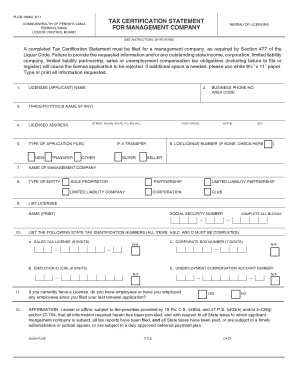

Exploring the Kentucky Tax Application 2015 Form

The Kentucky Tax Application 2015 Form is a critical document for businesses operating within the state of Kentucky. It enables businesses to register for various tax accounts such as Employer’s Withholding Tax, Sales and Use Tax, among others. By understanding its core aspects, businesses can ensure compliance and avoid potential penalties.

Understanding the Purpose and Scope

The Kentucky Tax Application 2015 Form serves to streamline the tax registration process for businesses. It provides a centralized application that covers multiple tax types required by the state. This form is vital for establishing the necessary tax accounts that facilitate accurate and compliant tax payments.

Primary Uses of the Form

- Employer's Withholding Tax: Businesses with employees need to register for this to withhold and remit taxes from employee wages.

- Sales and Use Tax: Necessary for businesses that deal with the sale of goods and services subject to sales tax.

- Other Tax Accounts: Businesses may also need to register for additional taxes depending on their specific activities, such as liquor taxes or telecommunications taxes.

Completing the Kentucky Tax Application 2015 Form

Filling out the Kentucky Tax Application 2015 Form requires attention to detail and an understanding of the business’s tax obligations. Here's a breakdown of the key steps involved:

Step-by-Step Instructions

- Obtain the Form: The form can be downloaded from the state’s Department of Revenue website or requested by mail.

- Gather Essential Information: This includes business name, address, Federal Employer Identification Number (FEIN), and business structure type.

- Fill Out Required Sections: Complete sections relevant to the specific taxes for which you are registering.

- Review for Accuracy: Double-check all entered information to prevent errors that could delay processing.

- Submit the Form: Submission can be done online or by mailing to the appropriate address provided in the instructions.

Additional Considerations

- Business Type and Structure: Specific sections must be filled out based on whether the entity is an LLC, corporation, partnership, or sole proprietorship.

- Signatory Requirements: Ensure that the person signing the form has the authority to act on behalf of the business.

Who Typically Uses the Form

This form is primarily used by businesses based in or conducting business within Kentucky. It is crucial for:

- New Business Owners: Establishing initial tax accounts.

- Existing Businesses: Modifying existing tax accounts due to changes in business operations.

- Accountants and Tax Professionals: Facilitating client compliance with state tax laws.

Required Documents and Information

Adequate preparation can significantly expedite the form completion process. The following documents and information are typically required:

- Federal Employer Identification Number (FEIN): Issued by the IRS.

- Legal Business Name and Trade Name (if applicable): Ensure consistency with other documentation.

- Business Structure Documentation: Articles of incorporation, partnership agreements, or sole proprietorship registration as relevant.

- Detailed Business Activity Description: Provides context for the types of taxes applicable to your operations.

State-Specific Rules and Compliance

Kentucky has specific regulations that businesses must adhere to when completing the tax application form. These include:

- Submission Deadlines: Businesses must submit applications in a timely manner to avoid penalties.

- Complete and Accurate Information: False or incomplete submissions can result in application rejection or legal issues.

Consequences of Non-Compliance

- Penalties and Fines: Failure to register or incorrect information can lead to financial penalties.

- Delayed Tax Processing: This can affect a business's ability to operate legally within the state.

Legal Aspects and Electronic Filing

With the increasing shift towards digital solutions, Kentucky provides electronic filing options for the tax application form. This ensures faster processing and ease of tracking:

Benefits of Electronic Submission

- Efficiency: Immediate submission and confirmation.

- Accuracy: Built-in validation to reduce errors.

- Security: Enhanced data protection through SSL encryption.

Practical Examples and Use Cases

Consider a retail business planning to expand its operations into Kentucky. By accurately completing the Kentucky Tax Application 2015 Form, the business can:

- Register for Sales Tax, enabling legal sales transactions.

- Establish Withholding Tax accounts to manage employee payroll taxes effectively.

- Ensure all necessary state tax obligations are met, facilitating smooth business operations.

In summary, the Kentucky Tax Application 2015 Form is a fundamental document for business tax compliance in Kentucky. Proper understanding and execution of the application process are crucial in maintaining good standing with state tax authorities.