Definition and Meaning of CtnbyDescent

CtnbyDescent refers to a document or form used for legal purposes related to citizenship or nationality by descent. It typically involves verifying and presenting documentation that supports a claim to citizenship based on the birth or nationality of one's parents. This form serves as a crucial piece of evidence in asserting rights under the citizenship laws of a particular country. Understanding the specifics of its purpose and application can provide clarity in navigating the processes of citizenship affirmation or application.

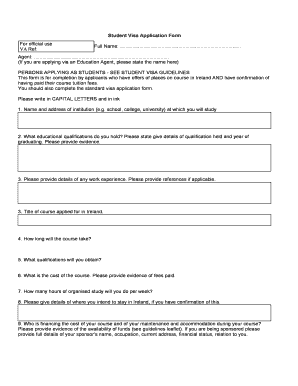

How to Use the CtnbyDescent

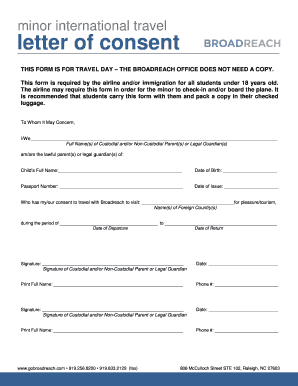

Using the CtnbyDescent form requires gathering appropriate evidence and documentation that supports your claim to citizenship by descent. Key steps include identifying the form's requirements, collecting birth or nationality records of both yourself and the qualifying parent, and providing any additional evidence of legal relationship. It's essential to follow the form's instructions carefully to ensure that all sections are accurately and fully completed. The form may need to be submitted along with supporting documents to relevant government authorities or agencies responsible for citizenship matters.

How to Obtain the CtnbyDescent

Obtaining the CtnbyDescent form involves requesting it from the appropriate government office or official website. In most cases, this form can be accessed online through the citizenship or nationality department of the country in question. You might need to create an account on an official portal to download the form or request a physical copy through mail or in-person visit. Ensure you are accessing the most current version of the form to avoid any processing delays due to outdated information.

Steps to Complete the CtnbyDescent

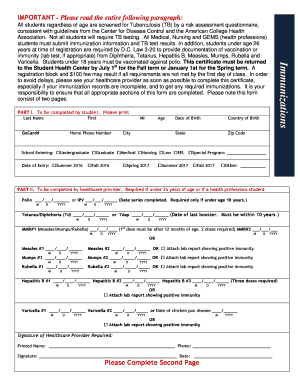

- Gather Required Information: Collect personal details of yourself and your parent(s) related to your claim.

- Prepare Documentation: Assemble necessary supporting documents, including birth certificates, proof of your parents' nationality, and legal documents proving your relationship.

- Complete the Form: Fill out the form with precise information, ensuring each section is addressed.

- Review for Completeness: Double-check that all information and supporting documents are accurate and complete.

- Submit the Form: Depending on the form's instructions, submit it online, through mail, or in person to the designated office.

Completing the form accurately is critical, as errors or missing information could lead to delays or rejection.

Key Elements of the CtnbyDescent

The CtnbyDescent form includes several critical elements, such as:

- Applicant's full name and birth details

- Parent's nationality details and citizenship documents

- Evidence of legal relationship (birth or adoption certificates)

- Signature and attestations by a legal authority or recognized notary

Each element must be filled with accuracy, supporting your claim to citizenship by descent.

Important Terms Related to CtnbyDescent

Familiarity with important terms can help in thoroughly understanding and accurately completing the form. These terms may include "jus sanguinis" (right of blood), which refers to the principle of nationality law in which citizenship is not determined by place of birth but by having one or both parents who are citizens of the state. Other terms might include "legal guardian" or "notarized document," which indicate necessary actions or parties involved in the process.

Eligibility Criteria for CtnbyDescent

Eligibility for the CtnbyDescent form typically requires a direct lineage to a citizen, evidenced through birth certificates and nationality documents proving that one or both parents were citizens at the time of birth. Other criteria may include age restrictions, adoption status, and sometimes, residency requirements. It is crucial to verify these conditions to ensure that you meet all criteria before applying.

Penalties for Non-Compliance with CtnbyDescent

Failure to comply with the terms and submission requirements of the CtnbyDescent can lead to several penalties. These may include the rejection of an application, inability to claim citizenship through descent, and potential legal ramifications if false information is submitted. Ensuring compliance with submission deadlines and verification processes mitigates these risks and supports successful documentation of citizenship by descent.

State-Specific Rules for CtnbyDescent

Different states or regions may have specific rules or interpretations regarding the CtnbyDescent form. For instance, certain jurisdictions may have unique requirements for documentation, additional verification processes, or specific forms distinct from the national ones. It is advisable to consult local legal experts or government resources to understand these variants to ensure accurate application and compliance with local regulations.

Comparison: Digital vs. Paper Version of CtnbyDescent

The CtnbyDescent form is often available in both digital and paper versions, each with its own advantages. The digital form allows for quicker processing, easy corrections, and accessible submission from anywhere with internet access. However, certain jurisdictions may still prefer paper submissions, which require physical handling but provide a tangible record for applicants. Understanding the preferred format for submission is essential for compliance and efficiency.

Real-World Examples of Using CtnbyDescent

Consider the case where a person with dual parental citizenship backgrounds applies for their CtnbyDescent in the United States. They might need to present unique documents such as dual birth certificates. Similarly, a person living abroad whose parents are citizens through descent may need to apply from overseas, highlighting the various circumstances and adaptations required for different applications. These examples illustrate the form's practical use in legally documenting citizenship claims.