Definition and Purpose of the Vermont Department of Taxes Form

The Vermont Department of Taxes form, specifically the 8821-VT, serves as a critical document that authorizes the release of a taxpayer's information to an authorized recipient. Unlike a power of attorney, this form exclusively permits the disclosure of tax-specific details without granting any authority for the recipient to act on the taxpayer's behalf. It is essential for taxpayers who need to share their tax information with third parties, such as accountants or tax advisors, while maintaining control over their tax affairs. This form is particularly useful for individuals and businesses seeking to streamline their tax management and ensure the proper handling of sensitive information.

How to Obtain the Vermont Department of Taxes Form

To obtain the Vermont Department of Taxes form, taxpayers can visit the Vermont Department of Taxes website, where forms are typically available for download. Alternatively, the form can be requested from a local tax office in Vermont. It is advisable to ensure that the form being used is the current version, as tax forms are subject to updates and changes. Taxpayers can also find the form in tax software packages if the Vermont Department of Taxes provides such compatibility. Engaging with a tax professional is another method to obtain the form, especially useful for individuals uncomfortable with navigating tax-related websites.

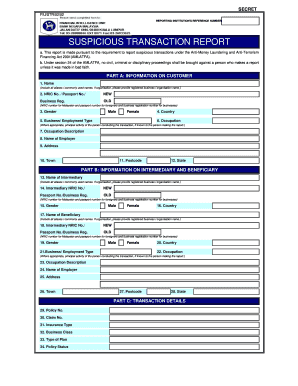

Steps to Complete the Vermont Department of Taxes Form

-

Personal Information: Enter the taxpayer's full name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) in the designated fields.

-

Authorized Recipient Details: Fill in the contact information of the person or entity authorized to receive the tax information. This includes their name, address, and contact number.

-

Scope of Authorization: Specify the type of tax information and the tax periods the authorization covers. Be precise about what information the recipient is authorized to access.

-

Duration and Revocation Instructions: Indicate the duration of the authorization and familiarize yourself with the process to revoke authorization, which is detailed on the form.

-

Signatures: The taxpayer or taxpayers must sign the form to legitimize it. Some forms may require notarization, so verify if that is a requirement for 8821-VT.

-

Submit the Form: Once completed, ensure the form is submitted to the appropriate Vermont tax department address or electronically if such options are available.

Key Elements of the Vermont Department of Taxes Form

- Taxpayer Information: Providing correct personal identifiers such as SSN or EIN is crucial for the form’s validity.

- Recipient Details: Accurate information about the recipient ensures the tax data is shared with the intended party.

- Type and Period of Taxes: Clearly articulated sections cover which taxes and periods the authorization includes.

- Instructions for Revocation: This part of the form is essential for taxpayers wishing to withdraw authorization.

Legal Use of the Vermont Department of Taxes Form

Usage of the 8821-VT form must comply with Vermont tax laws and regulations. The form should not be used to grant powers of attorney or any rights beyond what it explicitly authorizes. Misuse of the form, such as unauthorized sharing of personal tax information, could result in legal penalties or fines. Taxpayers should remain diligent about the legislations applicable to tax form authorizations to avoid inadvertently breaching state tax codes.

Filing Deadlines and Important Dates

Filing deadlines associated with the Vermont Department of Taxes forms align with the tax cycles for the types of taxes specified within the authorization scope. Although not a filing form by itself, the timing of the 8821-VT should coincide with the periods of tax assessments or disputes if it relates to ongoing matters. It is advisable to submit or update this form well ahead of any critical state tax filing deadlines to ensure continuity of data access and prevent delays in tax resolutions.

Penalties for Non-Compliance

Non-compliance with Regulations | Consequences

- Inaccurate Information: Filing a form with incorrect details can invalidate the authorization and may necessitate re-filing.

- Unauthorized Use: Allowing unauthorized third-party access to tax information can lead to investigations and potential fines.

- Missed Deadlines: Failing to update authorization or submit the form might delay tax processes or lead to loss of opportunity to delegate tax management effectively.

Digital vs. Paper Version of the Form

The choice between digital and paper versions of the Vermont Department of Taxes form relies on taxpayer preference and convenience. Digital forms can be completed and submitted online, offering speed and efficiency, particularly in urgent situations. Paper forms, while traditional, provide a tangible record that some individuals or entities might prefer for archival purposes. Ensuring that both forms comply with submission requirements is necessary to ensure process smoothness. Electronic forms may also offer built-in checks for errors, which is beneficial for accuracy.

Examples of Using the Vermont Department of Taxes Form

- Business Scenario: A Vermont-based LLC needs to authorize its accountant to handle its tax information during an audit. Completing the 8821-VT form specifies access to the necessary tax records without granting the accountant further powers.

- Individual Case: An individual taxpayer seeks to share tax returns with a financial planner for investment advice. The form is used to provide a broad scope of authorization covering multiple tax years.

Through real-world scenarios like these, the utility and applicability of the Vermont Department of Taxes form are evident.