporate governance and financial disclosure, often referenced in discussions of reform.

Contextual Relevance:

Familiarity with these terms ensures accurate interpretation of regulations and guidelines, which is essential for implementing reforms effectively.

Examples of Using the Framework

Practical examples are beneficial in understanding how A Framework of Analysis for Financial Reporting Reforms in the United is applied in real-world situations.

Scenario 1: Addressing Financial Scandals:

Using the framework to detect and rectify loopholes that led to financial malpractices by corporate executives, thus preventing future misconduct and restoring stakeholder trust.

Scenario 2: Enhancing Public Companies’ Reporting:

Incorporating reforms to align with Sarbanes-Oxley requirements, ensuring public companies offer transparent and truthful financial information, increasing investor confidence.

Digital vs. Paper Versions

In the digital era, the mode of implementing A Framework of Analysis for Financial Reporting Reforms in the United often contrasts between traditional paper-based systems and modern digital solutions.

Comparison:

- Digital Version: Offers real-time updates, enhanced accessibility, and greater efficiency in processing and analysis.

- Paper Version: Provides a tangible, though less dynamic, method of record-keeping, with challenges in timely updates and data management.

Benefits of Digital Implementation:

Transitioning to digital platforms allows for seamless integration with existing technologies and reduces administrative burdens, enhancing the efficiency of financial reporting reforms.