Definition and Meaning

The phrase "We, the Federal National Mortgage Association (Fannie Mae), will issue the" refers to a formal declaration made by Fannie Mae in the context of issuing financial securities, such as mortgage-backed securities (MBS) or other financial instruments. Fannie Mae is a government-sponsored enterprise that aims to expand the secondary mortgage market by securitizing mortgage loans, thereby increasing the availability and affordability of housing finance in the United States. This statement often appears in official documents like prospectus supplements, which detail the specifics of the financial instruments being offered.

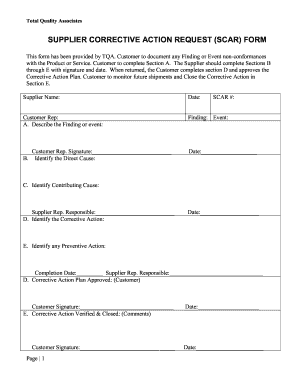

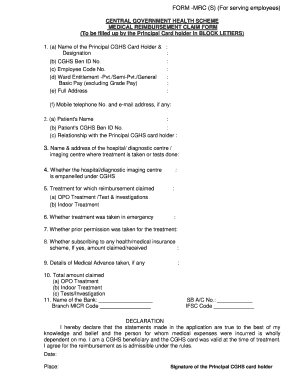

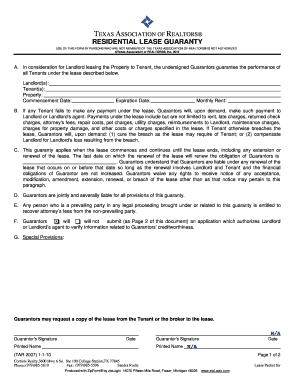

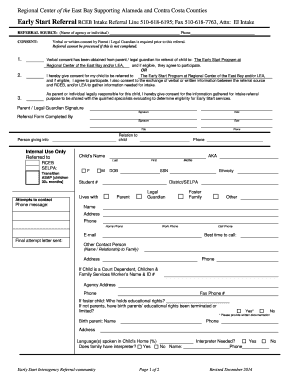

How to Use the Form

Using the form related to the issuance declaration involves understanding the financial instruments Fannie Mae is offering. For investors, this means reviewing the prospectus, understanding the security structure, payment terms, and assessing the risk factors outlined. This document informs the investment decision-making process and ensures compliance with the financial market's regulatory requirements.

Detailed Review Process

- Prospectus Analysis: Investors should begin by thoroughly reading the prospectus supplement, focusing on the description of the securities, payment structures, and risk factors.

- Consultation with Financial Advisors: Engaging with financial experts can provide insights into the potential benefits and risks involved with these financial instruments.

- Understanding Risks: It's crucial to evaluate market conditions and specific investment risks detailed in the prospectus to align investment decisions with financial goals.

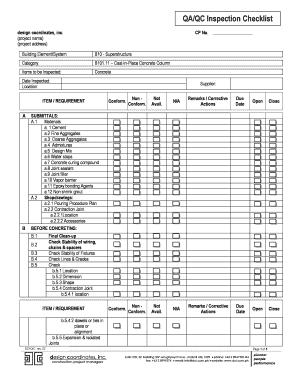

Steps to Complete the Form

Completing associated forms related to Fannie Mae's issuance typically involves a series of steps, each designed to ensure that all necessary information is accurately captured and regulatory requirements are met.

Step-by-Step Instructions

- Review the Document: Start by reading all sections of the form to ensure you understand each requirement.

- Gather Required Information: Collect necessary personal, financial, and related data points that the form requests.

- Fill in the Form: Enter all required information carefully, ensuring accuracy and completeness.

- Verify Accuracy: Double-check all entries to prevent errors which could result in processing delays.

- Submit the Form: Follow submission instructions, whether through an online portal, via mail, or in person, as specified in the document.

Who Typically Uses the Form

The form is primarily used by investors, financial analysts, and portfolio managers who are considering investing in Fannie Mae's financial products. It may also be employed by financial institutions, such as banks and mortgage lenders, which engage in secondary mortgage market activities.

User Profiles

- Institutional Investors: These include insurance companies or pension funds that manage large-scale investments and need detailed financial product information to diversify their portfolios.

- Individual Investors: More sophisticated individual investors might use this form to explore potential investments in mortgage-backed securities.

- Financial Advisors: Professionals guiding clients on investment choices would leverage the information contained within for strategic planning.

Key Elements of the Form

This document outlines several critical aspects that parties need to consider before proceeding with any associated transactions.

Essential Components

- Financial Structure: Details about the securities being issued, including MBS series, classes, and associated financial complexities.

- Legal and Risk Disclosures: Information on risk factors and legal language necessary for compliance with securities laws.

- Payment Terms and Conditions: Specifies how and when payments will be made to the certificate holders.

Legal Use of the Form

The legal use involves adhering to guidelines set forth by the Securities and Exchange Commission (SEC) and other regulatory bodies. It serves as an official declaration of issuance, which must be conducted within the confines of applicable financial and securities laws.

Adherence to Regulations

- Regulatory Compliance: All elements in the form must meet SEC standards for transparency and disclosure.

- Legal Disclaimers: It provides necessary legal disclaimers to protect both the issuer and the investor, ensuring clarity and transparency in securities transactions.

State-Specific Rules

While Fannie Mae's issuance is federally regulated, there might be state-specific considerations that impact how securities are marketed and sold within particular jurisdictions.

Considerations by State

- State Tax Implications: Investors should be aware of how state taxes might impact their returns.

- Local Investment Laws: Certain states may have additional requirements or restrictions on securities trading.

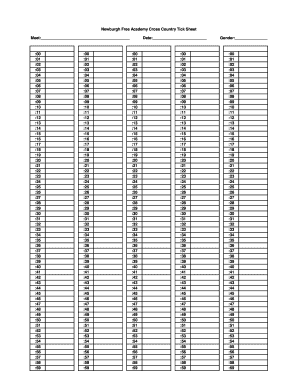

Filing Deadlines and Important Dates

The timing associated with the issuance form is critical, both for compliance and strategic investment reasons.

Critical Deadlines

- Offering Date: The date on which the securities are officially offered to investors.

- Closing Date: The deadline by which all purchases must be completed.

- Settlement Dates: Specific dates when transactions must be finalized and payments transferred.

Understanding and adhering to these deadlines ensures that all parties involved in the transaction meet legal and regulatory obligations, while also capitalizing on timely investment opportunities.