Definition and Purpose of 2024 M15 Form

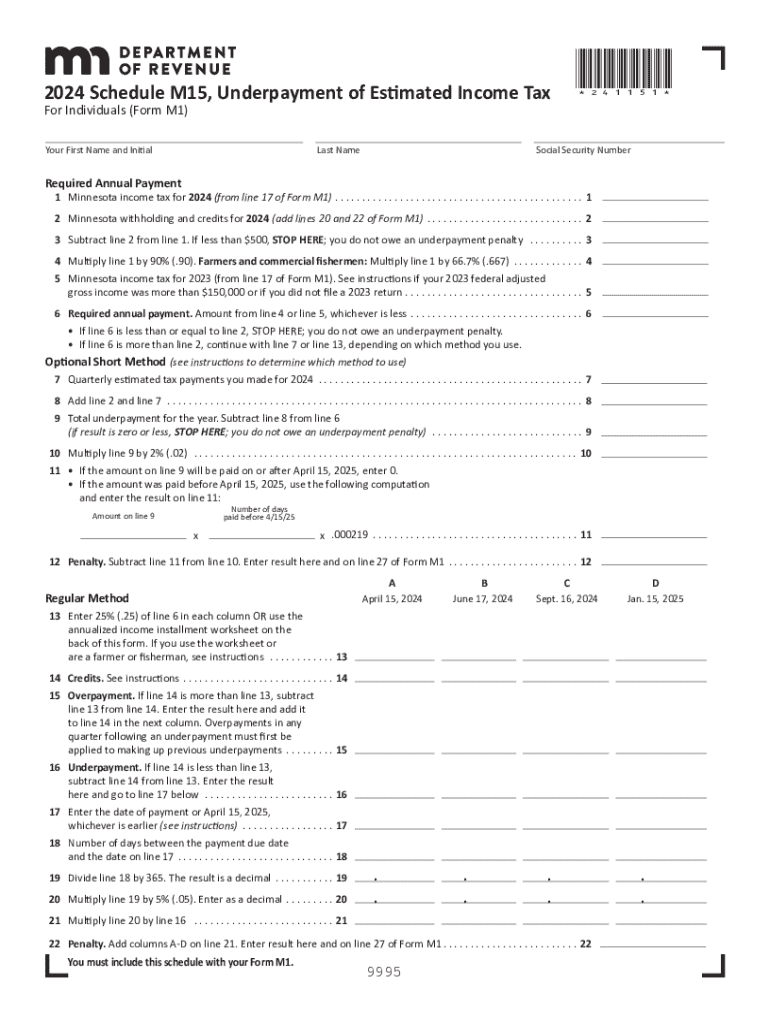

The 2024 M15 form is a crucial document for residents of Minnesota aiming to assess if they owe a penalty for the underpayment of estimated income tax. Specifically designed for individuals, this form serves as a tool to ensure taxpayers meet their annual tax obligations. It helps in calculating the required annual payments and identifying any potential underpayment penalties according to state tax laws.

Key Functions

- Penalty Assessment: Determines if penalties are applicable due to underpayment.

- Payment Calculation: Guides users in computing the estimated annual tax payments.

- Exemption Clarification: Allows taxpayers to claim exceptions to avoid penalties, particularly relevant for farmers and commercial fishermen.

Steps to Complete the 2024 M15 Form

Filling out the 2024 M15 form involves a series of detailed steps. Following these steps ensures completeness and accuracy, which are vital to meeting tax requirements and avoiding penalties.

- Gather Necessary Documents: Before you begin, collect all relevant financial documents, including previous year's tax returns and records of any payments made during the current year.

- Calculate Estimated Tax: Use the enclosed instructions to determine your estimated tax for the year accurately. Consider any credits or prior payments to get a precise number.

- Complete the Calculation Section: This involves entering data on estimated payments made quarterly, annual tax liabilities, and any overpayments from the previous year that might apply to the current year.

- Check for Special Situations: Identify if you qualify for any exceptions or reduced penalty guidelines, such as those for farmers or fishermen.

- Submit the Completed Form: Once all sections are completed, verify each entry's accuracy, then ensure timely submission either electronically or via mail.

Tips for Accuracy

- Double-check all numeric entries.

- Ensure that any mathematical calculations are accurately completed.

- Regularly consult official guidelines to stay updated on potential deductions or credits.

Legal Use and Compliance

The 2024 M15 form complies with Minnesota state laws regarding income tax payment. Proper usage of this form is significant for avoiding penalties and interest associated with late or insufficient tax payments.

Legal Considerations

- Compliance with Minnesota Statutes: The form aligns with legal statutes governing estimated payment requirements.

- Penalty Enforcement: Failure to complete or accurately file the form might result in state-imposed penalties.

- Exemption Support: Offers mechanisms to claim legitimate exemptions and prevent wrongful penalties.

Important Terms and Concepts

Understanding the terminology associated with the 2024 M15 form is essential for accurate completion. Here are several key terms:

- Estimated Tax: Refers to the anticipated amount of state income tax expected at year-end.

- Safe Harbor Rule: Allows taxpayers to avoid penalties if they pay a specified percentage of the previous year's liabilities.

- Quarterly Payment Schedule: The expected timeline for making periodic payments to meet annual estimated tax requirements.

Taxpayer Scenarios

The 2024 M15 form serves various types of taxpayers, addressing unique circumstances that may impact estimated tax payments and accuracy in filling out the form.

Common Taxpayer Profiles

- Self-Employed Individuals: Often face complex income streams and must closely estimate taxable income to avoid penalties.

- Retired Individuals: May have variable income streams from pensions and savings, requiring detailed attention to estimated payments.

- Students: Those with part-time jobs or investments need careful planning to align with tax regulations.

IRS Guidelines and Alignment

While primarily a state form, the 2024 M15 aligns with broader IRS guidelines on estimated tax payments. Coordination between federal and state tax forms is essential for compliance and effective tax management.

Key Considerations

- Federal and State Interaction: Ensure state filings do not conflict with federal returns.

- IRS Safe Harbor Rule: This federal provision protects individuals if certain payment thresholds are met, and understanding its alignment with state rules is crucial.

Filing Deadlines and Important Dates

Being aware of critical filing deadlines ensures compliance and minimizes the risk of penalties associated with late submissions.

Key Dates

- Quarterly Payment Deadlines: Payments are typically due April 15, June 15, September 15, and January 15 of the following year.

- Year-End Finalization: January 15 is usually the due date for final estimated payments.

Required Documents for Filing

Preparing the 2024 M15 form necessitates gathering a selection of supporting documents which aid in accurate calculation and record-keeping.

Essential Documents

- Previous Year's Tax Return: Provides a baseline for current calculations.

- Income Records: Includes documentation from all income sources throughout the year.

- Payment Proofs: Records of taxes paid throughout the year via estimated payments or withholdings.

Penalties for Non-Compliance

Failing to comply with the 2024 M15 requirements can result in penalties. Understanding these penalties motivates timely and accurate action.

Penalty Details

- Underpayment Penalty: A charge based on how much owed taxes exceed what was paid.

- Interest Charges: Additional financial costs due to late or insufficient payments.

Understanding the intricacies of the 2024 M15 form and following each step meticulously helps ensure compliance with Minnesota state tax law, avoiding unnecessary penalties and securing financial peace of mind.