Definition & Meaning

An Assigned ID Number is a unique identifier allocated to vehicles, motorboats, or specific entities to facilitate legal and secure identification. This number is essential for official documentation and helps streamline various processes, enabling authorities to track and verify the identity of the item or entity. The concept of an Assigned ID Number helps ensure accuracy and security across several domains, including taxation, business identification, and vehicle registration. In the context of vehicle registration, for example, each vehicle is granted a distinctive number that is integral to its identity, ensuring traceability and legal compliance.

How to Use the Assigned ID Number

To effectively employ an Assigned ID Number, one must understand its specific application relevant to their scope of work or interest. For vehicles and motorboats, this number is typically used during registration, on legal documents, and in transactions involving sales or transfers. The Assigned ID Number should be recorded accurately on all pertinent paperwork to ensure seamless transactions and avoid potential legal challenges. Businesses often utilize these numbers for tax reporting and compliance, ensuring clear identification of assets and fulfillment of legal obligations.

How to Obtain the Assigned ID Number

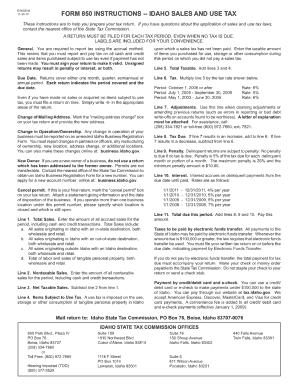

Obtaining an Assigned ID Number generally involves a formal application process. This typically includes:

- Completing an application form.

- Providing necessary identification documentation, such as proof of ownership or a government-issued ID.

- Paying any associated fees, which vary by jurisdiction.

- Submitting the application through the recommended method, which might include online submission, mailing, or in-person visits to specific offices. The approval process can range from a few days to several weeks, depending on the issuing authority and the complexity of the application.

Steps to Complete the Assigned ID Number Application

- Gather Required Documents: Ensure all necessary documentation, such as proof of ownership or personal identification, is ready.

- Complete the Application Form: Carefully fill out the application form, ensuring all sections are accurately completed to prevent delays.

- Submit the Application: Depending on the agency, submission could be online, by mail, or in person.

- Receive ID Number: Once approved, the Assigned ID Number will be provided via mail, email, or directly to a specified account.

- Attach ID Number: Securely attach the ID plates to the vehicle or relevant item in accordance with guidelines.

Legal Use of the Assigned ID Number

Legal use of the Assigned ID Number is crucial for ensuring compliance and avoiding penalties. Each number serves as a form of legal identification, whether for taxation purposes, asset tracking, or regulatory compliance. Incorrect use, such as falsifying or misrepresenting the number, can result in legal consequences, including fines or revocation of rights to operate the associated item. Therefore, it is imperative to use the number precisely as intended, adhering to the applicable laws and regulations governing its use.

Key Elements of the Assigned ID Number

The Assigned ID Number typically contains several key aspects:

- Uniqueness: Ensures no two entities share the same ID.

- Format: Depending on jurisdiction, the format may include a combination of letters and numbers.

- Security Features: Some numbers include security features to prevent tampering or duplication.

- Usage Scope: Specifies the contexts and legal frameworks in which the number applicable.

Required Documents

Acquiring an Assigned ID Number requires specific documentation to verify identity and ownership. Essential documents might include:

- Proof of identity, such as a driver's license or passport.

- Proof of ownership for vehicles or motorboats.

- Additional forms of identification as required by the issuing authority. All documentation must be current and valid to ensure smooth processing of the application.

Who Typically Uses the Assigned ID Number

Primarily, individuals and businesses involved in vehicle and property transactions utilize Assigned ID Numbers. This includes car dealerships, private sellers, maritime vehicle owners, and businesses requiring asset registration for tax and legal purposes. The number is integral in legal documentation, financial transactions, and compliance reporting, ensuring both personal and organizational accountability and identification in government records.

Penalties for Non-Compliance

Failure to correctly use or register an Assigned ID Number can result in significant penalties:

- Fines: Financial penalties for failing to comply with registration or reporting requirements.

- Increased Scrutiny: Businesses or individuals may be subject to additional investigations or audits.

- Operational Restrictions: Suspension or revocation of the right to operate vehicles or conduct business operations. It is essential to comply with all regulations concerning the use and registration of Assigned ID Numbers to avoid these penalties.