Definition and Application of Heather Noyes, CFP

Heather Noyes, CFP (Certified Financial Planner), represents a professional designation awarded to individuals who have met specific education, examination, experience, and ethics requirements prescribed by the Certified Financial Planner Board of Standards in the United States. CFP professionals are known for their comprehensive understanding of financial planning principles, including investment advice, tax planning, retirement savings, estate planning, and insurance. The credential is recognized and respected for its rigorous training and ethical standards, making it a trusted designation among financial advisors.

Comprehensive Role and Responsibilities

- Holistic Financial Planning: Heather Noyes, CFP, engages in creating and maintaining comprehensive financial strategies that align with clients' personal goals and financial situations.

- Investment and Portfolio Management: Advising clients on investments in accordance with risk tolerance and financial objectives, ensuring diversified and strategically managed portfolios.

- Retirement Planning: Assisting clients in preparing for retirement by projecting future income needs and proposing appropriate retirement savings strategies.

- Tax Optimization: Utilizing knowledge of tax laws to recommend strategies that minimize liabilities and maximize tax-efficient returns.

Ethical Obligations and Standards

- Fiduciary Commitment: Acting in the best interest of clients by prioritizing their financial well-being over personal gain.

- Continuing Education: Maintaining the CFP designation requires continuous learning to stay updated on the latest financial strategies and regulatory changes.

Steps to Engage a Heather Noyes, CFP

Initial Consultation and Assessment

- Identify Needs and Goals: Define personal financial goals, including retirement planning, investment strategies, and risk management needs.

- Research and Select a CFP: Evaluate potential financial planners based on their experience, specialization, and client reviews.

- Schedule a Consultation: Arrange an initial meeting to discuss financial goals, potential strategies, and how Heather Noyes, CFP can assist in achieving these objectives.

Developing and Implementing a Financial Plan

- Data Gathering and Analysis: Providing personal financial data for analysis allows Heather Noyes, CFP, to understand the current financial situation.

- Plan Design: Collaborate on designing a tailored financial plan, which includes strategies for investments, retirement, insurance, and estate planning.

- Execution: Work with CFP to implement the financial plan, making adjustments as necessary to align with changing life circumstances and market conditions.

Ongoing Monitoring and Adjustments

- Regular Reviews: Conduct periodic reviews to evaluate the performance of financial strategies and make adjustments based on market changes or shifts in personal goals.

- Adaptation to Life Changes: Incorporate major life events, such as marriage, birth, or career changes, into the financial plan to ensure continued relevance and effectiveness.

Why Engage a Heather Noyes, CFP

Expertise and Experience

- Heather Noyes, CFP, demonstrates extensive knowledge in comprehensive financial planning, providing peace of mind and confidence for clients unsure of navigating complex financial landscapes.

- The CFP certification is a mark of credibility, reflecting adherence to stringent professional standards and ethical practices.

Client-Centric Approach

- A commitment to understanding client needs and pursuing strategies that align with long-term financial goals distinguishes the CFP professional.

- Access to an array of financial products and strategies enables Heather Noyes, CFP, to offer diversified solutions tailored to individual client scenarios.

Peace of Mind and Future Security

- Engaging a CFP professional aids in mitigating financial risks, optimizing investment returns, and achieving financial goals efficiently and effectively.

- Regularly updated planning strategies help clients navigate tax liabilities, political changes, economic fluctuations, and personal circumstances.

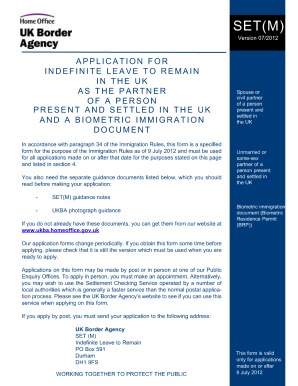

Legal Considerations and Compliance

Regulatory Standards

- CFP professionals, like Heather Noyes, are bound by fiduciary duty, ensuring that client interests are prioritized in every recommendation and strategy.

- Compliance with federal and state financial regulations is mandatory, safeguarding clients against unethical practices.

Confidentiality and Data Protection

- Adherence to strict confidentiality standards guarantees the protection of sensitive client information and prevents unauthorized disclosure.

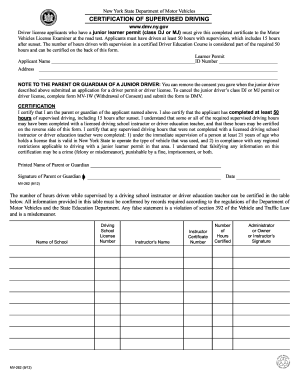

Required Documents for Financial Planning with Heather Noyes

Personal Financial Statements

- Income Documentation: Pay stubs, tax returns, or other documentation verifying current income levels.

- Assets and Liabilities: Statements detailing investment portfolios, properties, and liabilities, such as loans or credit card debts.

Legal and Financial Paperwork

- Insurance Policies: Copies of current insurance agreements for evaluation and integration into financial planning.

- Estate Planning Documents: Wills, trusts, powers of attorney, and anything related to estate management are crucial for comprehensive planning.

Continuous Update of Documentation

- Keep financial documents updated and provide them regularly to Heather Noyes, CFP, ensuring accurate and relevant financial planning.

Digital vs. Traditional Financial Planning Methods

Advancements in Technology

- Digital financial planning tools allow clients to access their financial plans online, with real-time updates and analysis.

- Heather Noyes, CFP, may utilize software for accurate planning, benchmarking tools, and digital communication channels for ease of access and improved client collaboration.

Benefits of Traditional Approaches

- Face-to-face interactions provide personalized experiences and deeper trust between Heather Noyes, CFP, and clients.

- While digital methods are convenient, the personal rapport established in traditional consultations can enhance understanding and comfort levels.

Selecting Heather Noyes, CFP, involves considering both digital and traditional methods for a comprehensive financial planning experience tailored to individual client preferences.