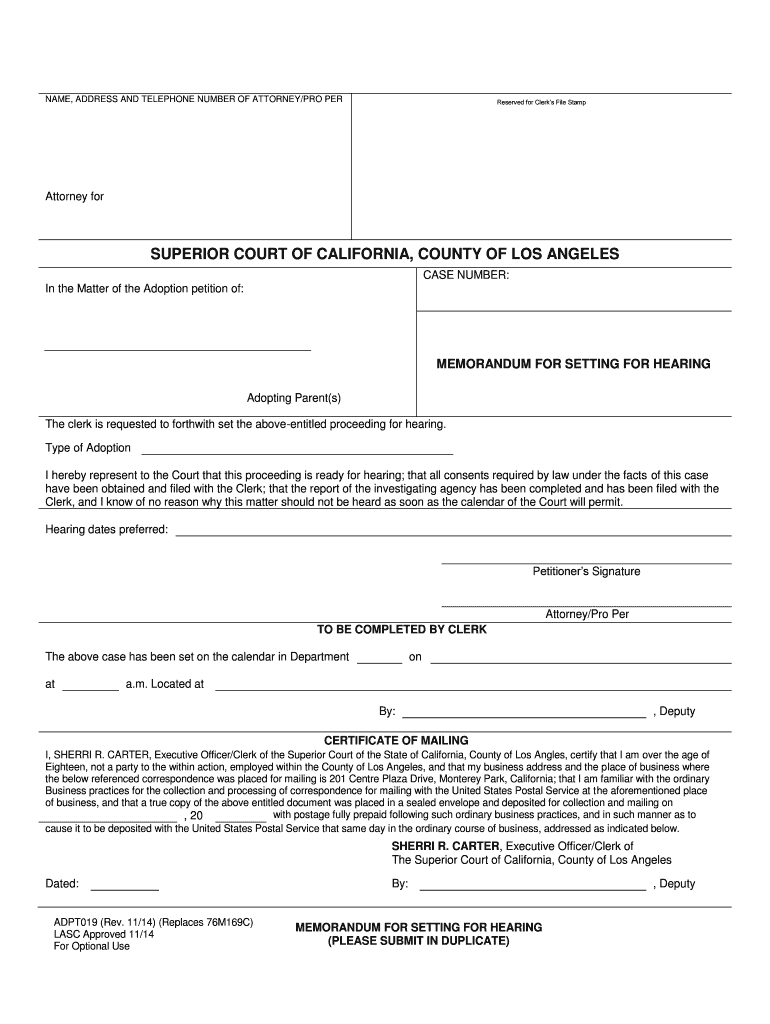

Definition & Purpose of the Memorandum for Setting Hearing

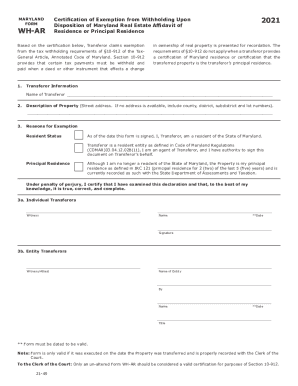

The "Memorandum for Setting for Hearing LAADPT019 Rev041015 dotx 2012 Michigan Fiduciary Income Tax Return" serves a dual function by merging two seemingly distinct forms. The first part of the document deals with the procedural aspects for setting a hearing concerning an adoption petition within the Superior Court of California, County of Los Angeles. This section identifies the requirements to prepare for the hearing, including obtaining necessary consents and completing investigation reports. Separately, the alternate aspect of this form also refers to specifics of fiduciary income tax returns as required by Michigan state law, although these details might appear to be a clerical note rather than a substantial part of the memorandum's function. This integration highlights the form's complexity, suggesting that attention to detail is crucial during its completion.

How to Use the Memorandum

To effectively utilize the memorandum, one must understand its dual purpose and segregate responsibilities accordingly. For the adoption hearing:

- Gather Necessary Documents: Ensure all required consents and investigation reports are compiled and attached.

- Complete Required Sections: Address each section concerning both the adoption procedure and any tax elements if applicable.

- Legal Verification: Verify document correctness with legal counsel well-versed in California adoption law.

- Consult Michigan's Tax Guidelines: If the fiduciary tax component is applicable, cross-reference with Michigan’s current fiduciary income tax requirements.

Using the memorandum pragmatically involves anticipating both legal and administrative needs. Legal professionals typically act on behalf of clients to unify these processes efficiently.

Steps to Complete the Memorandum

Completing the Adoption Hearing Requirement

- Fill in Basic Information: Names, addresses, and other identifying details of the petitioner must be included.

- Submit Required Consents: Attach all necessary consents from involved parties.

- Prepare an Investigation Report: Conduct and finalize the investigation report, supporting the request for setting a hearing.

Incorporating Michigan Fiduciary Tax Components

- Detail Fiduciary Responsibilities: Identify fiduciaries and beneficiaries, if they intersect with adoption procedures, though this may be contextually rare.

- Attach Relevant Financial Documentation: Include any necessary fiscal documents if the form is being used in a dual capacity for tax purposes.

Who Typically Uses This Memorandum

The memorandum is primarily utilized by legal representatives managing adoption cases. Their clients are usually petitioners seeking to formalize or update their circumstances through the judicial process. Secondary users could include tax professionals if the form crosses over into fiduciary financial responsibilities under Michigan law, although this usage is less common.

Legal Importance and Benefits

Utilizing the memorandum legally secures the arrangement of a hearing, a vital step in the formal adoption process. Legal professionals ensure compliance with court protocols, reducing the risk of rescheduling or procedural errors. Legally, this step facilitates transparency and preparation, thus ensuring the judicial proceedings operate smoothly and efficiently.

State-Specific Rules and Exceptions

Adoption proceedings in California do not inherently account for specific tax implications from other states, like Michigan. However, both parts of the memorandum must be observed under their respective jurisdictions. California’s legal nuances around adoptions stay region-specific, but financial matters or fiduciary responsibilities could diverge for residents involved in out-of-state custody cases, fostering an uncommon overlap.

Edge Cases

- Out-of-State Custody Complications: When adoption involves cross-state guardianships, extended fiduciary documentation may be required.

- Multi-jurisdictional Responsibilities: Legal obligations could require adherence to both California and Michigan standards.

Important Associated Terminology

- Petitioner: The individual filing the adoption petition.

- Fiduciary: A person or entity managing financial responsibilities on behalf of someone else.

- Consents: Legal permissions required for a judicial process.

- Investigation Report: An assessment document used to support adoption.

Examples of Usage in Legal Settings

One practical application includes a legal firm processing multiple adoption cases with various complexities, especially when petitioners reside in different states, like California and Michigan, requiring collaboration with both family law specialists and tax consultants to ensure all considerations are integrated satisfactorily.

Key Elements and Form Structure

- Sections Detailing Petitioner Information: Ensuring accuracy prevents delays in hearings.

- Integration of Financial Disclosure if Required: Allows for a holistic view, even when financial elements play a secondary role.

Such detailed considerations promote understanding for individuals navigating challenging legal landscapes involving both adoption hearings and occasionally intersecting financial responsibilities.