Definition & Meaning

Understanding the form "- tax alaska" is crucial for individuals and businesses involved in activities subject to state tax regulations in Alaska. This form pertains specifically to taxation requirements within the state, where unique rules may apply due to Alaska's distinct tax laws, such as the absence of a state-level personal income tax. Instead, the focus may be on other forms of taxation relevant to local commercial activities and resource management.

Key Elements of the - Tax Alaska

Several elements are essential to comprehend the - tax alaska form. These include the nature of taxes applicable in Alaska, such as corporate taxes, sales taxes on specific goods, and taxes imposed on resource extraction. Understanding these components is vital for accurately reporting and fulfilling tax obligations.

- Corporate taxes apply to businesses operating within the state.

- Sales taxes, although not prevalent statewide, can be imposed by local jurisdictions on specific goods or services.

- Resource extraction taxes are significant due to Alaska's rich natural resources.

Details such as tax rates, exemptions, and deductions will vary, emphasizing the importance of familiarizing oneself with these specifics to ensure compliance.

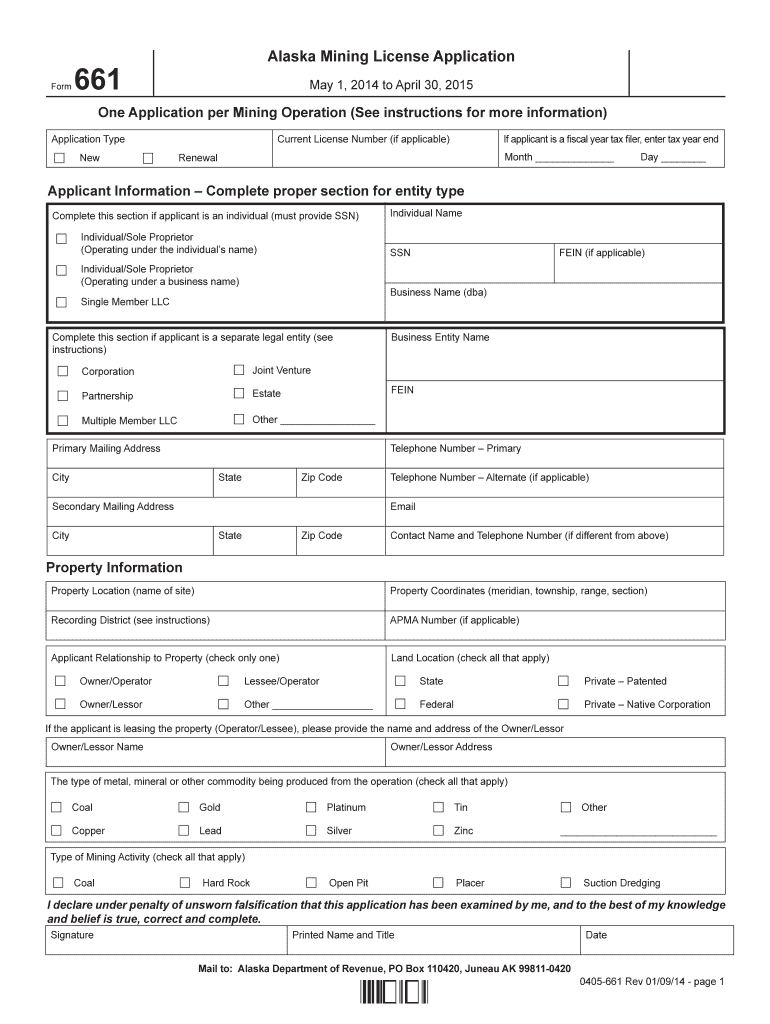

How to Use the - Tax Alaska

To efficiently utilize the - tax alaska form, follow the steps outlined below, each designed to guide you in understanding and completing your tax responsibilities accurately:

- Identify Applicability: Determine the specific tax obligations your business or activity is subject to within Alaska.

- Collect Information: Gather all necessary documents, such as financial records and past tax filings, to aid in accurate reporting.

- Complete the Form: Carefully fill in each section, ensuring all information is accurate to avoid penalties.

- Consult Guidelines: Refer to Alaska’s tax instructions, which provide detailed guidance on completing the form.

- Submit On Time: Ensure the form is submitted by the designated deadline to avoid late fees and penalties.

Steps to Complete the - Tax Alaska

Completing the - tax alaska form involves several detailed steps, designed to capture comprehensive data about your tax situation. It is crucial to adhere to these steps closely for precise form submission:

- Review Instructions: Start by carefully reviewing the accompanying instructions to ensure compliance with Alaska tax laws.

- Fill Out Identification Section: Provide personal or business identification information, including Taxpayer Identification Number and contact details.

- Report Income or Activity: Accurately report all relevant income or business activity subject to taxation.

- Calculate Tax Liability: Use the provided guidelines to calculate the tax liability based on reported figures.

- Attach Necessary Documentation: Attach any required documents, such as financial statements, to support your reported information.

- Double-check Entries: Before submission, double-check all entries for accuracy and consistency.

- Submit the Form: Submit the completed form using the appropriate method, ensuring delivery is confirmed.

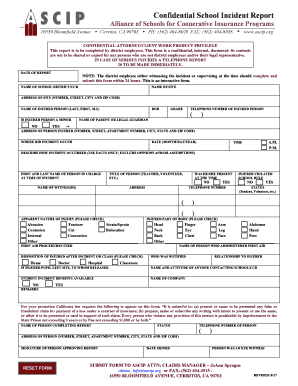

Legal Use of the - Tax Alaska

The legal use of the - tax alaska form ensures that individuals and businesses comply with the statutory requirements for taxation in Alaska. The form serves as a formal document for entities to declare their tax obligations, without which they could face legal repercussions.

- It provides a structured method for reporting income and tax liability.

- Legal adherence is necessary to avoid penalties or audits.

- Ensures transparency and accountability in financial activities related to state-required taxations.

Important Terms Related to - Tax Alaska

Familiarity with key terminology related to the - tax alaska form is essential for effective completion and compliance:

- Taxpayer Identification Number (TIN): A unique identifier for taxpayers.

- Gross Income: Total income before deductions or exemptions.

- Deductions: Allowable reductions from gross income that lower taxable income.

- Net Taxable Income: Income subject to tax after deductions and exemptions.

- Filing Status: Classification that determines applicable tax rates (e.g., individual, corporate).

Understanding these terms can prevent errors and facilitate smoother processing of the form.

State-Specific Rules for the - Tax Alaska

Alaska has unique tax rules that can significantly impact how the - tax alaska form should be approached:

- Absence of a personal income tax necessitates alternative tax considerations, such as specific levies on business revenues or resource extraction.

- Local jurisdiction variance means that sales taxes may apply differently based on location and goods/services sold.

- Periodic updates and changes to state tax laws require keeping informed about legislative amendments affecting tax obligations.

Filing Deadlines / Important Dates

Filing deadlines are crucial when dealing with the - tax alaska form. Ensuring timely submission avoids unnecessary penalties:

- Standard Filing Deadline: Alaska, like the IRS, generally aligns tax deadlines with the federal schedule for businesses, often falling on March 15 for corporations and April 15 for other business structures.

- Extensions: Extensions may be available upon request, but require adherence to specific application procedures.

- Amendments: Corrections after the initial submission should be filed promptly to prevent discrepancies or penalties.