Definition and Purpose of Form 500

Form 500, officially recognized as "Authorization to Disclose Tax Information," is a crucial document provided by the North Dakota State Tax Commissioner. It functions as a formal permission slip, granting designated individuals or entities the right to access a taxpayer's confidential tax information. This form is essential for taxpayers who want to authorize a third party to represent them, handle their tax matters, or access their sensitive tax data for specific purposes such as tax preparation, financial counseling, or legal advice.

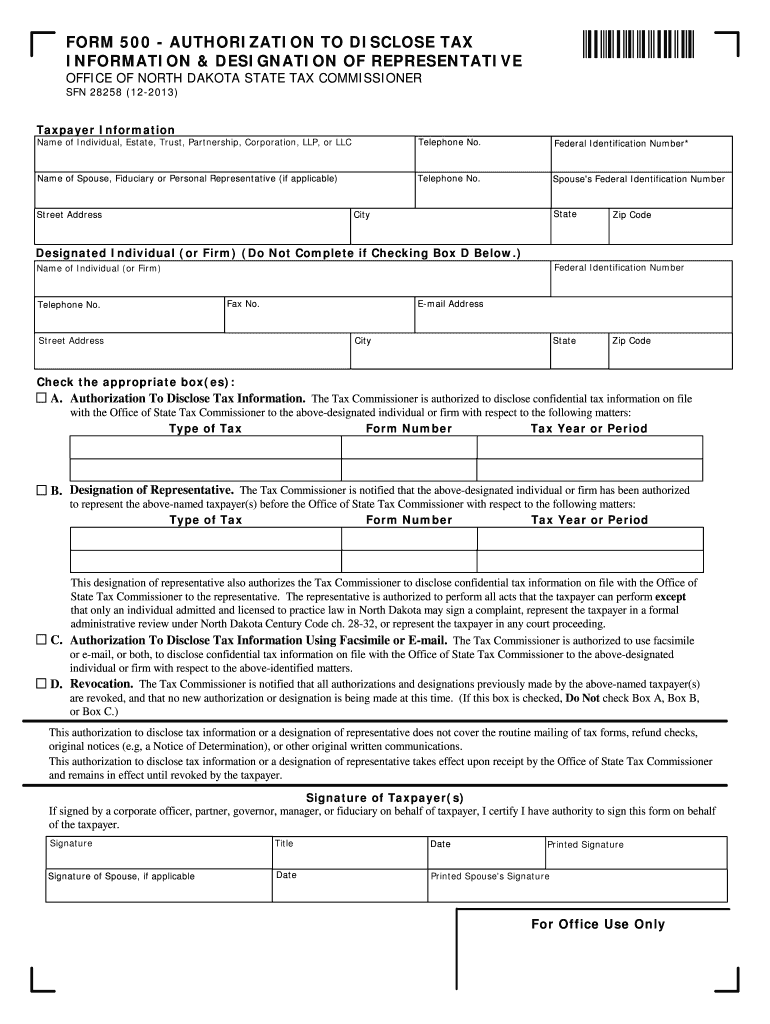

How to Use Form 500

Using Form 500 efficiently involves understanding the step-by-step process of authorization. Taxpayers fill out the form to specify the representative who will have access to their tax details. This involves entering personal information, the representative's details, and the scope of access being granted. It's crucial that taxpayers also specify how their information can be communicated — options might include email, fax, or traditional mail. Clarity in these instructions ensures that their tax information is managed safely and appropriately.

Steps to Complete Form 500

To accurately complete Form 500, follow these steps:

- Enter Taxpayer Information: Fill in personal details such as name, address, and taxpayer identification number for verification.

- Provide Representative Details: Specify the individual's or firm's name and address who will be authorized to access the information.

- Select Disclosure Options: Indicate the information types that can be disclosed and preferred communication methods.

- Sign and Date: Ensure the taxpayer's signature is included to validate the authorization.

- Review and Submit: Double-check all filled information for any inaccuracies before submission.

Key Elements of Form 500

Form 500 comprises several sections that must be accurately filled out:

- Taxpayer Information: Basic personal details of the person granting authorization.

- Representative Details: Information of the designated individual or firm.

- Scope of Authorization: The extent and type of tax information the representative may access.

- Communication Preferences: Chosen methods for sharing information, ensuring secure transmission.

Who Typically Uses Form 500

Form 500 is predominantly used by taxpayers who require professional assistance with tax-related matters. It's commonly employed by:

- Individuals: Seeking help from tax advisors or lawyers.

- Businesses: Delegating tax information management to accountants or financial consultants.

- Legal Representatives: Acting on behalf of clients in managing tax obligations and disputes.

Legal Use and Compliance

Using Form 500 involves specific legal responsibilities. It is vital for taxpayers and their representatives to comply with North Dakota's tax regulations when handling sensitive data. The form outlines the boundaries of authority granted, ensuring representatives do not overstep these permissions. Misuse of this form can have legal repercussions, emphasizing the importance of adhering to the outlined legal framework.

Examples of Using Form 500

Consider practical scenarios where Form 500 proves indispensable:

- A Retired Individual: Authorizing a financial planner to manage tax filings and deductions.

- A Business Owner: Delegating tax management to an external CPA firm for efficiency in handling multiple accounts.

- A Student: Enabling a parent or guardian to assist with educational tax credits and filing processes.

Disclosure Requirements and Privacy Concerns

Form 500 is designed with taxpayer privacy in mind. While it facilitates the necessary disclosure of tax information, it also includes robust privacy terms. Taxpayers must clearly define what information can be shared and ensure that the representative adheres to confidentiality agreements. This vigilance maintains privacy and prevents unauthorized access to sensitive tax details.

State-Specific Rules for North Dakota

In North Dakota, Form 500 follows specific state guidelines. Taxpayers must ensure that their use of the form aligns with North Dakota's tax laws and regulations. This includes understanding state-specific nuances in tax codes and the procedural handling of the form. Submitting this form allows taxpayers to navigate state tax obligations seamlessly while authorizing necessary third-party access.

By using Form 500 correctly, taxpayers in North Dakota can enhance their ability to effectively manage their tax information through authorized representatives, ensuring compliance and protection of their sensitive data.