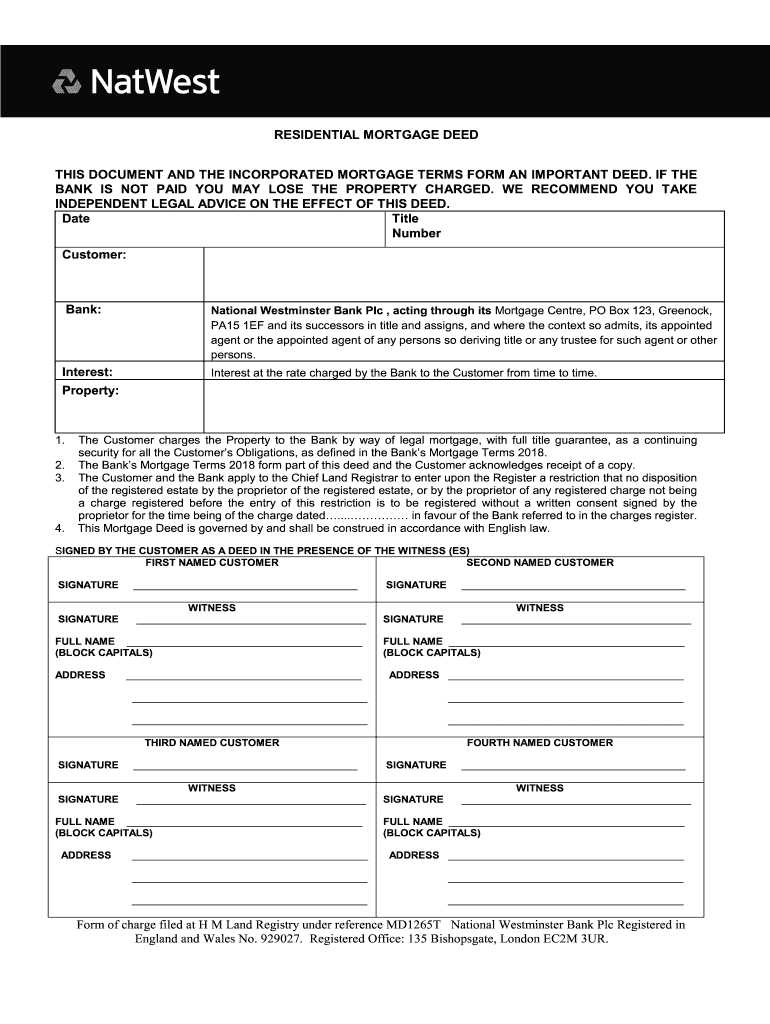

Definition and Meaning of the NatWest Mortgage Deed

The NatWest mortgage deed is a legal document executed between the borrower and National Westminster Bank Plc, establishing a mortgage loan agreement. It outlines the terms under which a property is used as collateral for a loan. The mortgage deed specifies the borrower's obligations to repay the loan and the rights of the lender, particularly in the event of default.

Key Components of the Mortgage Deed

- Borrower Identification: Details regarding the mortgagor, including names and addresses.

- Property Description: A comprehensive description of the property being mortgaged, often including its title number.

- Loan Amount and Terms: Specifies the total loan amount, interest rate, and repayment schedule.

- Rights of the Lender: Outlines the legal rights the lender possesses, such as the right to repossess the property in case of default.

- Occupier's Consent: If there are other occupants of the property, their consent is usually required, ensuring they understand their rights and obligations under the mortgage deed.

Understanding these components is essential for both parties involved to ensure compliance and clarity in the mortgage process.

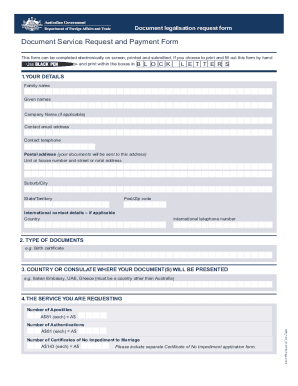

How to Obtain the NatWest Mortgage Deed

Acquiring a NatWest mortgage deed involves a few strategic steps, often initiated during the mortgage application process.

