Definition and Purpose of the Cost Basis Update Form for Noncovered Shares APP70117-04

The Cost Basis Update Form for Noncovered Shares APP70117-04 is a document used by investors, particularly clients of Charles Schwab, to update missing cost basis information for their securities. Cost basis is the original value of an asset for tax purposes, and it is critical for calculating capital gains or losses upon disposal of the asset. This form specifically addresses noncovered shares, which are securities purchased before a specific regulatory requirement for cost basis reporting. The form aids in ensuring accurate tax reporting and financial planning by allowing updates for any missing or incorrect cost basis details of these investments.

Steps to Complete the Cost Basis Update Form

-

Gather Necessary Information:

- Collect all pertinent investment transaction details, including purchase dates, prices, and quantities.

- Acquire relevant account numbers and other identifiers from your Charles Schwab statements.

-

Access and Fill Out the Form:

- Obtain the form from Charles Schwab’s website or request a physical copy from their customer service.

- Enter personal and account information accurately in the provided sections.

-

Specify Securities:

- List the noncovered shares requiring a cost basis update.

- Provide the required details, such as the name of the security, number of shares, and any previous cost basis records.

-

Complete Cost Basis Details:

- Enter any missing cost basis information gathered from your records or brokerage statements.

- If uncertain, consult a financial advisor or tax professional to ensure correctness.

-

Review and Sign:

- Carefully review the filled form for any errors or omissions.

- Sign the form to certify the accuracy of the provided information.

-

Submit the Form:

- Depending on your preference, submit the completed form through Charles Schwab’s online portal, via mail, or at a local branch.

Why Update Cost Basis Information

- Tax Accuracy: Maintaining accurate cost basis information ensures correct calculation of capital gains or losses, affecting tax liability.

- Investment Tracking: Accurate cost basis helps investors track the performance of their investment portfolio over time.

- Preventing Penalties: Providing updated cost basis information can prevent potential penalties or fines due to incorrect tax submissions.

Who Uses the Cost Basis Update Form

- Individual Investors: Particularly those holding noncovered securities needing updated cost information for tax purposes.

- Financial Advisors: Professionals assisting clients with their investment portfolios and tax preparations.

- Tax Preparers: Specialists preparing tax returns who require accurate cost basis data for computations.

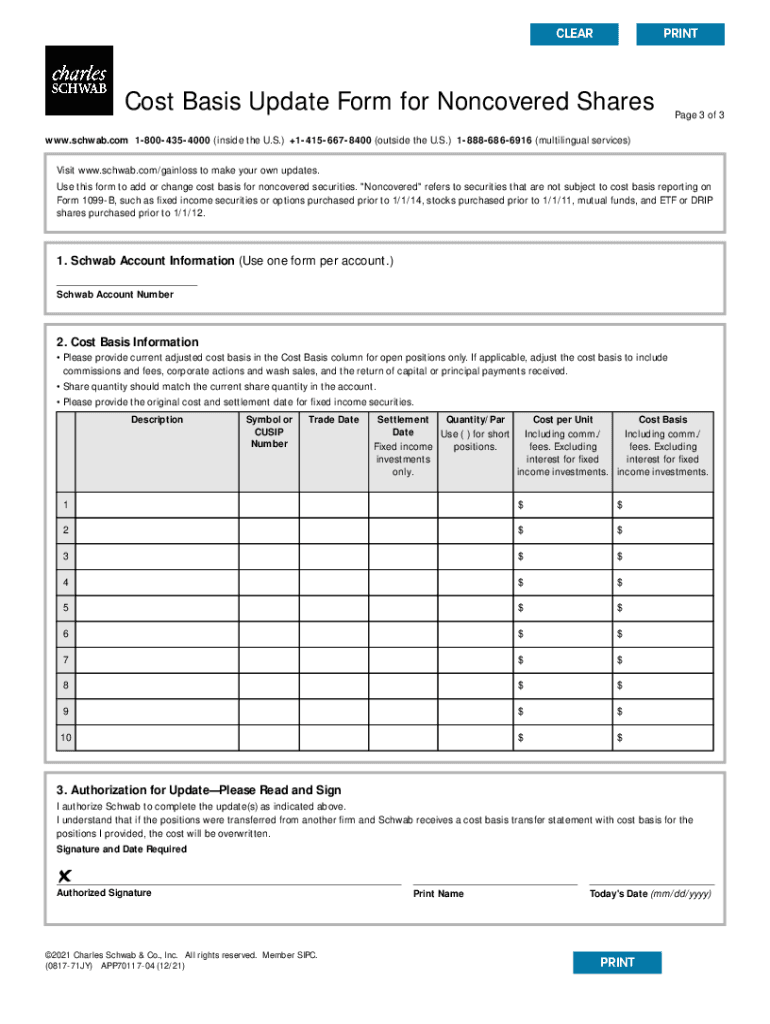

Key Elements of the Form

- Personal Information Section: Captures the necessary details of the investor, such as name and account number.

- Securities Details: Section where investors list the affected securities, their previous and updated cost basis information.

- Signature Line: Includes a mandatory signature field to authenticate the information provided.

Important Terms Related to the Form

- Cost Basis: The original value of an asset for tax calculation, reflecting its purchase price plus associated transaction costs.

- Noncovered Shares: Securities bought before the Broker Reporting Rule for cost basis implementation.

- Capital Gains: Profits realized from the sale of stocks or securities.

IRS Guidelines for Cost Basis Reporting

The IRS mandates accurate reporting of cost basis on tax returns to compute proper capital gains or losses. Noncompliance can lead to penalties, making it crucial to keep updated records through forms like APP70117-04.

Penalties for Non-Compliance

Failure to update and provide accurate cost basis information can result in substantial fines or penalties, including interest on unpaid taxes due to incorrect filings.

Form Submission Methods

- Online: Utilize Charles Schwab’s online portals for efficient and secure form submissions.

- Mail: Mail completed forms to the specified Charles Schwab address for processing.

- In-Person: Submit the form directly at a local Charles Schwab office.

Each section should be comprehensively detailed with practical examples and scenarios to offer comprehensive guidance to the user for maximum utility.