Definition and Purpose of the AR1000DC

The AR1000DC form is a document used by taxpayers in Arkansas to claim a $500 Developmentally Disabled Individual Credit on their state income tax returns. This tax credit is designed to provide financial assistance to those supporting a developmentally disabled individual, offering some relief for associated care costs. The credit's aim is to ease the taxable burden on individuals or families who have a dependent with a qualifying medical condition.

The form must accompany the taxpayer's Arkansas Individual Income Tax Return for the first claim and is valid for five consecutive tax years. This differentiation is crucial as the tax credit's continuity relies on the initial submission with the necessary documentation. Understanding the form's purpose helps taxpayers grasp its critical role in reducing tax liabilities related to developmental disabilities.

Eligibility Criteria for the AR1000DC

Filing the AR1000DC requires meeting specific eligibility criteria. First, the dependent must be a resident of Arkansas and have a certified developmental disability. Often, this includes conditions such as intellectual disabilities or autism. The individual claiming the credit must either be the direct caregiver or financially responsible for the dependent's care.

- Dependency Status: The disabled individual must be claimed as a dependent on the taxpayer’s federal and Arkansas state tax returns.

- Residency Conditions: Both the taxpayer and dependent must reside within Arkansas for the tax year in question.

- Medical Documentation: Appropriate medical certification from a licensed health professional verifying the developmental disability is mandatory.

Meeting these criteria is crucial, as they ensure that the credit supports only those truly in need of assistance.

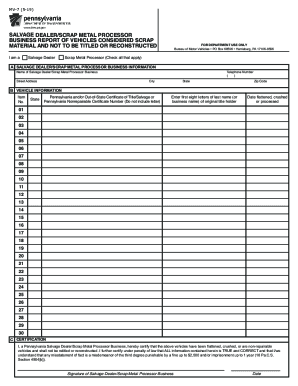

Steps to Complete the AR1000DC

Filling out the AR1000DC requires careful attention to each section to avoid errors that could delay processing or lead to a denial of the credit.

- Obtain Necessary Forms: Begin by ensuring you have the AR1000DC and your Arkansas Individual Tax Return forms.

- Gather Documentation: Collect all required documents, such as medical certifications, proof of residency, and previous tax returns, to demonstrate eligibility.

- Fill in Personal Information: Clearly write or type your personal and dependent's details in the appropriate sections.

- Document Dependent's Condition: Provide a brief description of the developmental disability and attach any medical documents as evidence.

- Submit with Attached Tax Return: The completed AR1000DC should be submitted with your state tax return the first time you claim it.

This step-by-step approach helps streamline the completion process, minimizing potential errors or omissions.

Key Elements of the AR1000DC

Several key components of the AR1000DC form need to be completed accurately:

- Personal Details: Involves providing the taxpayer's name, social security number, and contact information, ensuring identification consistency.

- Dependent Information: Requires full details about the developmentally disabled dependent, including age, relationship to the taxpayer, and residence status.

- Certification and Signature: The taxpayer must certify the information provided is correct and sign the form.

Properly completing these components is essential for the valid acceptance of the form and ensures the taxpayer receives the full credit available.

Legal Use and Compliance

The AR1000DC is strictly regulated, and taxpayers must adhere to legal standards to ensure compliance. This includes providing truthful and accurate information, maintaining up-to-date records that support credit claims, and understanding state-specific regulations that may influence how the credit is applied.

Failure to comply with these regulations can result in penalties, the denial of the tax credit, or other legal consequences. Ensuring compliance protects taxpayers from adverse legal outcomes and secures the financial benefits designed to assist with the costs of supporting a developmentally disabled individual.

State-Specific Rules for Claiming the AR1000DC

Arkansas's state-specific guidelines play a significant role in determining how the AR1000DC is claimed and processed. The state’s regulations mandate that both taxpayer and dependent maintain residency within Arkansas, highlighting the role of the state government in overseeing residency criteria and confirming eligibility.

These state-specific rules ensure a structured and consistent approach, helping the Arkansas Department of Finance and Administration manage claims effectively while safeguarding against fraudulent entries.

Examples of Using the AR1000DC

Consider a scenario where a taxpayer has a child diagnosed with a developmental disability, meeting all necessary criteria. By filing the AR1000DC with their Arkansas tax return, they effectively reduce their taxable income, providing financial relief to facilitate better care and support for their child.

Another example could be a retired couple supporting an adult child with a developmental disability. Filing this form allows them to leverage credits aligned with their financial responsibilities, systematically reducing tax liabilities that would otherwise burden their fixed income.

These examples showcase practical applications of the AR1000DC, delivering tangible benefits that align financial aid with the taxpayer's caregiving responsibilities.

Filing Deadlines and Important Dates

Arkansas residents need to adhere to state tax filing deadlines to claim the AR1000DC. Typically, Arkansas tax returns are due on the same date as federal returns, around April 15th. However, deadlines may adjust slightly based on state advisories.

Submissions beyond the stated deadline may result in penalties or disqualification from claiming the credit, underscoring the importance of timely compliance. Taxpayers should keep abreast of any changes in filing schedules to ensure their eligibility is maintained each year the credit is claimed. Adjustments or exceptions to these dates, often due to legislative updates or state announcements, should be monitored to avoid complications.