-

Mortgage Application Submission:

- Apply for a mortgage through NatWest, providing necessary documentation such as income verification and credit history.

-

Approval Process:

- Once your application is reviewed and approved, NatWest will prepare the mortgage deed, which outlines the specific terms and conditions.

-

Review and Signing:

- Review the mortgage deed carefully. Seek independent legal advice if necessary. Ensure all details are accurate before signing.

-

Document Retention:

- After signing, obtain a copy of the completed NatWest mortgage deed for your records. It is crucial for reference throughout the mortgage term.

By following these steps, borrowers can effectively secure their mortgage deed without unnecessary complications, ensuring that all parties fully understand their obligations.

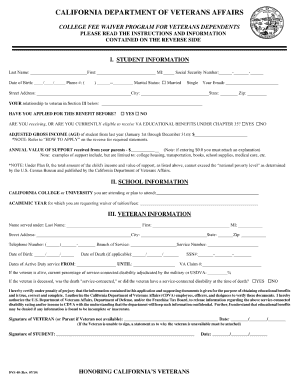

Steps to Complete the NatWest Mortgage Deed

Completing the NatWest mortgage deed requires attention to detail and compliance with legal standards.

-

Gather Required Documentation:

- Collect personal identification, proof of income, and details regarding the property to be mortgaged.

-

Complete the Mortgage Application:

- Fill out the mortgage application provided by NatWest, ensuring to provide accurate and honest information.

-

Review Loan Terms:

- Understand the loan terms, including the interest rate, repayment schedule, and consequences of default.

-

Sign the Deed:

- Once finalized by NatWest, sign the mortgage deed in the presence of a witness to make it legally binding.

-

Store Documentation Safely:

- Keep your signed mortgage deed in a secure location, as it may be required for future reference during the repayment period or legal queries.

This structured approach not only ensures compliance but also protects the interests of the borrower throughout the mortgage process.

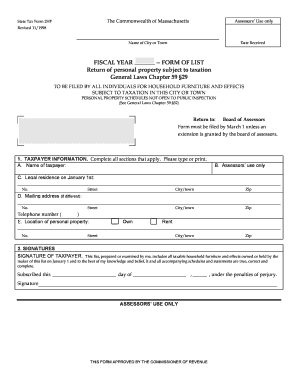

Important Terms Related to the NatWest Mortgage Deed

Understanding key terminology associated with the NatWest mortgage deed is crucial for clarity in the mortgage process.

- Principal: The original sum of money borrowed, which must be repaid along with interest.

- Interest Rate: The amount charged as a percentage of the principal for borrowing the money.

- Default: Failure to repay the mortgage according to the terms of the deed, which may result in foreclosure.

- Transfer of Title: The legal process of transferring ownership of the property from the borrower to the lender in case of default.

- Equity: The value of the owner's interest in the property after deducting any outstanding liability on it.

These terms serve as the foundation of understanding the implications, rights, and responsibilities tied to a NatWest mortgage deed.

Legal Use of the NatWest Mortgage Deed

The legal enforceability of the NatWest mortgage deed is significant in protecting both the lender and the borrower’s interests.

- Binding Contract: Once signed, the mortgage deed acts as a legally binding contract, obligating the borrower to comply with the repayment terms.

- Prioritization of Claims: In the event of liquidation, the mortgage deed secures the lender's rights, allowing them to claim the property over unsecured creditors.

- Regulatory Compliance: The mortgage deed must adhere to local and federal regulations governing real estate financing, ensuring legality and legitimacy.

The legal framework surrounding the NatWest mortgage deed is structured to promote safe lending practices and uphold borrowers' rights within a regulated environment. Ensuring compliance with legal standards is indispensable in preventing disputes throughout the mortgage term.