Understanding Northwestern Mutual Terms of Withdrawal

The Northwestern Mutual terms of withdrawal are essential for policyholders seeking to access their funds. These terms outline the processes and conditions under which withdrawals can be made from various types of accounts. Understanding these terms is crucial to avoid penalties and ensure that the withdrawal process aligns with financial goals.

Types of Withdrawals Available

Withdrawals from Northwestern Mutual accounts can generally be categorized into several types:

-

Partial Withdrawals: Policyholders may request a portion of their investment while maintaining the rest of their funds within the account. This option is commonly available in life insurance policies and annuity contracts.

-

Full Withdrawals: This entails withdrawing the entire balance from the account. This may involve surrenders, especially for policies that have accrued value.

-

Loans Against Policy: Policyholders may have the option to borrow against the accrued cash value of their policies. This form of withdrawal does not require immediate repayment, but it may impact the death benefit.

-

Surrenders: When a policyholder opts to terminate their policy or contract, surrendering the account allows them to receive the cash value, minus any applicable surrender charges.

Steps to Withdraw Funds

To withdraw funds from a Northwestern Mutual account, consider the following steps:

-

Review Policy Terms: Understand the specific terms related to your policy to ensure eligibility for withdrawal.

-

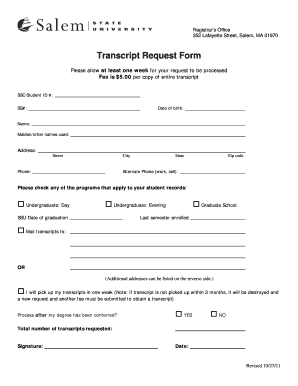

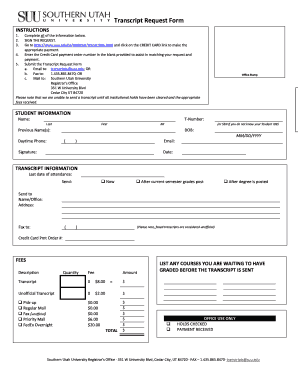

Complete Necessary Forms: Fill out the appropriate forms, which may include the Northwestern Mutual withdrawal form or surrender form, depending on the type of withdrawal.

-

Submit Documentation: Send the completed forms to your Northwestern Mutual representative or through their online portal, if available.

-

Await Processing: After submitting your request, there may be a processing period. Ensure to follow up if you do not receive confirmation.

-

Receive Funds: Funds are typically distributed via check or direct deposit, depending on the preference indicated in the forms.

Important Considerations for Withdrawals

When considering withdrawals, it is vital to be aware of several key factors:

-

Tax Implications: Withdrawals, especially from annuities and life insurance policies, can have tax consequences. Ensure to consult with a tax advisor to understand potential impacts on your overall tax liabilities.

-

Surrender Charges: Full withdraws or surrenders may incur charges based on the policy terms. This could significantly affect the amount received.

-

Impact on Benefits: Withdrawals may reduce future benefits, such as the death benefit in life insurance policies. Assess how the withdrawal will affect long-term financial planning.

-

Annual Limitations: Some policies may have restrictions on the frequency and amount of withdrawals. Review the annual limits specified in the terms.

Forms Related to Withdrawals

Several forms are associated with withdrawing funds from Northwestern Mutual accounts:

-

Northwestern Mutual Withdrawal Form: This form is used for requesting partial or full withdrawals from life insurance and annuity accounts.

-

Northwestern Mutual Surrender Form: Required when terminating a policy and accessing the full cash value.

-

Northwestern Mutual 1035 Exchange Form: If transferring funds to another insurance product, this form enables tax-free exchanges under IRS regulations.

-

Northwestern Mutual IRA Withdrawal Form: Specifically used for withdrawals from Individual Retirement Accounts maintained with Northwestern Mutual.

Common Issues with Withdrawals

Policyholders may encounter common challenges when requesting withdrawals, including:

-

Incomplete Documentation: Missing information or signatures on withdrawal forms can delay processing times.

-

Eligibility Confusion: Misunderstanding the terms can lead to incorrect withdrawal attempts, potentially incurring penalties.

-

Processing Delays: During high-volume periods, processing requests may take longer than anticipated. It is advisable to submit requests well in advance of needed funds.

Understanding the terms of withdrawal at Northwestern Mutual ensures that policyholders can navigate their financial options effectively. Being informed about the types of withdrawals available, the associated processes, potential implications, and required documentation sets the foundation for a successful withdrawal experience.