Definition & Meaning

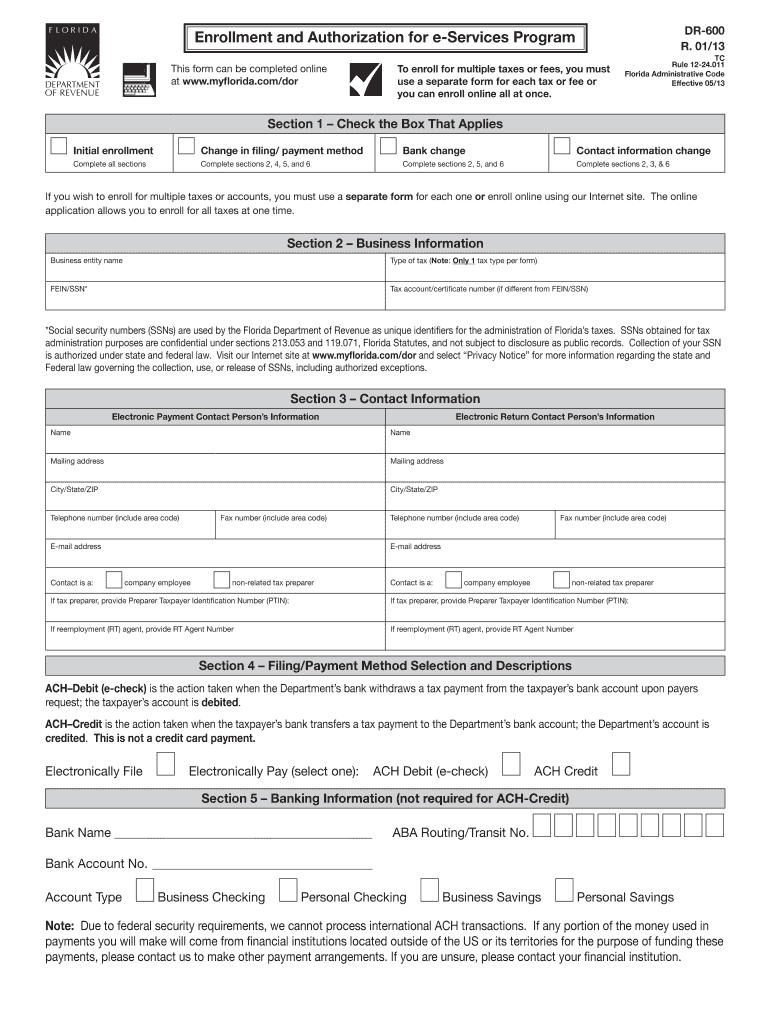

The "Enrollment and Authorization for e-Services Program - Florida" is a formal document used by businesses and individuals to engage with the Florida Department of Revenue's electronic filing and payment system. This process allows users to enroll in various state-managed tax and fee categories, facilitating efficient financial transactions and compliance with state regulations. The program's objective is to streamline the interaction between taxpayers and the Department, fostering a secure and efficient method to manage tax-related responsibilities via electronic access.

The form delineates the necessary procedures for identifying and authenticating participating entities, establishing a secure point of contact for electronic transactions. It plays an essential role in ensuring that participants can securely pay taxes and access other electronic services within Florida's framework, which includes confidentiality measures for sensitive information such as Social Security Numbers.

How to Obtain the Enrollment and Authorization Form

Acquiring the "Enrollment and Authorization for e-Services Program" form is straightforward through the Florida Department of Revenue's official online platform. Users can navigate to the "e-Services Program" section where downloadable PDF versions of the form are available, or they can access digital applications directly.

In instances where internet access may be limited, individuals can also request paper forms via telephone or direct mail to the Department’s service centers. Offering both digital and paper formats ensures inclusivity and accessibility for all potential applicants, accommodating different technological capabilities and user preferences.

Steps to Complete the Enrollment and Authorization Form

Completing the "Enrollment and Authorization for e-Services Program" involves several detailed steps, each ensuring compliance and transparency:

-

Identify the Required Tax Types: Begin by selecting the tax or fee categories relevant to your business or personal needs. This step is crucial for specifying the type of electronic service you'll need guidance and authorization for.

-

Provide Business Information: Fill in the detailed business information, including legal names, addresses, and identifying numbers, ensuring accuracy to avoid future complications in processing.

-

Designate Contact Person: Assign an authorized representative to manage e-Service interactions, including their contact details and any relevant designations like power of attorney, if applicable.

-

Authorize Electronic Transactions: Affirm consent for conducting transactions electronically by agreeing to terms and conditions, completing authentication procedures as proof of consent and accurate representation.

-

Submission and Verification: Submit the form through preferred channels and await confirmation from the Department of Revenue. Verification procedures will follow, sometimes necessitating further information or documentation verification.

Each step ensures participants are authenticated correctly, aligning with authorizations necessary for electronic dealings with the state.

Key Elements of the Enrollment and Authorization Form

The form comprises essential components critical for its successful execution:

- Comprehensive Tax Categories: Details the various tax types available for electronic services, allowing users to select the ones pertinent to their filings.

- Secure Information Handling: Specific fields designed to protect personal and sensitive information, incorporating encryption and confidentiality protocols.

- Authorized Personnel Designation: Allows clear identification and authorization of individuals responsible for handling the e-Services communication.

By addressing every critical component, the form ensures compliance, efficient processing, and secure exchanges between the taxpayer and the Department of Revenue.

Legal Use of the Enrollment and Authorization Form

The form serves as a legally binding agreement between the participant and the Florida Department of Revenue. Compliance with all specified processes and accurate representation in the form is mandated, ensuring all transactions conducted under the authorization are legitimate and adhere to state laws. It is particularly vital for maintaining the confidentiality and integrity of tax information, which is assured through legislative measures incorporated within the agreement.

Important Terms Related to Enrollment and Authorization

Understanding specific terminology is vital for accurately engaging with the "Enrollment and Authorization for e-Services Program":

- e-Services: The suite of digital services offered by the Florida Department of Revenue for tax-related transactions.

- Taxpayer Identification Number (TIN): A unique identifier used in processing electronic service applications.

- Electronic Funds Transfer (EFT): The electronic movement of funds from one account to another, authorized through the e-Services program.

Grasping these terms ensures seamless navigation and understanding of the process.

State-Specific Rules for the Program

Florida's specific regulations govern the "Enrollment and Authorization for e-Services Program," setting standards distinct from federal mandates. These rules include specific eligibility criteria for enrollees, mandatory participation thresholds based on the volume of transactions, and explicit confidentiality practices. Understanding these regulations helps businesses and individuals remain compliant and avoid potential penalties.

Penalties for Non-Compliance

Non-compliance with the terms outlined in Florida's e-Services authorization can result in significant penalties. These may include monetary fines, revocation of electronic service privileges, and potential legal actions for deliberate breaches of confidential tax information. Ensuring adherence to every aspect of the enrollment form and subsequent interactions mitigates risks associated with non-compliance, protecting the integrity of taxpayer engagements with the Department.