Definition & Meaning

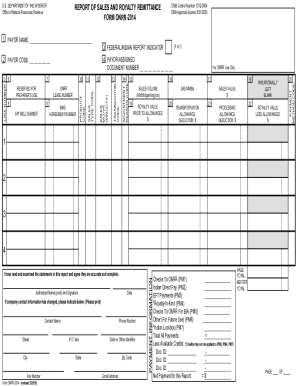

The 2000 form is a key document used for specific administrative or regulatory purposes. Although the exact type and purpose of this form can vary based on the context, its use generally aligns with detailed data collection or reporting requirements. This form often serves as an affidavit or declaration that requires the filer to provide detailed information on specific topics.

Purpose and Use Cases

The form is typically utilized in situations where there is a need for detailed information collection, which could include areas such as tax reporting, legal declarations, or applications for government programs. The specifics of its use will depend on the originating agency's requirements and the need for structured data submission.

How to Use the 2000 Form

Instructions for Completion

- Read Instructions Carefully: Begin by reviewing any accompanying instructions to understand each section's requirements.

- Fill Personal Information: Enter your personal details, such as name, address, and any other identifying information requested.

- Provide Required Data: Fill out each section with the requested information. This may include financial data, legal declarations, or other specific details.

- Review and Verify: Double-check all entries to ensure accuracy and completeness before submission.

Practical Scenarios

- Legal Documentation: Use the form when providing legally required declarations or when participating in governmental or organizational compliance activities.

- Financial Reporting: It's often used for submitting financial data related to personal or business activities.

Steps to Complete the 2000 Form

- Gather Necessary Information: Prepare all documentation needed to accurately complete the form.

- Fill out Sections Sequentially: Work through each section step-by-step to prevent omissions.

- Validate Entries: Verify the accuracy of all entries against your records.

- Submit to the Appropriate Agency: Ensure the form is submitted to the correct address or portal as required.

Common Mistakes to Avoid

- Inaccurate Data Entry: Double-check all numerical entries and spellings to prevent errors.

- Incomplete Sections: Ensure that every required field is filled out and no mandatory sections are left blank.

- Missing Signatures: Confirm that all necessary signatures are included before submission.

Important Terms Related to the 2000 Form

Understanding the terminology associated with the form can significantly impact its correct completion.

- Affidavit: A written statement confirmed by oath for use as evidence in court.

- Declarant: The person who declares information as true within the document.

- Compliance: Adhering to a set of regulations or standards defined by law or policy.

Who Typically Uses the 2000 Form

Target Users

The form is generally used by individuals or organizations required to report specific information to governmental or regulatory bodies. This might include:

- Business Owners: They may need to report compliance or regulatory information.

- Individuals in Legal Proceedings: When documentation of support or declarations are necessary.

- Taxpayers: For specific financial declarations or affidavit purposes.

Use by Professional Advisors

Legal advisors, accountants, and business consultants often assist in preparing this form correctly, ensuring compliance with applicable regulations.

Legal Use of the 2000 Form

The legal implications surrounding the use of the form extend to its role as part of compliance or regulatory requirements. Falsifying information on the form can result in legal consequences, including penalties or forfeitures.

Compliance Requirements

- Accuracy Obligations: Ensure all provided information is accurate and truthful.

- Timeliness: Submission within designated deadlines is crucial to avoid penalties.

Key Elements of the 2000 Form

Components

- Personal Details Section: Captures essential personal information for identification.

- Declaration Statements: Contains sections where the declarant affirms information to be true.

- Supporting Documents Section: Allows attached evidence or documentation that supports the entered information.

Variations in Documentation

These elements can vary if the specific form is subject to state or jurisdiction-specific regulations, requiring additional fields or reports.

Filing Deadlines / Important Dates

Understanding the relevant deadlines is crucial for compliance and avoiding penalties. Always refer to the specific requirements or guidelines provided by the issuing authority to determine the accurate submission timeline.

Critical Timelines

- Initial Submission Deadline: Generally aligns with annual or quarterly filing periods for statutory forms.

- Correction Window: Indicates the timeframe allowed for submitting corrections or amendments post-filing.

Penalties for Non-Compliance

Failure to comply with the 2000 form’s requirements, such as timely submission or accurate reporting, can result in penalties. These can range from fines to legal action depending on the severity and jurisdiction.

Common Non-Compliance Issues

- Late Submission: Incurs monetary fines and possible interest on due amounts.

- False Declarations: Legal penalties including possible prosecution for fraud.